Understanding Tax Forms: Your Quick Guide to W-9 vs 1099

What is the difference between w 9 and 1099? Here’s the simple answer:

- Form W-9 is filled out by contractors to provide their tax information to businesses before getting paid.

- Form 1099 is filled out by businesses to report payments made to contractors to the IRS after the tax year ends.

- W-9 collects information (name, address, Tax ID) that businesses keep on file.

- 1099 reports income ($600+) to both the contractor and the IRS by January 31st.

- W-9 is not filed with the IRS; 1099 is filed with the IRS and sent to the contractor.

The relationship: Businesses use the information from a W-9 form to accurately complete a 1099 form at year-end.

If you’re a freelancer who just got asked for a W-9, or a small business owner figuring out when to send a 1099, this guide will clear up the confusion. The two forms work together: the W-9 gathers information at the start, and the 1099 reports what was paid at the end. While IRS tax forms can seem complicated, understanding this basic flow is straightforward and protects you from penalties.

Start filling your W9 now at https://fillablew9.com/apply.

This guide will break down exactly how these forms work, when you need them, and how to avoid common mistakes that cost time and money.

What is a Form W-9? The Information Gathering Tool

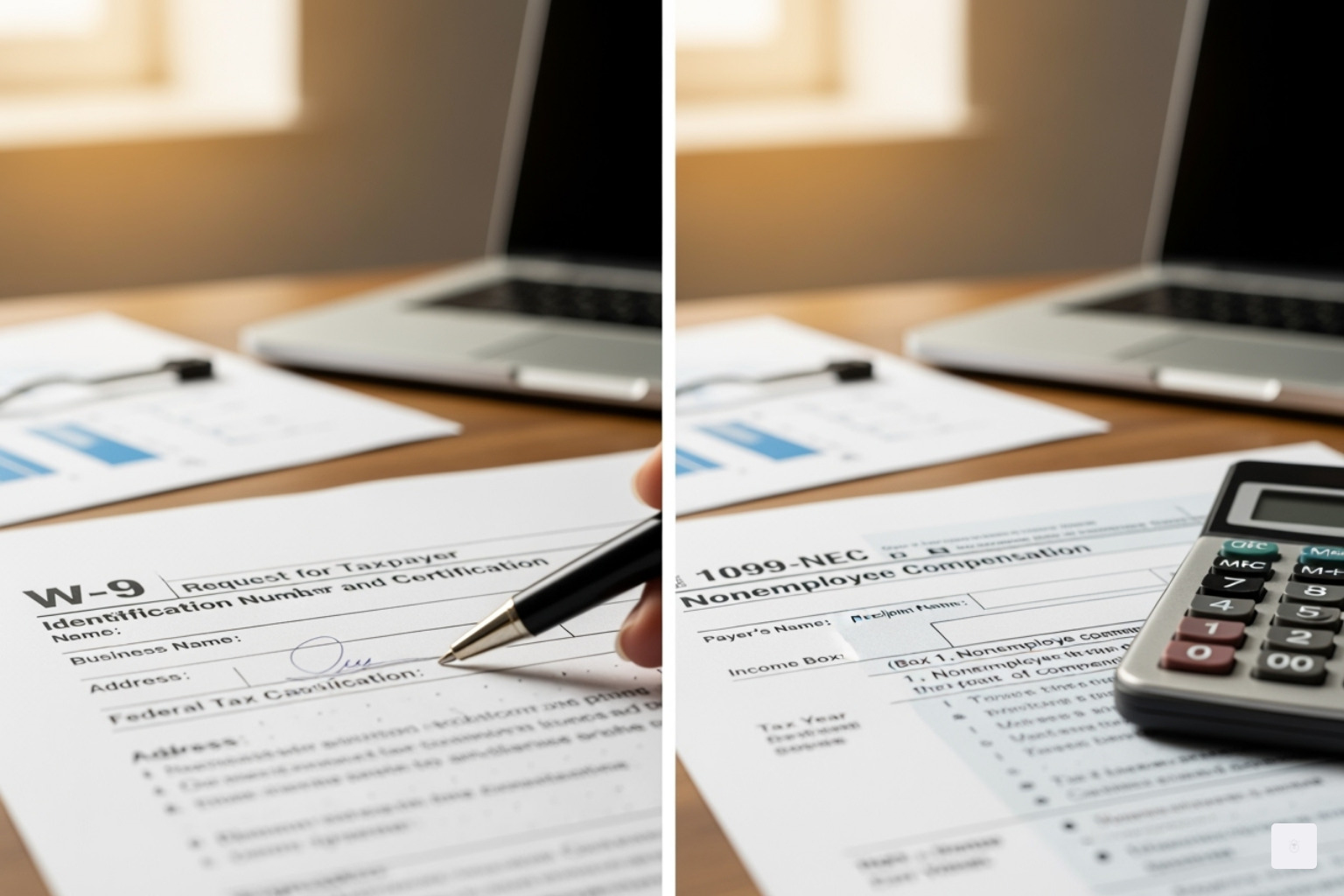

Think of the W-9 form as the “getting to know you” document of the tax world. Officially the “Request for Taxpayer Identification Number and Certification,” this form is how independent contractors, freelancers, and vendors introduce themselves to the businesses that hire them. Its purpose is to collect essential taxpayer information from non-employees so businesses can report payments to the IRS later.

When a business hires you, they should ask you to fill out a W-9 before making any payment. By getting your information up front, they ensure they’re covered for tax reporting.

A critical point: the W-9 is not filed with the IRS. The business that requested it keeps the form for their records. They use this information to prepare 1099 forms and determine if backup withholding applies. It’s an internal document between you and the payer.

Pro tip: Don’t waste time with paper forms — complete your secure W9 online at https://fillablew9.com/apply.

Who Fills Out a W-9 and What Information is Needed?

Any U.S. person or entity receiving payment from a business as a non-employee will likely need to complete a W-9. This includes:

- Freelancers, consultants, and sole proprietors

- Corporations, partnerships, and LLCs

- Vendors supplying goods or services

- Landlords renting property to a business

The form gathers the essential details a business needs to report payments accurately. You will provide:

- Your legal name and business name (if applicable), matching what’s on your tax return.

- Your federal tax classification (e.g., sole proprietor, S-Corp, LLC).

- Your mailing address.

- Your Taxpayer Identification Number (TIN). For individuals, this is your Social Security Number (SSN). For businesses, it’s your Employer Identification Number (EIN).

- Your signature and date, certifying that the information is correct and that you are a U.S. person not subject to backup withholding.

Providing this information accurately on your W-9 is the first step in the tax reporting process and ensures that the 1099 you receive at year-end is correct.

What is a Form 1099? The Year-End Income Report

If the W-9 is the introduction, the Form 1099 is the year-end report card. Its purpose is to inform both the payee and the IRS about income received from sources other than wages. The IRS uses this to ensure all income is reported.

The payer (the business) is responsible for filling out and filing the 1099. Unlike the W-9, which stays in the business’s files, copies of the 1099 are sent to both the contractor and the IRS. The deadline is January 31st of the following year.

The magic number to remember is $600 or more. Businesses must issue a 1099 to any individual or unincorporated entity they paid $600 or more during the tax year for services, rent, or other specified payments.

Crucially, the information on the 1099 comes directly from the W-9. The payer uses the name, address, and TIN from the W-9 to populate the 1099, which is why an accurate W-9 is so important.

Common Types of 1099 Forms

While “1099” is a general term, there are several variations. The most common for freelancers and businesses are:

- Form 1099-NEC (Nonemployee Compensation): This is the primary form for reporting payments of $600 or more to independent contractors and freelancers for their services.

- Form 1099-MISC (Miscellaneous Information): This form is now used for other income of $600 or more, such as rent, royalties, prizes, and certain payments to attorneys.

- Form 1099-DIV (Dividends and Distributions): Reports dividends from stocks and mutual funds.

- Form 1099-INT (Interest Income): Reports interest income from banks and financial institutions.

What Information is on a Form 1099?

A 1099 form compiles key financial details for the tax year. It includes:

- Payer Information: The name, address, and TIN of the business making the payment.

- Payee Information: The name, address, and TIN of the contractor receiving the payment (taken from the W-9).

- Total Payments: The total amount paid during the year, reported in specific boxes like “Nonemployee compensation.”

- Federal Income Tax Withheld: This box is usually empty unless backup withholding was required.

This reporting ensures both the payee and the IRS have a clear record of income, facilitating accurate tax filing.

What is the Difference Between W-9 and 1099? A Side-by-Side Comparison

The clearest way to understand what is the difference between w 9 and 1099 is to see them as partners in the tax reporting process. They serve different purposes at opposite ends of the payment timeline. The W-9 asks the question (“Who are you?”), and the 1099 provides the answer (“Here’s what we paid them.”).

The W-9 is the information collector, filled out by the contractor at the start of a business relationship. The business keeps this form on file; it never goes to the IRS.

The 1099 is the income reporter, filled out by the business at the end of the tax year. It tells both the contractor and the IRS how much was paid.

| Feature | W-9 Form | 1099 Form |

|---|---|---|

| Purpose | Collects payee info for reporting | Reports payments to IRS/payee |

| Who Completes It | Payee (contractor/vendor) | Payer (business/client) |

| Who Receives It | Payer keeps on file | IRS & payee |

| When It’s Used | Before payment | After year-end, if $600+ paid |

| Information Included | Name, TIN, address, classification | Payment amount, TIN, payer/payee |

| IRS Action | Not filed with IRS | Filed with IRS |

Don’t waste time with paper forms — complete your secure W9 online at https://fillablew9.com/apply.

The Crucial Relationship: How a W-9 Becomes a 1099

The W-9 provides the raw data needed for the 1099. A business transfers the contractor’s name, address, and TIN from the W-9 directly onto the 1099, adds the total payment amount, and files it with the IRS.

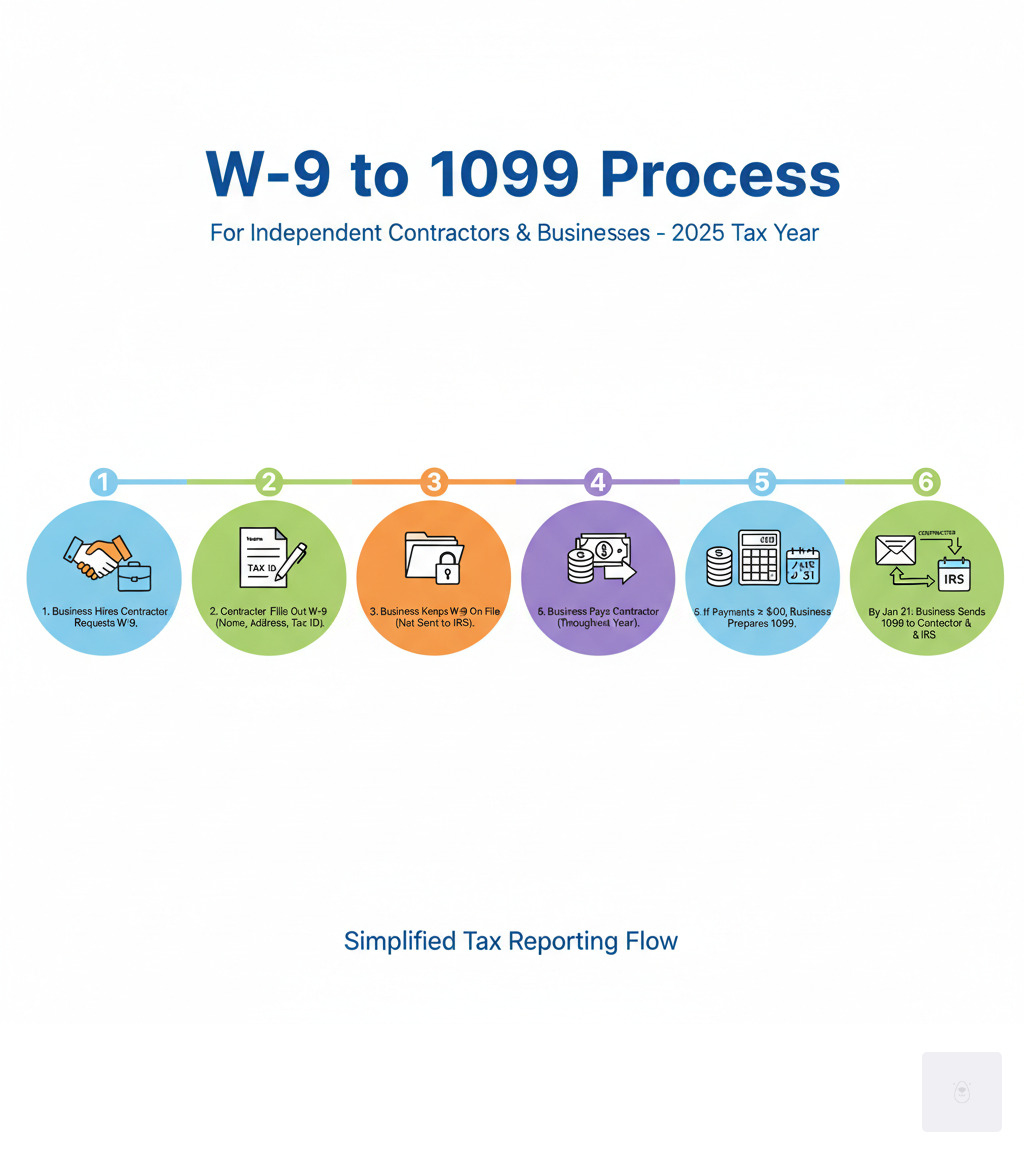

The process is simple:

- Collect: The business requests a W-9 from the contractor before payment.

- Track: The business tracks payments to the contractor throughout the year.

- Report: If payments total $600 or more, the business uses the W-9 info to prepare a 1099.

- File: By January 31, the business sends the 1099 to the contractor and the IRS.

For the Contractor (Payee)

- W-9: This is your responsibility. You proactively provide your information to a client so they can pay you and report your income correctly. An accurate W-9 prevents future problems.

- 1099: This is what you receive. It’s a summary of your earnings from that client, which you’ll use to file your tax return and calculate self-employment tax.

For the Business (Payer)

- W-9: You are the collector. It’s your job to request and keep a W-9 from every contractor you pay $600 or more. This is your backup documentation.

- 1099: You are the reporter. You must fill out and file a 1099 for each eligible contractor, reporting their income to the IRS. Failing to do so can lead to significant penalties.

Compliance, Consequences, and Best Practices

Understanding what is the difference between w 9 and 1099 is the first step; compliance is the next. The IRS takes these rules seriously.

First, ensure proper worker classification. Employees get W-4s and W-2s, while independent contractors get W-9s and 1099s. Misclassifying workers can lead to back taxes and penalties. Refer to the IRS guide on independent contractor vs. employee if you are unsure.

For record retention, keep W-9 forms for at least four years after the last payment. Keep copies of 1099 forms for at least three years, though many professionals recommend seven.

Consequences of Non-Compliance

The IRS issues penalties for mistakes and missed deadlines. According to the IRS page on information return penalties, you can face fines for:

- Failure to file a correct 1099 on time: Penalties range from $60 to $330 per form (for 2024), depending on how late you are.

- Intentional disregard: If the IRS determines you intentionally ignored filing requirements, the penalty jumps to $660 per form (for 2024) with no maximum.

- Failure to furnish a W-9: Payers can be fined $50 for failing to obtain a correct TIN, and payees can be fined $50 for failing to provide one.

Understanding Backup Withholding

Backup withholding is the IRS’s safety net. If a contractor fails to provide a correct Taxpayer Identification Number (TIN) on their W-9, the business must withhold 24% of their payments and send it to the IRS.

This is a significant loss of immediate income for the contractor and extra administrative work for the business. The good news is that backup withholding is completely avoidable. An accurate W-9 provided upfront prevents it. For more details, see the IRS page on backup withholding.

Frequently Asked Questions about W-9 and 1099 Forms

Let’s clear up some of the most common questions about these forms.

How do W-9 and 1099 forms differ from a W-4?

The difference is based on your worker status:

- W-9 & 1099: These forms are for independent contractors. The W-9 provides your tax info to a client, and the 1099 reports your annual earnings from them. No taxes are withheld from your payments.

- W-4 & W-2: These forms are for employees. You fill out a W-4 to tell your employer how much tax to withhold from your paycheck. At year-end, you receive a W-2 summarizing your wages and taxes paid.

In short: contractors use W-9/1099 and handle their own taxes, while employees use W-4/W-2 and have taxes withheld by their employer.

What is the threshold for issuing a 1099 form?

The threshold is $600 or more paid to an individual or unincorporated entity during the tax year for services, rent, or other specific payments. This is based on the total for the year, not per invoice. If you pay a contractor $599, no 1099 is required. If you pay them $600, you must file one.

How long should I keep W-9 and 1099 forms?

Proper record-keeping is crucial for compliance.

- W-9 Forms: Businesses should keep these on file for at least four years after the last payment to the contractor.

- 1099 Forms: Both the business and the contractor should keep copies for at least three years from the tax filing date. Many experts recommend keeping them for seven years.

Conclusion: From Information Gathering to Income Reporting

If you’ve made it this far, you now have a clear picture of what is the difference between w 9 and 1099. These two forms might seem confusing at first, but they’re actually working together in a straightforward partnership. The W-9 collects your information at the beginning of a business relationship, while the 1099 reports your income to the IRS at year’s end.

Think of it this way: the W-9 is your introduction, and the 1099 is the final report card.

For freelancers and contractors, filling out an accurate W-9 means you’re setting yourself up for success. You’re ensuring that payments flow smoothly and that your tax reporting stays accurate. No one wants surprise tax issues because of a simple form error.

For businesses, the responsibility is just as important. Collecting W-9s from your contractors and issuing 1099s correctly isn’t just good practice—it’s the law. Following these procedures protects you from penalties and keeps your business operations running smoothly and transparently.

The truth is, mistakes with these forms can cost you time, money, and unnecessary stress. Whether it’s a missed deadline, an incorrect TIN, or backup withholding that could have been avoided, the consequences add up quickly. That’s exactly why we built Fillable W9—to take the confusion and risk out of the process entirely.

We’ve designed our platform to make completing and managing your W-9 forms secure, simple, and fast. No more wondering if you filled in the right box or worrying about keeping paper forms organized. You can handle everything online in just minutes, giving you more time to focus on the work you actually love doing.

✅ Ready to complete your W9 in minutes? Apply here now.