Why IRS Compliance for Freelancers Matters More Than Ever

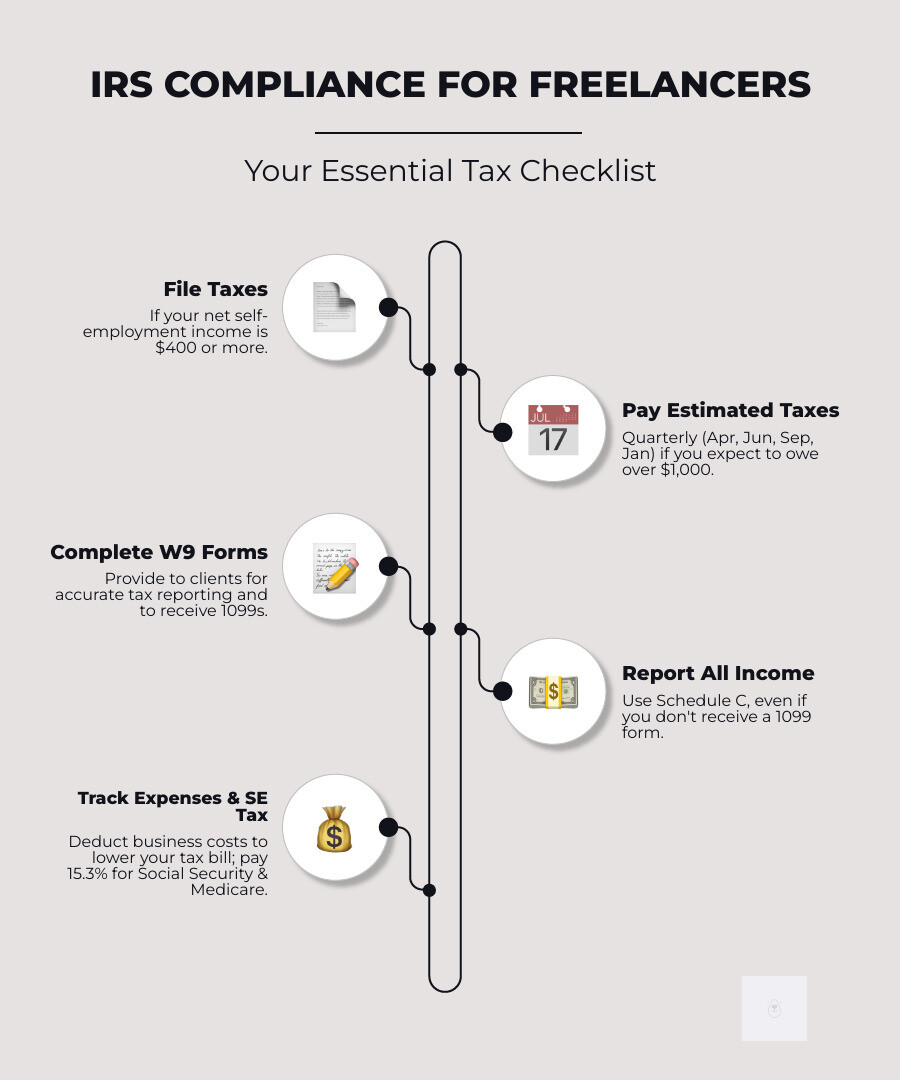

IRS compliance for freelancers starts with understanding your core obligations. Here’s what you need to know:

- File taxes if your net self-employment income is $400 or more.

- Pay estimated taxes quarterly (April 15, June 17, September 16, January 15) if you expect to owe over $1,000.

- Complete a W9 form for clients so they have your correct tax information.

- Report all income on Schedule C, even if you don’t receive a 1099 form.

- Pay self-employment tax at 15.3% to cover Social Security and Medicare.

- Track business expenses to claim deductions and lower your tax bill.

With 36% of U.S. workers now freelancing, the IRS has increased its scrutiny. Payment platforms like Venmo and PayPal must now report users who earn more than $600. This means your income isn’t flying under the radar.

Staying compliant is manageable once you understand the basics. The W9 form is your starting point—it’s how you provide your taxpayer identification number to clients. Get this wrong, and you risk payment delays or backup withholding at 24%.

Start filling your W9 now at https://fillablew9.com/apply.

Understanding your tax obligations is critical to business success, protecting your income and reputation.

Are You an Employee or an Independent Contractor? (And Why the W9 Matters)

Figuring out if you’re an employee or an independent contractor is critical, as the IRS cares deeply about this distinction. They use “common law rules” focusing on three areas to determine your status.

- Behavioral Control: Does the company control how you do your work? Detailed instructions and mandatory training suggest an employee relationship. Freedom to choose your own methods points to a contractor.

- Financial Control: Who controls the business aspects? If you invoice for services, work for multiple clients, and invest in your own equipment, you’re likely a contractor. Employees get a steady paycheck.

- Relationship Type: Written contracts, employee benefits (like health insurance), and whether your work is core to the business are all considered.

If you’re unsure, you or the business can file Form SS-8 for an official determination, though it takes at least six months. For more, see the IRS page on Independent contractor (self-employed) or employee?

Key Differences in Tax Treatment for Freelancers

Your classification dramatically changes your tax responsibilities. Employees have taxes withheld by their employer and receive a W-2 tax form.

As an independent contractor, you’re on your own. You pay your own income and self-employment taxes through quarterly estimated payments. This is why the W9 form is essential for IRS compliance for freelancers. When a client asks for a W9, they’re collecting your Taxpayer Identification Number to report your income on a 1099 form. The W9 is your starting point for freelancer tax compliance.

| Feature | Employee (W-2) | Independent Contractor (1099) |

|---|---|---|

| Tax Withholding | Employer withholds income, Social Security, Medicare | No withholding by client; you pay estimated taxes |

| Social Security/Medicare | Shared between employee and employer (7.65% each) | You pay both portions (15.3% self-employment tax) |

| Tax Forms Received | W-2 Wage and Tax Statement | 1099-NEC, 1099-MISC, 1099-K (if applicable) |

| Business Expenses | Limited deductions (unreimbursed expenses generally not deductible) | Deductible business expenses on Schedule C |

| Benefits | Typically offered (health, retirement, paid leave) | No client-provided benefits |

| W9 Requirement | Not typically required for employment | Required by clients to report payments |

The upside for contractors is the ability to deduct business expenses on Schedule C, significantly reducing your taxable income.

Consequences of Worker Misclassification

Getting this wrong has serious financial consequences. Businesses that misclassify employees as contractors face IRS audits, back taxes, interest, and penalties.

If you believe you’ve been misclassified, you can file Form 8919 to report your share of Social Security and Medicare taxes, which alerts the IRS. Businesses can correct past errors through the Voluntary Classification Settlement Program (VCSP), which offers partial relief from back taxes in exchange for future compliance. Understanding your status is fundamental to IRS compliance for freelancers.

Your Core Tax Obligations: Self-Employment, Estimated Taxes, and IRS Compliance

As a freelancer, you’re responsible for your own taxes. IRS compliance for freelancers becomes manageable once you understand the core rules. The first is simple: if you earn more than $400 in net self-employment income, you must file a tax return.

Unlike employees, you receive full payment from clients, so you must set aside money for taxes. This means understanding self-employment tax and estimated taxes is non-negotiable. The IRS offers a helpful guide to Manage taxes for your gig work.

A Freelancer’s Guide to IRS Compliance: Understanding Self-Employment Tax

As a freelancer, you pay both the employee and employer portions of Social Security and Medicare taxes. This is called the self-employment tax.

For 2024, the rate is 15.3% on your net earnings (12.4% for Social Security up to $168,600 and 2.9% for Medicare with no cap). High earners may also owe an additional Medicare tax of 0.9%.

The good news: you can deduct one-half of your self-employment tax, which helps offset the cost.

Staying Ahead with IRS Compliance for Freelancers: Paying Quarterly Estimated Taxes

Since taxes aren’t withheld from your payments, you must send them to the IRS yourself throughout the year. These are called estimated taxes. If you expect to owe at least $1,000 in taxes for the year, you’re required to make these quarterly payments.

The 2024 due dates are April 15, June 17, September 16, and January 15, 2025. You’ll use Form 1040-ES to calculate and pay. It’s better to overpay slightly than to underpay and face penalties. You may also need to pay state estimated taxes, so check your state’s requirements.

Don’t waste time with paper forms — complete your secure W9 online at https://fillablew9.com/apply.

Essential Paperwork for Freelancers: The W9 and 1099 Forms

Two forms are central to your freelance career: the W9 and the 1099. They are the backbone of your IRS compliance for freelancers and connect your income to tax reporting.

When a new client asks for a W9, they are collecting your name, address, and Taxpayer Identification Number (TIN). They need this because if they pay you $600 or more, they must report it to the IRS. Your completed W9 form gives them the information to do so.

The W9 is just the start. At year-end, clients use it to generate 1099 forms, which document how much you earned. With payment platforms like PayPal and Etsy now required to report users earning over $600, nearly all freelance income is tracked.

Decoding Your W9 and 1099 Forms

Here’s what each form means for your IRS compliance for freelancers:

- W9 Form: You fill this out for clients. It certifies your name, business structure, and TIN are accurate. An error can lead to 24% backup withholding. Keep a current, secure fillable W9 ready.

- 1099-NEC (Nonemployee Compensation): You’ll receive this from any client who paid you $600 or more for services. It’s the most common 1099 for freelancers.

- 1099-MISC (Miscellaneous Information): This form is for other income types over $600, like rent, royalties, or prizes.

- 1099-K (Payment Card and Third Party Network Transactions): This comes from payment processors like PayPal or Stripe. The reporting threshold is currently in transition but is expected to be $600. You must understand your Form 1099-K to report your taxes correctly.

Crucially, you must report all income, even if you don’t receive a 1099.

Choosing the Right Business Structure for Your W9

Your business structure affects how you fill out your W9 and how you’re taxed.

- Sole Proprietorship: This is the default for freelancers. You and your business are one entity. You’ll use your name and Social Security Number on the W9 and report income on Form 1040 Schedule C.

- Limited Liability Company (LLC): This creates a legal separation, protecting your personal assets. A single-member LLC is usually taxed like a sole proprietorship, but you’ll use your LLC’s name and Employer Identification Number (EIN) on the W9.

- S-Corp: This structure can offer tax savings on self-employment taxes for higher earners but requires more administrative work. You’d check the S-Corp box on your W9.

Consult a tax professional to choose the right structure as your income grows.

A Freelancer’s Guide to Tax Deductions and Record Keeping

One of the biggest perks of being a freelancer is deducting business expenses to lower your taxable income. The IRS rule is simple: expenses must be “ordinary and necessary” for your business. An ordinary expense is common in your industry, and a necessary one is helpful and appropriate.

The key to maximizing deductions and ensuring IRS compliance for freelancers is meticulous record-keeping. Save every receipt, invoice, and bank statement. If you’re ever audited, your records are your defense. Accounting software or even a detailed spreadsheet can make this manageable.

Common and Important Tax Deductions for Freelancers

Many expenses qualify. Here are some of the most common:

- Office supplies and software subscriptions for tools essential to your work.

- Business travel costs, including transportation and lodging for client meetings or conferences.

- Client meals, which are generally 50% deductible.

- Health insurance premiums if you’re not eligible for an employer’s plan.

- Professional development costs for courses and certifications that improve your skills.

- Marketing and advertising expenses, from website hosting to online ads.

- Retirement plan contributions to a Solo 401(k) or SEP IRA, which reduce your taxable income now while you save for the future.

The Home Office Deduction: Rules and Limitations

The home office deduction is valuable but has strict rules. You must meet two tests:

- Exclusive Use: The space must be used exclusively for your business. A desk in the corner of your living room doesn’t count if the area is also used for personal activities.

- Regular Use: You must use the space regularly as your principal place of business.

If you qualify, you have two calculation methods. The simplified method lets you deduct $5 per square foot (up to 300 sq. ft., for a max of $1,500). It’s easy but limited. The actual expense method involves deducting a percentage of your actual home expenses (rent, utilities, insurance) based on the office’s square footage. It requires more record-keeping but can yield a larger deduction.

Step-by-Step Guide: How to Fill Out a W9 for Freelancers

Completing a W9 form is a core task for IRS compliance for freelancers. Accuracy is critical to avoid payment delays. Here’s how to fill out your W9 form with confidence.

Step 1: Get the latest W9 form.

Download the current version from the IRS website or use a secure online platform like Fillable W9 to handle it digitally and reduce errors.

Step 2: Enter your name and business name.

On Line 1 (Name), enter your legal name as it appears on your tax return. On Line 2 (Business Name), only enter a name if you have a DBA or formal business name. Otherwise, leave it blank.

Step 3: Select your federal tax classification.

Most freelancers check Individual/sole proprietor or single-member LLC. If you’ve formed an LLC taxed as a corporation or partnership, select the appropriate box.

Step 4: Enter your address and TIN.

Fill in your mailing address. In Part I, enter your Taxpayer Identification Number (TIN). For sole proprietors, this is usually your Social Security Number (SSN). If you have an Employer Identification Number (EIN), use that instead. Never enter both.

Step 5: Sign and date the form.

In Part II, read the certification, then sign and date the form. An unsigned W9 is invalid.

Pro Tip: Double-check every line. An incorrect TIN or mismatched name can trigger 24% backup withholding, where your client sends a chunk of your payment directly to the IRS.

Start your W9 securely at https://fillablew9.com/apply.

Frequently Asked Questions about IRS Compliance and the W9 for Freelancers

Navigating IRS compliance for freelancers brings up common questions. Here are clear answers to the most frequent concerns about W9 forms and tax reporting.

How do digital platforms like Uber or Etsy handle W9 and tax reporting?

Digital platforms like Uber and Etsy are considered “third-party payment networks.” They will require you to complete a W9 when you sign up. They use this information to issue a Form 1099-K if you meet certain income thresholds. The threshold was lowered to $600 starting with the 2023 tax season, though the IRS implemented a transitional threshold of $5,000 for 2024. The 1099-K reports your gross payments, not your net profit, so you’ll need to deduct your expenses separately. The IRS provides specific guidance on managing taxes for your gig work.

What happens if a client doesn’t send me a 1099-NEC?

The answer is simple: you must still report all your income. The 1099 is a reporting tool for the IRS, not a prerequisite for you to report income. If your net self-employment earnings are $400 or more, you are required to file a tax return and pay self-employment tax. This is why your own records—invoices, bank statements, and payment confirmations—are essential for IRS compliance for freelancers. You’ll report all business income on Schedule C (Form 1040), whether you received a 1099 or not. The Self-employed individuals tax center confirms this responsibility is yours.

Where can I find official IRS forms and resources?

Always go straight to the source for tax information. IRS.gov is the official website and your best resource. Key pages for freelancers include:

- Gig economy tax center: Provides guidance specifically for gig workers.

- Forms and associated taxes for independent contractors: Explains the W9, 1099-NEC, and other relevant forms.

- Publication 334 (Tax Guide for Small Business) and Publication 505 (Tax Withholding and Estimated Tax): These free, downloadable guides offer in-depth information.

Bookmark these resources and check them annually, as tax rules can change.

✅ Ready to complete your W9 in minutes? Apply here now.

Conclusion: Stay Compliant and Confident with Your W9

The truth about IRS compliance for freelancers is that it’s manageable with the right habits. It’s a crucial skill for your business success.

We’ve covered the essentials: determining your contractor status, understanding the W9 and 1099 forms, paying self-employment and estimated taxes, and finding valuable deductions.

Build these habits from day one:

- Classify yourself correctly to know your obligations.

- Fill out your W9 accurately to ensure smooth payments.

- Pay quarterly estimated taxes to avoid penalties.

- Track every business expense to lower your tax bill.

All income must be reported, whether you receive a 1099 or not. Your records are your proof. For official guidance, the Self-employed individuals tax center on the IRS website is your best resource.

The freelance life offers incredible freedom. Don’t let tax stress undermine it. With tools like Fillable W9, you can handle your paperwork efficiently and focus on the work you love.

✅ Ready to complete your W9 in minutes? Apply here now.