Why Your Taxpayer ID Number Matters for IRS Compliance

A taxpayer ID number is a unique nine-digit identification number issued by the Social Security Administration (SSA) or the Internal Revenue Service (IRS) to track your tax obligations. Whether you’re an individual, freelancer, business owner, or non-resident, this number is essential for filing tax returns, reporting income, and staying compliant with federal tax laws.

Quick Answer: What is a Taxpayer Identification Number (TIN)?

- Definition: A unique 9-digit number used by the IRS to administer tax laws

- Who issues it: Social Security Administration (SSA) or Internal Revenue Service (IRS)

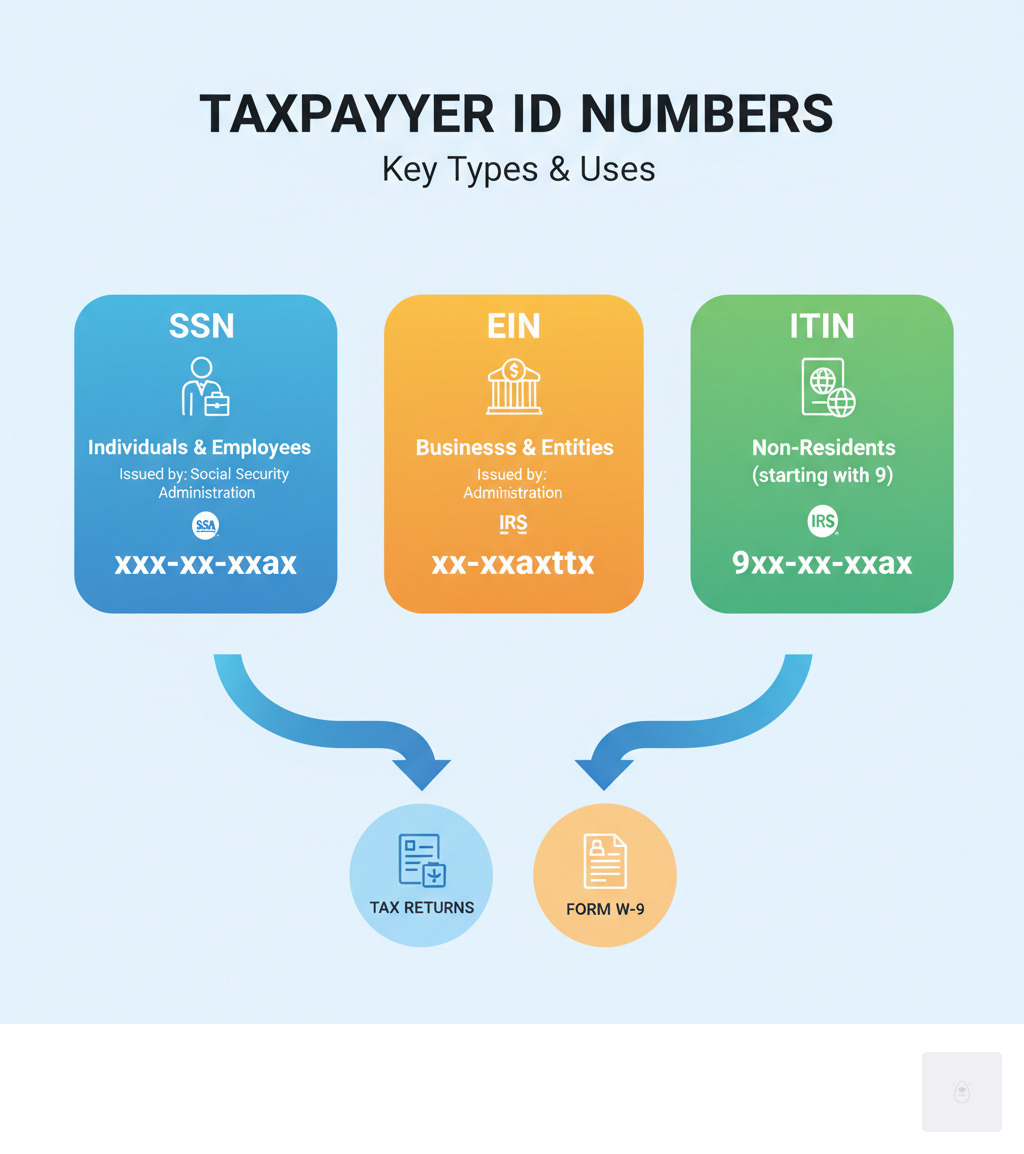

- Main types: Social Security Number (SSN), Employer Identification Number (EIN), Individual Taxpayer Identification Number (ITIN)

- Format examples:

- SSN: xxx-xx-xxxx

- EIN: xx-xxxxxxx

- ITIN: 9xx-xx-xxxx (always starts with 9)

- When you need it: Filing tax returns, claiming treaty benefits, employment, opening business accounts

- Who needs one: U.S. citizens, resident aliens, non-residents with tax obligations, businesses, trusts, estates

Your taxpayer ID number serves as your unique identifier in the U.S. tax system. Without it, you can’t file returns, claim refunds, or receive Social Security benefits. For freelancers and contractors, providing an accurate TIN on Form W-9 is critical to avoid penalties and backup withholding.

The IRS requires you to furnish your TIN on all tax-related documents. If you’re paid $600 or more as an independent contractor, your client will request a W-9 form from you, which includes your taxpayer ID number. Providing incorrect information can result in IRS penalties and delayed payments.

My work helping businesses streamline compliance has shown me how confusion around taxpayer ID numbers creates delays for freelancers and small business owners. Understanding which TIN you need and how to provide it correctly on forms like the W-9 is essential for maintaining professional relationships and avoiding IRS complications.

The Main Types of Taxpayer ID Numbers Explained

The term taxpayer ID number is an umbrella term for several identification numbers, each designed for a different situation. The Social Security Administration (SSA) and the Internal Revenue Service (IRS) issue these numbers to track tax obligations. Understanding which type of taxpayer ID number you need can save you headaches down the road.

| Type of TIN | Who it’s for | Issuing Agency | Format | Primary Use |

|---|---|---|---|---|

| SSN | Individuals (U.S. citizens, lawful permanent residents, eligible non-citizens) | Social Security Administration (SSA) | xxx-xx-xxxx | Employment, individual tax filing, Social Security benefits |

| EIN | Businesses (sole proprietors, corporations, partnerships, LLCs), estates, trusts | Internal Revenue Service (IRS) | xx-xxxxxxx | Business tax filing, employer identification |

| ITIN | Non-resident aliens, resident aliens, and dependents who don’t have an SSN but need a U.S. TIN | Internal Revenue Service (IRS) | 9xx-xx-xxxx | Individual tax filing for those ineligible for an SSN |

Social Security Number (SSN)

If you’ve had a job in the United States, you’re familiar with the Social Security Number (SSN). This nine-digit number is issued by the Social Security Administration to U.S. citizens, lawful permanent residents, and certain eligible non-citizens.

Your SSN follows the format xxx-xx-xxxx and is your primary identifier for employment and individual tax returns. It allows you to work legally in the U.S. and contribute to and claim Social Security benefits.

Under federal law, your SSN functions as your taxpayer ID number for tax purposes. When you fill out a Form W-9 as a freelancer or contractor, your SSN is what you’ll typically provide unless you’ve established a separate business entity.

Employer Identification Number (EIN)

If you run a business, you’ll likely need an Employer Identification Number (EIN), also known as a Federal Tax Identification Number. The IRS issues this nine-digit number in the format xx-xxxxxxx to identify business entities for tax purposes.

You’ll need an EIN if you operate as a corporation, partnership, or LLC. Some sole proprietors also need one, particularly if they hire employees or file certain tax returns. Estates and trusts also require EINs for their tax filings.

An EIN is like a Social Security Number for your business. You’ll use it to file business tax returns, open business bank accounts, and handle payroll. When clients request a W-9 from your business, you’ll provide your EIN instead of your personal SSN, which adds a layer of privacy protection.

The IRS makes it easy to obtain an EIN. You can learn more on their Employer Identification Number page.

Individual Taxpayer Identification Number (ITIN)

If you need to file U.S. taxes but aren’t eligible for an SSN, the IRS issues an Individual Taxpayer Identification Number (ITIN). This taxpayer ID number follows the format 9xx-xx-xxxx and always starts with the number 9. The IRS created it for non-resident aliens, resident aliens, and their dependents who have U.S. tax filing requirements but cannot get an SSN.

An ITIN allows you to comply with U.S. tax laws and file returns. However, it does not authorize you to work in the U.S., make you eligible for Social Security benefits, or qualify you for the Earned Income Tax Credit.

International students, visiting professors, and others claiming treaty benefits often need ITINs. You can find details on the IRS’s Individual Taxpayer Identification Number page.

Other Specialized TINs

Beyond the main three, a few specialized taxpayer ID numbers exist:

Adoption Taxpayer Identification Number (ATIN): The IRS issues a temporary nine-digit Adoption Taxpayer Identification Number if you are adopting a U.S. child but can’t get an SSN for them in time to file your tax return. This allows you to claim the child as a dependent.

Preparer Tax Identification Number (PTIN): Paid tax preparers must have a valid Preparer Tax Identification Number to prepare federal tax returns. This helps the IRS track who is preparing returns professionally.

How to Get Your Required Taxpayer ID Number

Obtaining the right taxpayer ID number is straightforward once you know the process. Each TIN has a specific application pathway, and having the correct forms and documents ready will save you time. Here’s how to get the main types of taxpayer identification numbers.

Applying for a Social Security Number (SSN)

To apply for an SSN, you’ll work with the Social Security Administration (SSA). The process starts with Form SS-5, Application for a Social Security Card PDF, available on the SSA website.

The SSN application requires original documents or certified copies to prove your identity (e.g., driver’s license), age (e.g., birth certificate), and U.S. citizenship or lawful immigration status. Photocopies are not accepted.

You can apply in person at a local Social Security Administration office or mail your application and documents. The SSA will return your original documents after processing, which usually takes about two weeks.

Applying for an Employer Identification Number (EIN)

Getting an EIN for your business is convenient. You’ll use Form SS-4, which can be submitted in three different ways.

The online application is the fastest method, providing an EIN immediately upon completion during business hours (Monday-Friday, 7 a.m. to 10 p.m. ET). This is ideal for urgent needs like opening a bank account.

Alternatively, you can fax your completed Form SS-4 and receive your EIN back within four business days. The traditional mail option takes about four weeks but is a valid choice if you’re not in a hurry.

The application requires information about your “responsible party”—the person or entity managing the business. You must provide their own taxpayer ID number (SSN, ITIN, or another EIN). For detailed instructions, the IRS offers a guide called Understanding Your EIN.

Applying for an Individual Taxpayer Identification Number (ITIN)

Applying for an ITIN requires more documentation, as you must prove to the IRS why you need a U.S. taxpayer ID number without being eligible for an SSN. The application uses Form W-7, Application for IRS Individual Taxpayer Identification Number.

Along with Form W-7, you must provide documents establishing your foreign status and identity, such as a foreign passport or national identity card with a photograph. You must generally attach a federal income tax return to your Form W-7, unless you meet a specific exception.

You can apply by mailing your application to the IRS, visiting a designated IRS walk-in office, or working with an authorized Acceptance Agent. These agents can certify your documents so you don’t have to mail your originals.

For a complete list of requirements, see the IRS’s U.S. Taxpayer Identification Number Requirement page.

Ready to complete your W9 in minutes? Apply here now!

✅ Start filling your W-9 online now at https://fillablew9.com/apply/

TINs in a Global Context: Non-Residents and International Equivalents

Understanding your taxpayer ID number is crucial in our interconnected world, especially if you work internationally or have cross-border financial dealings. Tax identification systems exist worldwide, each with unique rules.

Global initiatives like the Common Reporting Standard (CRS) and various tax treaties help prevent double taxation and ensure compliance. Understanding different national taxpayer ID systems is essential for anyone with international tax obligations.

The Role of the ITIN for International Individuals

If you’re an international individual with U.S. tax obligations but can’t get an SSN, the Individual Taxpayer Identification Number (ITIN) is your key to IRS compliance. This nine-digit taxpayer ID number is for people who must interact with the U.S. tax system but are ineligible for an SSN.

- Non-resident aliens often need an ITIN for U.S.-sourced income from rental properties, investments, or business activities.

- International students and professors use ITINs to file U.S. tax returns and claim benefits they are entitled to under tax treaties.

- Resident aliens who meet the substantial presence test but lack work authorization also rely on ITINs while their immigration status is being finalized.

An ITIN allows these individuals to comply with U.S. tax laws, but it is purely for tax administration. It does not authorize U.S. employment, grant eligibility for Social Security benefits, or qualify you for the Earned Income Tax Credit. The IRS offers comprehensive guidance for international taxpayers.

How a U.S. taxpayer ID number differs from foreign IDs

Most developed nations use a taxpayer ID system, but the specifics vary. Understanding these differences is key for international tax matters.

For example, Canada’s Social Insurance Number (SIN) is a nine-digit number similar to an SSN but issued for employment, taxes, and government benefits. You can learn more on their Social Insurance Number Overview page.

Sweden’s personal identity number is even more integrated, encoding birthdate and serving as a lifelong identifier for taxes, banking, and healthcare. The Swedish Tax Agency (Skatteverket) provides information on Personal identity numbers.

In the European Union, each member state has its own version of a taxpayer ID number with a unique name and format. They all serve to identify taxpayers for domestic and cross-border tax administration, as detailed by the European Commission’s page on Taxpayer Identification Number (TIN).

When dealing with international clients or tax forms, you’ll often need to provide both your U.S. taxpayer ID number and your foreign one. This dual reporting is crucial for smooth international business operations.

Need to provide your TIN to an international client? Complete your W-9 securely online.

✅ Start filling your W-9 online now at https://fillablew9.com/apply/

Protecting Your TIN and Consequences of Non-Compliance

Your taxpayer ID number is a key to your financial identity, making its protection a top priority. While the IRS and SSA have safeguards, you must also be careful about when and how you share your TIN.

Under § 6109 of the Internal Revenue Code, TINs are required on tax documents, implying a need for confidentiality. If your TIN is compromised, you risk identity theft and financial fraud that can take years to resolve. It’s crucial to only provide your TIN when legally required and to verify that any recipient has proper security measures in place.

What Happens if You Don’t Have a TIN?

Lacking or providing an incorrect taxpayer ID number leads to significant problems with the IRS.

First, the IRS imposes penalties for missing or incorrect TINs on information returns. According to IRC Section 6721, these can range from $60 to over $630 per return, depending on when the correction is made and whether the error was intentional. You can review the details on the IRS’s Information return penalties page.

Additionally, you face the inability to file taxes properly without a valid TIN, putting you in a state of non-compliance. If you’re expecting a refund, a missing or incorrect taxpayer ID number will cause significant processing delays.

Most immediately, failing to provide a correct TIN to a payor triggers backup withholding. This requires them to withhold 24% of your payment and send it to the IRS, significantly impacting your cash flow. You can learn more about backup withholding on the IRS website.

The Importance of an Accurate taxpayer ID number on Form W-9

Form W-9, “Request for Taxpayer Identification Number and Certification,” is a critical tool for freelancers and contractors. It’s how you provide your taxpayer ID number (SSN or EIN) to clients.

An accurate W-9 ensures your income is reported correctly, helping you avoid discrepancies and B-Notices. These IRS notices, sent to payors when a name and TIN don’t match, create administrative headaches and can strain professional relationships. Your client must ask for a corrected W-9, and if the issue persists, backup withholding begins.

An inaccurate W-9 can trigger the same 24% backup withholding, meaning you lose a quarter of your income to the IRS before you see it. The IRS provides detailed Instructions for the Requester of Form W-9 that highlight the importance of accurate information.

Taking a few minutes to ensure your W-9 is correct saves you from penalties, backup withholding, and strained client relationships. It’s a simple step for hassle-free tax compliance.

Don’t waste time with paper forms — complete your secure fillable W9 online at https://fillablew9.com/apply/ today!

Frequently Asked Questions about Taxpayer ID Numbers

Navigating taxpayer ID numbers can be overwhelming. Here are answers to some of the most common questions.

How is a taxpayer ID number different from a state tax ID number?

A federal taxpayer ID number (SSN, EIN, or ITIN) is for federal tax purposes. A state tax ID number is separate and issued by a state for its own tax requirements, like sales or franchise tax. For example, a business in Texas might need a state ID from the Texas Comptroller for state-level matters.

The key difference is jurisdiction: a federal TIN is for IRS matters nationwide, while a state tax ID is only for that specific state’s tax obligations. Your federal TIN is your passport for IRS dealings, while state tax IDs are local permits.

Can I look up a taxpayer ID number online?

No, you cannot look up a taxpayer ID number in a public database. TINs are confidential and protected to prevent identity theft and fraud. If these numbers were publicly searchable, it would open the door to widespread financial crime.

To get a TIN, you must request it directly from the individual or business, typically by having them complete a Form W-9. This is the standard, professional way to collect a taxpayer ID number and certify its accuracy.

For businesses verifying many TINs, the IRS offers a TIN Matching service. This is a verification tool for legitimate business purposes, not a public lookup tool, and it only confirms if a name/TIN combination matches IRS records.

What do I do if my TIN is lost or stolen?

If your taxpayer ID number documentation is lost or stolen, don’t panic. There are clear steps to recover it and protect yourself.

- Lost SSN Card: Request a free replacement from the Social Security Administration. You’ll need to provide proof of identity.

- Lost EIN: Check old tax returns or IRS correspondence. If needed, an authorized person from your business can call the IRS Business & Specialty Tax Line to retrieve it.

- Lost ITIN: Look for it on past tax returns or IRS notices. If you can’t find it, contact the IRS for assistance.

If you suspect your taxpayer ID number was stolen, act immediately. Contact the IRS Identity Protection Specialized Unit, notify the SSA if an SSN is involved, and place fraud alerts with the three major credit bureaus (Equifax, Experian, and TransUnion). Filing a police report is also recommended as it creates an official record of the theft.

Your TIN is valuable. Keep it secure, share it only when necessary, and act quickly if you believe it’s been compromised.

Ready to complete your W9 securely and accurately? Fill out your W-9 online in minutes at https://fillablew9.com/apply/.

Conclusion: Simplify Your Tax Compliance Today

Understanding your taxpayer ID number (SSN, EIN, or ITIN) is fundamental to navigating the U.S. tax system. This unique identifier is the cornerstone of IRS compliance, allowing you to file returns and report income. Whether you’re a freelancer completing a Form W-9 or a business managing tax obligations, precision is paramount.

We’ve covered the types of TINs, how to get one, and the importance of compliance. At Fillable W9, our goal is to empower you to manage these essential tax documents with ease. Our secure platform for completing forms like the fillable W9 simplifies this complex process.

Don’t let tax forms add unnecessary stress to your valuable time. Ensure your tax compliance is seamless and secure.

✅ Ready to complete your W9 in minutes? Apply here now!