Why Understanding Contractor Tax Forms Is Critical for Your Business

Contractor tax form confusion is one of the most common pain points for independent workers and small business owners. Whether you’re a freelancer in the U.S. navigating the W-9 and 1099-NEC system, or a Canadian contractor dealing with T2125 and T4A slips, knowing which forms you need—and when—can save you from costly penalties and tax headaches.

Here’s what you need to know:

- U.S. Contractors: You’ll need to provide a Form W-9 to clients who pay you, and you’ll receive a Form 1099-NEC if you earn $600 or more from a single client in a tax year.

- Canadian Contractors: You’ll report business income using Form T2125 and may receive a T4A slip from clients who paid you $500 or more (or deducted tax from any payment).

- Tax Deadlines Matter: In the U.S., 1099-NEC forms are due January 31st. In Canada, self-employed individuals must file by June 15th (but pay any taxes owed by April 30th).

- Deductions Lower Your Tax Bill: Independent contractors can deduct business expenses like home office costs, travel, supplies, and professional services.

Picture this: You’re an independent contractor living the freelance dream. You set your own hours, choose the projects you want to work on, and answer to no one but yourself. But then tax season rolls around, and suddenly you’re lost in a maze of forms and regulations.

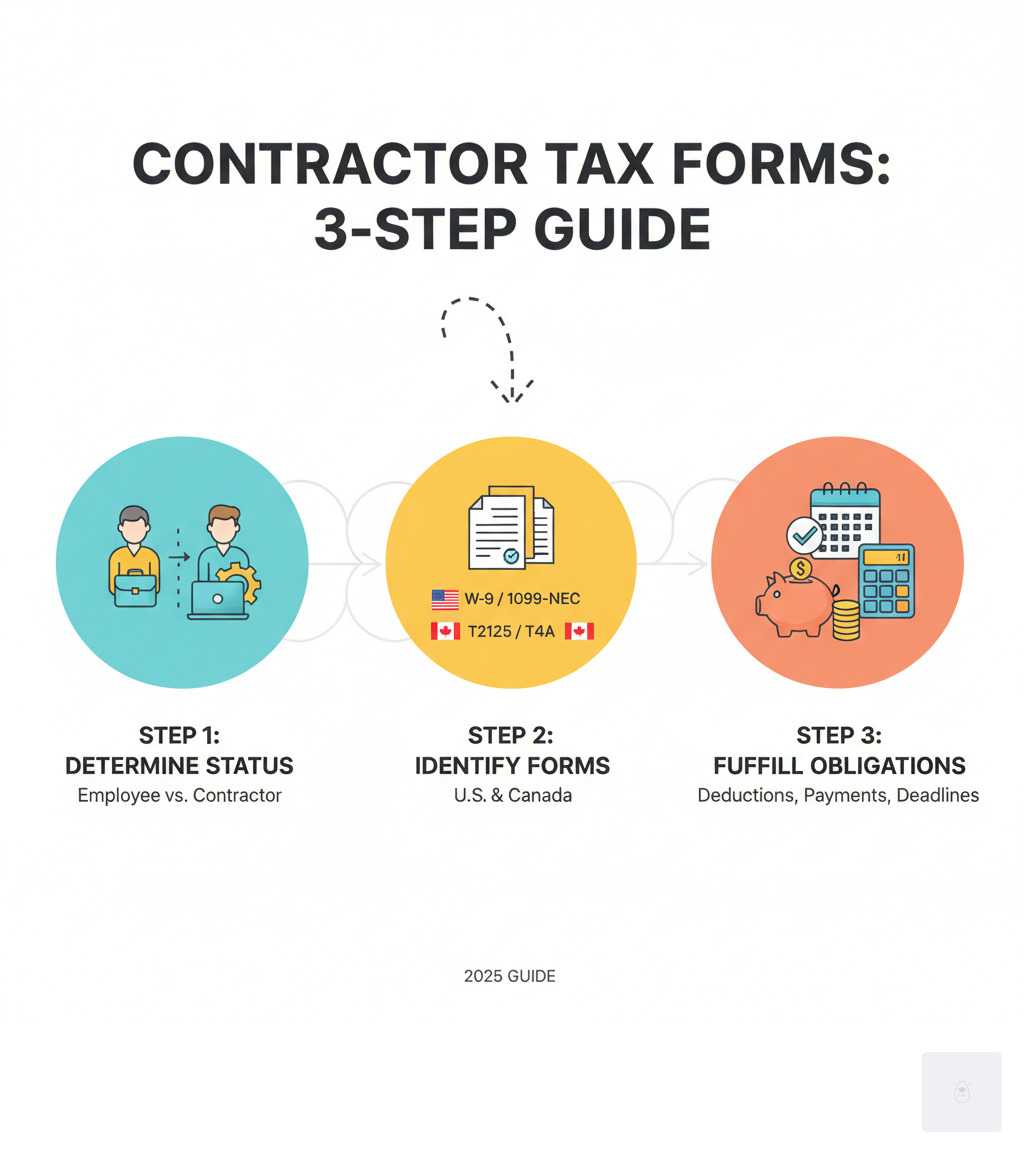

The good news? Understanding contractor tax forms doesn’t have to be complicated. This guide breaks down the three essential steps to identify, complete, and file the right tax forms—whether you’re working in the U.S., Canada, or serving clients across North America.

I’m Haiko de Poel, a fractional Chief Marketing Officer and digital strategist who has helped businesses like Palmetto Surety Corporation and eSURETY® steer complex compliance and operational challenges. Through my work with independent contractors and small businesses, I’ve seen how the right contractor tax form strategy can streamline operations and prevent costly mistakes.

Step 1: Determine Your Worker Status: Are You an Employee or an Independent Contractor?

Before you can tackle any contractor tax form, you need to answer one fundamental question: Are you actually an independent contractor, or are you an employee? This isn’t just a technicality—your classification determines everything from which forms you file to how much you owe in taxes.

The IRS and the Canada Revenue Agency (CRA) both use common-law rules to make this determination. These rules focus on the degree of control and independence in your working relationship. Get this wrong, and you could face penalties, back taxes, or lose out on benefits you’re entitled to.

Let’s break down what tax authorities look for when they evaluate your worker status.

In the U.S., the IRS examines three main categories to determine whether you’re an independent contractor or an employee. First, there’s behavioral control—does the company tell you not just what to do, but how to do it? If your client provides detailed instructions, extensive training, or closely monitors your work methods, that points toward an employee relationship. Independent contractors typically control their own work processes and decide how to complete projects.

Second, the IRS looks at financial control. Do you invest in your own equipment? Can you take on other clients? Do you pay your own business expenses without reimbursement? Independent contractors usually own their tools, market their services to multiple clients, and have the opportunity to make a profit or take a loss based on their business decisions. Employees, on the other hand, are generally paid a regular wage and have their expenses covered by the company.

Third, there’s the type of relationship to consider. Written contracts matter, but so do the practical realities. Do you receive employee benefits like health insurance, vacation pay, or a pension plan? Is your work arrangement ongoing and indefinite, or project-based? Are you performing work that’s central to the company’s core business? These factors all help determine your true status.

Canadian contractors face similar scrutiny from the CRA, which examines various factors to distinguish employees from self-employed individuals. The CRA looks at control—who decides when, where, and how the work gets done? Independent contractors typically set their own schedules and work methods, while employees follow the company’s direction.

The CRA also considers ownership of tools and equipment. If you provide your own laptop, software, vehicle, or specialized equipment, that suggests you’re self-employed. There’s also the chance of profit or risk of loss—can you earn more by working efficiently, or lose money if a project goes over budget? This financial risk is a hallmark of true independent contractor status. Finally, the CRA examines whether you have the right to subcontract or hire assistants to help complete the work.

Misclassification isn’t just an abstract concern—it has real consequences. If you’re a U.S. worker who was incorrectly classified as an independent contractor when you should have been an employee, you can use 2024 Form 8919 to report uncollected Social Security and Medicare taxes on your wages. This form ensures your earnings are properly credited to your Social Security record, which directly affects your future retirement and disability benefits.

For businesses, misclassifying workers can result in owing back taxes, penalties, and interest. You might also be liable for employment taxes you should have withheld, plus the employee’s share of those taxes. It’s a situation worth avoiding.

The good news? Once you’ve confirmed your status as an independent contractor, you can move forward with confidence, knowing exactly which tax forms you need to complete. That brings us to Step 2, where we’ll identify the specific contractor tax form requirements for your situation.

Step 2: Identify the Right Contractor Tax Form for Your Business

Now that we’ve nailed down your worker status, it’s time to figure out which contractor tax form you actually need to deal with. This is where things get practical—and honestly, a bit different depending on which side of the border you’re on.

The forms you’ll encounter vary significantly between the U.S. and Canada, and knowing which ones apply to you can save you from midnight panic sessions during tax season. For U.S. contractors looking for the complete picture, the IRS offers comprehensive guidance on Forms and associated taxes for independent contractors | IRS.

Let’s break down what you need to know for both countries.

For U.S. Contractors: The W-9 and 1099-NEC

If you’re working as an independent contractor in the United States, two forms will become your constant companions. Think of them as the dynamic duo of contractor tax documents.

Form W-9 is where your tax journey begins. This isn’t a form you file with the IRS—instead, it’s something you provide directly to your clients. When a new client asks you to “fill out a W-9,” they’re requesting your Taxpayer Identification Number (TIN), which is either your Social Security Number (SSN) or Employer Identification Number (EIN), along with your name and address. Your clients need this information to report the payments they make to you. The current Form W-9 (Rev. March 2024) is available directly from the IRS website. Here’s the thing: if you don’t provide a properly completed W-9, your clients might be legally required to withhold 24% of your payments for backup withholding. That’s money coming out of your pocket unnecessarily.

Form 1099-NEC is the form that shows up in your mailbox (or inbox) after the calendar year ends. If a client paid you $600 or more during the year, they’ll send you—and the IRS—a 1099-NEC showing exactly how much you earned. The “NEC” stands for Nonemployee Compensation, which is tax-speak for “you’re a contractor, not an employee.” This form replaced the old 1099-MISC for reporting contractor payments starting in 2020. While Form 1099-MISC still exists, it’s now reserved for other types of payments like rent, royalties, or prizes—not your contractor income. If you’re curious about how these forms work together, W9 vs 1099: A Simple Guide to Contractor Tax Forms offers a helpful breakdown.

For Canadian Contractors: The T2125 and T4A

Canadian contractors have their own set of forms to wrangle, and while the names are different, the purpose is similar: tracking your income and making sure the Canada Revenue Agency (CRA) knows what you’ve earned.

Form T2125, the Statement of Business or Professional Activities, is your bread and butter. This is where you report all your self-employment income and expenses to calculate your net business income (or loss, if it wasn’t a great year). Whether you’re a freelance writer, a consultant, or running a small business, the T2125 is mandatory. You’ll complete this form and include it with your personal T1 income tax return. If you’re juggling multiple business activities, you’ll need a separate T2125 for each one. The official Form T2125 is available on the CRA website.

T4A slips are the Canadian equivalent of the 1099-NEC, with a few twists. Clients will issue you a T4A if they paid you $500 or more in a calendar year, or if they deducted any tax from payments they made to you. The T4A covers various types of income beyond standard employment—pension income, scholarships, and yes, your contractor payments. You won’t necessarily receive a T4A from every client, but when you do, it’s an important document to hang onto. The CRA provides detailed information about a T4A slip and when it’s required. The key difference? A T4A is not the same as a T4 slip, which is issued to employees whose employers regularly withhold taxes from their paychecks.

Special Cases for Your Contractor Tax Form

Most contractors will stick with the standard forms we’ve covered, but certain situations call for additional documentation or special considerations.

Construction industry contractors in Canada need to be aware of the Contract Payment Reporting System (CPRS). If you’re a subcontractor in construction, the companies that pay you are required to report those payments to the CRA through this system. It’s the government’s way of ensuring compliance in an industry known for cash transactions and complex subcontracting chains.

Form TD1 in Canada is primarily an employee form used to determine tax withholding, but it’s worth understanding as a contractor. If you’re in a situation where a client needs to withhold tax from your payments, they might ask you to complete a TD1 to determine the correct amount. Without it, they’ll default to withholding based only on the basic personal amount, which could leave you with a surprise tax bill later. Quebec contractors should also be familiar with the provincial TP-1015.3-V, Source Deductions Return, which serves a similar purpose for provincial taxes.

Non-resident contractors face an extra layer of complexity. If you’re a Canadian contractor working for U.S. clients (or vice versa), you’ll need to steer international tax treaties and non-resident withholding rules. This often means dealing with different forms and potentially having taxes withheld at source. It’s one of those situations where consulting a cross-border tax professional can save you a lot of headaches and money.

We know that sorting through all these forms can feel overwhelming, especially when you’re just trying to run your business and serve your clients. That’s exactly why we built Fillable W9—to take the confusion out of completing your W-9 accurately and securely. ✅ Ready to complete your W9 in minutes? Apply here now.

Step 3: Fulfill Your Tax Obligations: Deductions, Payments, and Deadlines

Getting the right contractor tax form is just your starting point. The real work begins when you need to understand what you can deduct, how to actually pay your taxes throughout the year, and—perhaps most importantly—when everything is due. We’ve seen too many contractors get hit with penalties simply because they didn’t know the rules.

Claiming Business Expenses to Lower Your Tax Bill

Here’s some good news: as an independent contractor, you have a powerful advantage that employees don’t. You can deduct legitimate business expenses from your taxable income, which directly lowers your tax bill. We can’t stress enough how important it is to track every single business-related expense. That coffee meeting with a client? That new laptop you use for work? Your home internet bill? Many of these costs can reduce what you owe.

Think about your home office costs first. If you have a dedicated space in your home that you use exclusively and regularly for business, you can deduct a portion of your rent or mortgage, utilities, property taxes, and homeowner’s insurance. The keyword here is “exclusively”—your kitchen table where you sometimes work doesn’t count, but a spare bedroom converted into an office does.

Your office supplies and software are straightforward deductions. Everything from printer ink and paper to specialized design programs and accounting software qualifies. Even a portion of your internet and phone bills can be deducted if you use them for business purposes.

Travel expenses related to your business are deductible too. We’re talking about mileage when you drive to meet clients (or actual vehicle expenses if you prefer that method), airfare to conferences, hotel stays, and even meals during business travel—though meals typically have a 50% limitation. The key is that the travel must have a clear business purpose.

Don’t forget about professional services. Fees you pay to accountants, lawyers, business coaches, or consultants are generally deductible. Your marketing and advertising costs—whether it’s your website, business cards, or online ads—count as well. And if you’re investing in yourself through courses, workshops, or certifications that improve your business skills, those professional development expenses are often deductible.

Insurance is another important category. Business liability insurance, professional indemnity insurance, and in some cases, health insurance premiums (particularly if you’re self-employed and not eligible for other coverage) might be deductible.

If you’re a Canadian contractor whose annual earnings cross the $30,000 threshold, you’ll need to register for a GST/HST account. This means collecting and remitting sales tax—a separate obligation from income tax, but one that’s crucial for growing businesses.

How to Pay Your Taxes and Avoid Penalties

Unlike traditional employees who have taxes automatically withheld from every paycheck, we as independent contractors need to manage our own tax payments. This typically means making payments throughout the year rather than waiting until tax season.

For U.S. contractors, if you expect to owe at least $1,000 in taxes for the year, you’ll generally need to make quarterly estimated tax payments. These payments cover your income tax, self-employment tax (which includes Social Security and Medicare), and any other taxes you might owe. The IRS has set specific due dates—typically April 15, June 15, September 15, and January 15 of the following year.

Canadian contractors face similar requirements through tax installments. If your net tax owing exceeds $3,000 in the current year and either of the two previous years (or $1,800 for Quebec residents), the CRA will require you to pay your income tax by installments throughout the year.

Now, let’s talk about something that catches many U.S. contractors off guard: backup withholding. This is a 24% withholding rate that kicks in when you fail to provide your correct Taxpayer Identification Number (TIN) to a payer, or when the IRS notifies the payer that your TIN is incorrect. The payer then withholds 24% of your payments and sends it directly to the IRS. This is exactly why completing your W-9 accurately matters so much. For complete details, the IRS provides comprehensive guidance on Backup Withholding | IRS.

The penalties for non-compliance aren’t trivial. You could face late filing penalties for tax returns submitted after the deadline, late payment penalties for taxes not paid on time, and underpayment penalties if you don’t pay enough estimated tax throughout the year. Payers who fail to file required forms like 1099-NEC on time or with incorrect information face their own set of penalties, which the IRS details in their Information return penalties | IRS guidance.

We want to help you avoid these pitfalls entirely. Completing your contractor tax form correctly and on time is your first line of defense.

Key Tax Deadlines for Independent Contractors

Missing a deadline is one of the easiest ways to end up paying penalties you didn’t need to pay. Let’s walk through the critical dates you need to mark on your calendar.

For U.S. contractors, the most important date is January 31—this is when payers must furnish Form 1099-NEC to recipients and file it with the IRS. It’s a hard deadline with no wiggle room, and we emphasize its importance for both payers and recipients. April 15 serves double duty: it’s both the deadline for filing your annual income tax return (Form 1040) and paying any tax due for the previous year, and it’s also when your first quarterly estimated tax payment for the current year is due. Your second quarterly payment is due June 15, followed by the third on September 15. The fourth and final quarterly payment for the current year is due January 15 of the following year.

Canadian contractors need to remember that payers must issue T4A slips by February 28. Here’s where Canadian deadlines get a bit nuanced: while self-employed individuals have until June 15 to file their personal income tax returns, any taxes owed must still be paid by April 30. As the CRA clearly states, “elf-employed individuals is June 15 of the following year; but if you owe any taxes, you’ll need to make your payment by April 30“. This means you get extra time to file, but not extra time to pay.

We’ve put together a comparison table to help you keep these dates straight:

Frequently Asked Questions about Contractor Tax Forms

We know that even with all the information, questions can linger. Here are some common concerns we hear about contractor tax form requirements:

What’s the difference between a W-9 and a 1099?

This is probably the most common question we get! Think of it this way: a W-9 is the information you give to your client before they pay you, while a 1099 is the record of payment they give to you (and the IRS) after they’ve paid you.

The W-9 is proactive—you’re providing your Taxpayer Identification Number (TIN) and certifying your tax status so your client has everything they need on file. Your client keeps this form for their records.

The 1099-NEC is reactive—it’s your client’s way of reporting to the IRS (and to you) that they paid you $600 or more for services during the year. It’s a summary of the income you earned from that particular client.

In short, the W-9 collects information, and the 1099 reports payments. They work hand-in-hand to ensure accurate tax reporting. One requests your details, the other documents what you were actually paid.

Do I need to file a contractor tax form if I was paid less than $600?

Here’s where many contractors get confused. While your U.S. clients generally aren’t required to send you a Form 1099-NEC if they paid you less than $600, that doesn’t mean the income isn’t taxable or that you can skip reporting it.

As an independent contractor, you’re responsible for reporting all your income, regardless of the amount or whether you receive a 1099 form. The $600 threshold is for the payer’s reporting obligation to the IRS, not for your obligation to report income. Every dollar you earn from your business activities needs to be reported on your tax return.

Similarly, in Canada, while a client might not issue a T4A slip if they paid you less than $500 (unless tax was deducted), you are still required to report all your business income on your T2125 form. Keep detailed records of all payments, no matter how small they seem.

As a Canadian contractor, what happens if I don’t receive a T4A?

Don’t panic if a T4A slip doesn’t arrive in your mailbox. Even if a client doesn’t provide you with a T4A slip, you are still obligated to report all income you received from them. The responsibility to report income ultimately rests with you, the contractor, not with your client’s paperwork.

This is why meticulous record-keeping is so important. Keep copies of all your invoices, receipts, and bank statements showing payments received. You’ll use these personal records to accurately complete your Form T2125, Statement of Business or Professional Activities, which is mandatory for reporting your self-employment income and expenses to the CRA.

Don’t wait for a slip that might not come—be proactive with your record-keeping from day one. Your own business records are your best defense during tax season.

Conclusion: Simplify Your Contractor Tax Forms Today

Navigating contractor tax form requirements doesn’t have to keep you up at night. We’ve walked through the three essential steps together: first, determining whether you’re truly an independent contractor or an employee; second, identifying the specific forms you need—whether that’s the W-9 and 1099-NEC if you’re working in the U.S., or the T2125 and T4A if you’re based in Canada; and third, understanding exactly how to fulfill your tax obligations through smart deductions, timely payments, and hitting those critical deadlines.

The truth is, tax season confidence comes down to preparation. When we keep accurate records throughout the year, understand which business expenses we can legitimately deduct, make our estimated tax payments on schedule, and never lose sight of filing deadlines, we transform tax compliance from a source of anxiety into a manageable part of running our business.

For U.S. contractors, everything starts with that first crucial document: the W-9. Getting this form completed accurately means your clients have the correct information to report payments to the IRS, and it helps you avoid the headache of backup withholding. It’s the foundation that makes everything else run smoothly.

We built Fillable W9 specifically to take the stress out of this process. No more worrying about outdated forms, messy handwriting, or security concerns when sharing sensitive information. Our platform lets you complete your W-9 correctly, securely, and in just a few minutes—so you can get back to doing what you do best.

✅ Ready to complete your W9 in minutes? Apply here now