The ‘1099 for Employees’ Myth: What Businesses Need to Know

Ever heard the term 1099 for employees to fill out? It’s a common point of confusion for businesses and freelancers alike. Let’s clear it up.

- Employees receive a Form W-2 from their employer; they do not fill out 1099s.

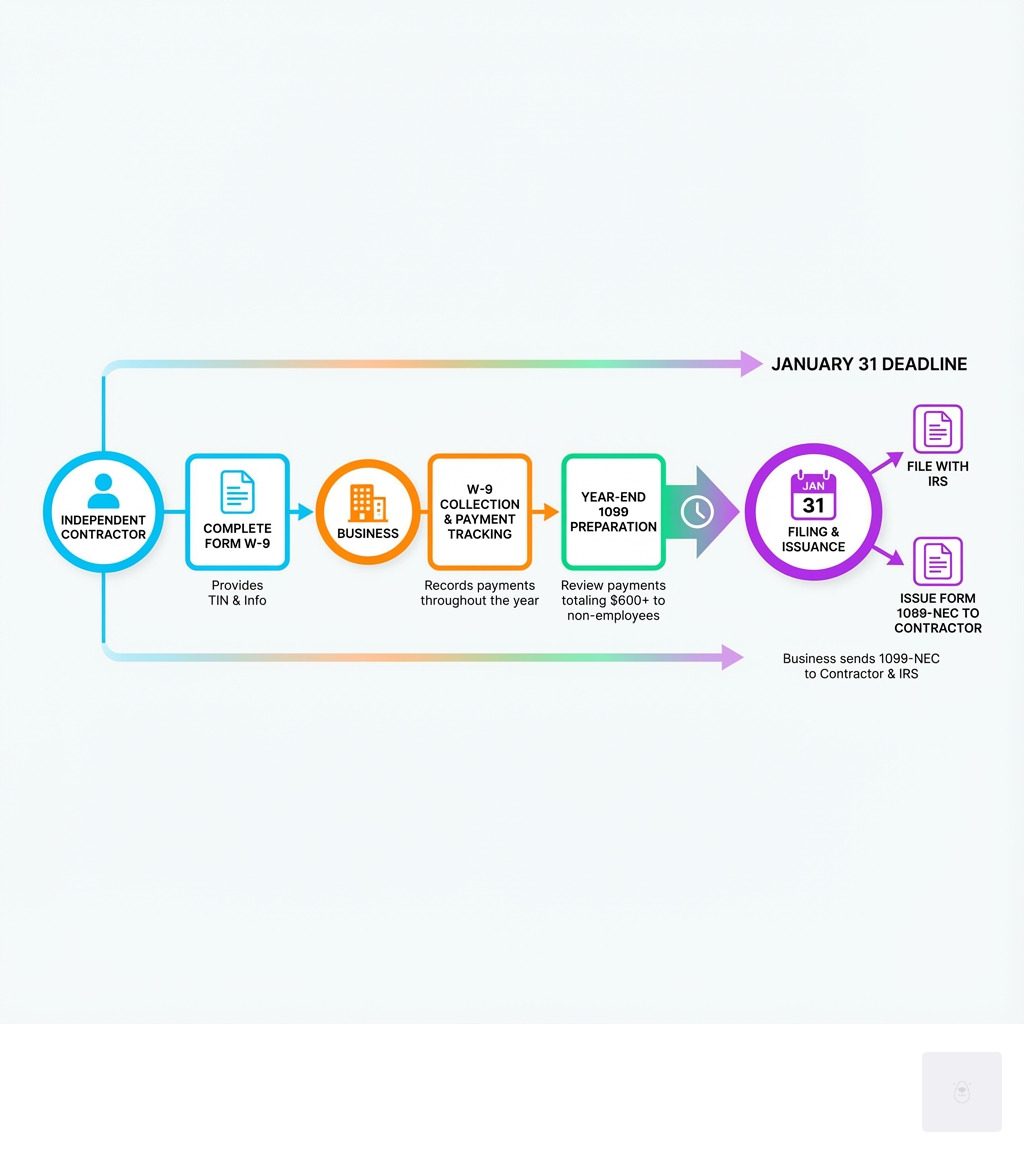

- Independent contractors fill out a Form W-9 to provide their tax information to a business.

- Businesses use the W-9 to prepare and issue a Form 1099-NEC to the contractor.

- Form 1099-NEC is used to report payments of $600 or more to non-employees.

The term “1099 employee” is technically incorrect. If someone receives a 1099 form, they’re an independent contractor, not an employee. This distinction is critical for taxes, benefits, and legal compliance.

As businesses increasingly rely on freelancers, understanding this process is vital. With projections suggesting that 86.5 million Americans will be working as freelancers by 2027, getting your tax forms right is more important than ever.

The confusion often stems from the paperwork flow. Contractors complete a Form W-9 to provide their Taxpayer Identification Number (TIN). The business then uses that information to prepare a Form 1099-NEC (Nonemployee Compensation) at year-end. The contractor receives a copy but doesn’t fill it out.

Misclassifying workers or filing incorrect forms can result in penalties ranging from $50 to over $500 per form. With stakes this high, knowing who fills out what form is essential for compliance.

I’m Haiko de Poel, and through my work with companies managing contractor relationships and tax compliance, I’ve seen how confusion around 1099 for employees to fill out can lead to costly errors. My experience helping businesses streamline their contractor onboarding and tax reporting processes has shown me that clarity on these forms is the foundation of proper compliance.

Start filling your W9 now at https://fillablew9.com/apply.

Key terms for 1099 for employees to fill out:

W-2 Employee vs. 1099 Contractor: Getting Classification Right

One of the most fundamental business decisions is classifying talent as a W-2 employee or an independent contractor. The term 1099 for employees to fill out highlights this common confusion. In reality, a “1099 employee” is an independent contractor who receives a Form 1099.

The IRS defines an independent contractor as someone in an independent trade, business, or profession offering services to the public. To determine a worker’s status, we look at three key categories:

- Behavioral Control: Does the company control how the worker does their job? For contractors, the business specifies the result, but the contractor decides how to achieve it.

- Financial Control: Who controls the business aspects of the job? This includes pay, expense reimbursement, and who provides tools. Contractors often have unreimbursed expenses and use their own equipment.

- Type of Relationship: Is there a written contract or employee-type benefits (like insurance or PTO)? Is the work ongoing? Contractors typically work on a project basis and don’t receive employee benefits.

For W-2 employees, employers withhold income, Social Security, and Medicare taxes. Independent contractors are self-employed and responsible for paying their own self-employment and income taxes.

If there’s ever uncertainty about a worker’s classification, either the company or the worker can submit Form SS-8 to the IRS. The IRS will then make a determination based on all factors, including the written contract, the type of relationship, and the degree of independence. Correctly distinguishing between employees and contractors is paramount to avoiding future headaches.

Why Correct Classification is Crucial

Misclassifying workers can lead to significant headaches and financial penalties. The IRS takes worker classification seriously because it affects tax revenue and worker protections.

If the IRS determines a worker was misclassified as a contractor, your business could be liable for back taxes, including the employer’s share of FICA and FUTA taxes, plus interest. You could also face penalties for failing to withhold income tax.

- Tax Penalties: We might be liable for back taxes, including the employer’s share of Social Security and Medicare taxes (FICA), federal unemployment taxes (FUTA), and even income tax withholding that should have occurred. Penalties can also include interest on unpaid taxes.

- Overtime Pay Liability: Employees are often entitled to overtime pay under the Fair Labor Standards Act (FLSA), which doesn’t apply to independent contractors.

- Workers’ Compensation and Unemployment Insurance: Misclassified workers may retroactively qualify for workers’ compensation and unemployment benefits, which could result in additional costs and legal challenges for your business.

- Lawsuits: Workers who believe they were wrongly classified might sue for lost wages, benefits, and other damages.

These consequences underscore why understanding the distinction between employees and contractors is one of the most important aspects of managing your workforce.

Key Differences at a Glance

To help clarify the differences, here’s a quick comparison:

| Feature | W-2 Employee | 1099 Contractor |

|---|---|---|

| Tax Withholding | Employer withholds income, Social Security, Medicare. | Responsible for their own self-employment and income taxes. |

| Benefits | Eligible for employer-provided benefits (health insurance, retirement, PTO). | Not eligible for employer-provided benefits. |

| Control Over Work | Employer controls when, where, and how work is done. | Controls how, when, and where work is performed. |

| Tools/Equipment | Employer typically provides tools and equipment. | Provides their own tools, equipment, and workspace. |

| Business Expenses | Employer may reimburse business expenses. | Deducts their own business expenses. |

| Permanence | Ongoing relationship, integral to business operations. | Project-based or temporary, can work for multiple clients. |

| Forms Received | Form W-2 | Form 1099-NEC (from payer), fills out Form W-9 (for payer) |

The First Step: Why Contractors Fill Out a W-9, Not a 1099

When you engage a contractor, the first piece of paperwork they provide is Form W-9, Request for Taxpayer Identification Number and Certification. This is where the phrase 1099 for employees to fill out gets it wrong. Contractors fill out a W-9, not a 1099.

The W-9 is essential for collecting a contractor’s correct Taxpayer Identification Number (TIN), name, and address. You need this information to accurately prepare their 1099-NEC at year-end. Without a completed W-9, you may be required to use backup withholding.

It’s a best practice to collect a W-9 from every contractor before making any payments. This form is for your internal records only—do not send it to the IRS. For a detailed walkthrough, you can always check out how to fill out a W9 on our site.

Don’t waste time with paper forms — complete your secure W9 online at https://fillablew9.com/apply.

What’s on the W-9 Form? A Quick Guide

When a contractor fills out a W-9 for us, they’ll need to provide several key pieces of information to ensure accuracy:

- Contractor’s Name: Their legal name, as it appears on their tax return.

- Business Name/Disregarded Entity Name: If they operate under a business name (e.g., DBA) or are a single-member LLC, this will be listed here.

- Federal Tax Classification: They’ll indicate their business entity type, such as individual/sole proprietor, C corporation, S corporation, partnership, trust, or estate.

- Address: Their complete mailing address.

- Taxpayer Identification Number (TIN): This is either their Social Security Number (SSN) if they are an individual or sole proprietor, or an Employer Identification Number (EIN) if they operate as a business entity.

- Certification Signature: By signing, the contractor certifies that the information provided is correct, that they are not subject to backup withholding, and that they are a U.S. person.

Ensuring this information is accurate and complete is critical for us as the payer. Using a secure online platform helps contractors complete a secure W9 online, streamlining the process and protecting sensitive data.

What About International Contractors?

For contractors who are not U.S. persons, the process differs. Instead of a W-9, foreign independent contractors generally fill out Form W8-BEN, Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting (Individuals). This form certifies their foreign status and helps determine if they are subject to U.S. tax withholding.

Foreign contractors may be subject to a 30% withholding rate on certain U.S. source income, unless a tax treaty between their country of residence and the U.S. provides for a reduced rate or exemption. The W-8BEN allows them to claim these treaty benefits, if applicable. It’s crucial for us to obtain the correct W-8 form (there are several variations like W-8BEN-E for entities) from our international contractors to ensure proper U.S. tax compliance and avoid potential penalties.

Understanding the Key 1099 Forms: NEC vs. MISC

Once we’ve collected the W-9 from our contractors, we’re ready for the next phase: understanding the 1099 forms we’ll need to issue. This is another area where the phrase 1099 for employees to fill out causes confusion, as it’s the business that issues these forms, not the recipient. The IRS uses various 1099 forms to report different types of income paid to non-employees. For businesses engaging independent contractors, the two most common forms we’ll encounter are Form 1099-NEC and Form 1099-MISC.

It’s important to differentiate between these forms, as they serve distinct purposes. The About General Instructions for Certain Information Returns provides a broad overview, but understanding the specific use cases for NEC and MISC is key to accurate reporting and avoiding penalties.

Form 1099-NEC: For Contractor Payments

As of the 2020 tax year, Form 1099-NEC (Nonemployee Compensation) made a comeback to specifically report payments to independent contractors. Prior to this, nonemployee compensation was reported on Form 1099-MISC. This change was implemented to simplify and streamline reporting, particularly for the January 31st deadline for contractor payments.

We use IRS Form 1099-NEC to report payments of $600 or more made in the course of our trade or business to a person who is not our employee for services rendered. This includes:

- Fees, commissions, or other forms of compensation for services performed by independent contractors, freelancers, or consultants.

- Payments to attorneys for legal services (fees for services, not settlement proceeds).

If we pay an independent contractor $600 or more for their services during the calendar year, we must issue them a 1099-NEC and file it with the IRS. This form ensures the IRS is aware of the income received by the contractor, who then reports it on their own tax return.

Form 1099-MISC: For Other Miscellaneous Payments

While Form 1099-NEC handles nonemployee compensation, About Form 1099-MISC, Miscellaneous Information is still very much in use for a variety of other miscellaneous payments. We generally use Form 1099-MISC to report payments of $600 or more (with some exceptions for lower thresholds) for the following types of income:

- Rents: Payments for office space, land, machine rentals, etc.

- Royalties: Payments of $10 or more for intellectual property, oil and gas leases, etc.

- Prizes and Awards: Payments for contests, sweepstakes, or awards that are not for services performed.

- Gross Proceeds Paid to an Attorney: This is distinct from attorney fees. If we pay settlement proceeds to an attorney on behalf of a client, those gross proceeds (of $600 or more) are reported on Form 1099-MISC, Box 10.

- Medical and Health Care Payments: Payments of $600 or more to physicians or other providers of medical or health care services (even if the provider is a corporation).

- Other Income: Any other fixed, determinable, annual, or periodical gains, profits, or income totaling $600 or more that doesn’t fit into other specific 1099 categories.

It’s crucial to select the correct form to avoid reporting errors. We need to be mindful of the specific payment types and their respective reporting thresholds to ensure compliance.

Step-by-Step Guide: How to Collect and Use W9s for 1099 Filing

Now that we understand the difference between W-2 employees and 1099 contractors, and the roles of Forms W-9, 1099-NEC, and 1099-MISC, let’s walk through the practical steps we need to take to ensure smooth and compliant 1099 filing. This process is essential for any business engaging independent contractors.

Step 1: Gather Your Completed W-9 Forms

Our first and most critical step is to collect a completed Form W-9 from every independent contractor we work with. We do this before making any payments. Why? Because the W-9 provides us with the contractor’s accurate name and Taxpayer Identification Number (TIN), which are indispensable for preparing their 1099 forms later.

- Request a W9 from every contractor before payment. Make it a standard part of your onboarding process.

- Verify TIN and information for accuracy. We should compare the information on the W-9 with our records and ensure the TIN is correct. If the IRS notifies us that a TIN is incorrect, we must request a new W-9 from the contractor.

- Store securely for recordkeeping and compliance. We are required to keep W-9s on file for at least four years. Digital storage is often the most efficient and secure method.

The W-9 is for our records, not for submission to the IRS. It’s the foundation upon which all our 1099 reporting is built. This process is integral to understanding the distinction between a W9 and a 1099, as further explained in our W9 vs 1099 explained guide.

Step 2: Use W9 Information to Prepare 1099-NEC

Once the year concludes, and we’ve determined which contractors we paid $600 or more for services, we’ll use the information from their W-9s to prepare Form 1099-NEC.

- January 31 deadline for sending 1099-NEC to contractors and IRS. This is a strict deadline. We must furnish Copy B of Form 1099-NEC to our contractors by January 31st. Simultaneously, we must file Copy A with the IRS.

- Use W9 details to complete 1099-NEC accurately. Every piece of information on the 1099-NEC, from the contractor’s name and address to their TIN, should match what’s on their W-9.

- Copy A to IRS; Copy B to contractor. We send Copy A to the IRS and Copy B to the contractor. If we send electronically, we must obtain their written consent beforehand, following IRS requirements for electronic delivery.

For any other miscellaneous payments (rents, royalties, etc.) exceeding the thresholds, we would prepare Form 1099-MISC. The deadlines for 1099-MISC are slightly different: we must furnish Copy B to recipients by January 31st, but the filing deadline for Copy A with the IRS is February 28th (paper) or March 31st (electronic).

Step 3: File with the IRS and State (If Required)

After preparing the forms, the next step is to file them. Most businesses today opt for electronic filing due to its efficiency and the IRS’s preference for it.

- We can file electronically through the IRS’s IRIS e-filing system or the traditional FIRE system. Electronic filing is mandatory if we are filing 10 or more information returns (this threshold was lowered from 250 in prior years).

- If we are still filing paper forms, we must use official IRS forms (not printouts from the internet) and include Form 1096, Annual Summary and Transmittal of U.S. Information Returns, as a cover sheet.

- State Filing: Some states require a copy of Form 1099-NEC. However, Texas, where our company is based, is one of the states where no 1099-NEC is required to be filed at the state level. This simplifies things for us! For other states, we would check if they participate in the Combined Federal/State Filing Program, which means the IRS automatically forwards the information. Otherwise, we might need to file directly with the state, which we can verify through resources like the Quickbooks state-by-state 1099 filing portal list.

Checklist: W9 and 1099 Compliance

- [x] Collect a W9 from every contractor before payment.

- [x] Verify all information is complete and accurate.

- [x] Use W9 data to prepare 1099-NEC.

- [x] Distribute 1099-NEC by January 31.

- [x] File with IRS and state as required (remembering Texas does not require state-level 1099-NEC filing).

Frequently Asked Questions about W9s and 1099s for Contractors

We often hear similar questions from businesses navigating independent contractors and tax forms. Let’s tackle some of the most common ones.

What are the penalties for misclassifying a worker?

Misclassifying a worker as an independent contractor when they should be an employee can lead to severe consequences for your business. The IRS, state labor departments, and even the workers themselves can impose penalties. We could face:

- Financial Penalties: This includes back taxes for Social Security and Medicare (FICA), federal unemployment tax (FUTA), and any income tax withholding that should have been deducted. Penalties for failure to file accurate information returns can range from $50 to over $500 per form.

- Interest: On all unpaid taxes.

- Benefit Liability: If a worker is reclassified, we might be liable for employee benefits (health insurance, retirement contributions) that were not provided.

- Lawsuits: Misclassified workers can sue for unpaid overtime, minimum wage violations, and other employee protections they were denied.

It’s always best to err on the side of caution and ensure our worker status determinations are correct.

What is backup withholding and when does it apply?

Backup withholding is a mechanism the IRS uses to ensure that income tax is paid on certain types of income when the recipient fails to provide a correct Taxpayer Identification Number (TIN). As the payer, you would collect this tax and send it to the IRS.

Backup Withholding | IRS applies in situations such as:

- The contractor doesn’t provide a TIN in the required manner.

- The IRS notifies us that the TIN provided by the contractor is incorrect.

- The contractor fails to certify that they are not subject to backup withholding.

If backup withholding applies, we must withhold 24% of the payments made to the contractor and remit it to the IRS. This is why collecting an accurate and certified W-9 upfront is so vital!

Do I need to issue a 1099 if I paid a contractor less than $600?

Generally, no. The IRS – $600 Threshold for Form 1099-NEC (Nonemployee Compensation) means we only need to issue the form if we paid a contractor $600 or more for services during the calendar year.

However, there are a few nuances and exceptions:

- Payments to corporations: Generally, payments to corporations for services are exempt from 1099-NEC reporting, with exceptions for legal and medical payments.

- Other 1099 forms: Other types of 1099s might have different thresholds. For example, Form 1099-MISC reports royalties of $10 or more.

- Best practice: Even if a payment is below $600, it’s still a good practice to track all payments made to contractors and keep their W-9s on file. This helps with our own recordkeeping and can be useful if an individual’s total income from various sources eventually crosses a reporting threshold.

Conclusion: Simplify Your Contractor Compliance with Fillable W9

Navigating independent contractor tax forms, especially the myth of a 1099 for employees to fill out, can feel complex. However, the process becomes clear once you understand the distinct roles of Form W-9, Form 1099-NEC, and Form 1099-MISC.

Your commitment to accurate W-9 form collection is the cornerstone of correct 1099 filing. By proactively gathering W-9s and filing the right forms on time, you ensure compliance and build trust with your contractors, all while avoiding costly IRS penalties.

At Fillable W9, we understand the complexities involved. Our platform is designed to streamline this entire process, from secure W-9 collection to ensuring you have all the information needed for accurate 1099 filing. We aim to make compliance as simple and straightforward as possible, so you can focus on what you do best—running your business.

✅ Ready to complete your W9 in minutes? Apply here now.