Understanding When to Send W9: The Essential Timing Guide

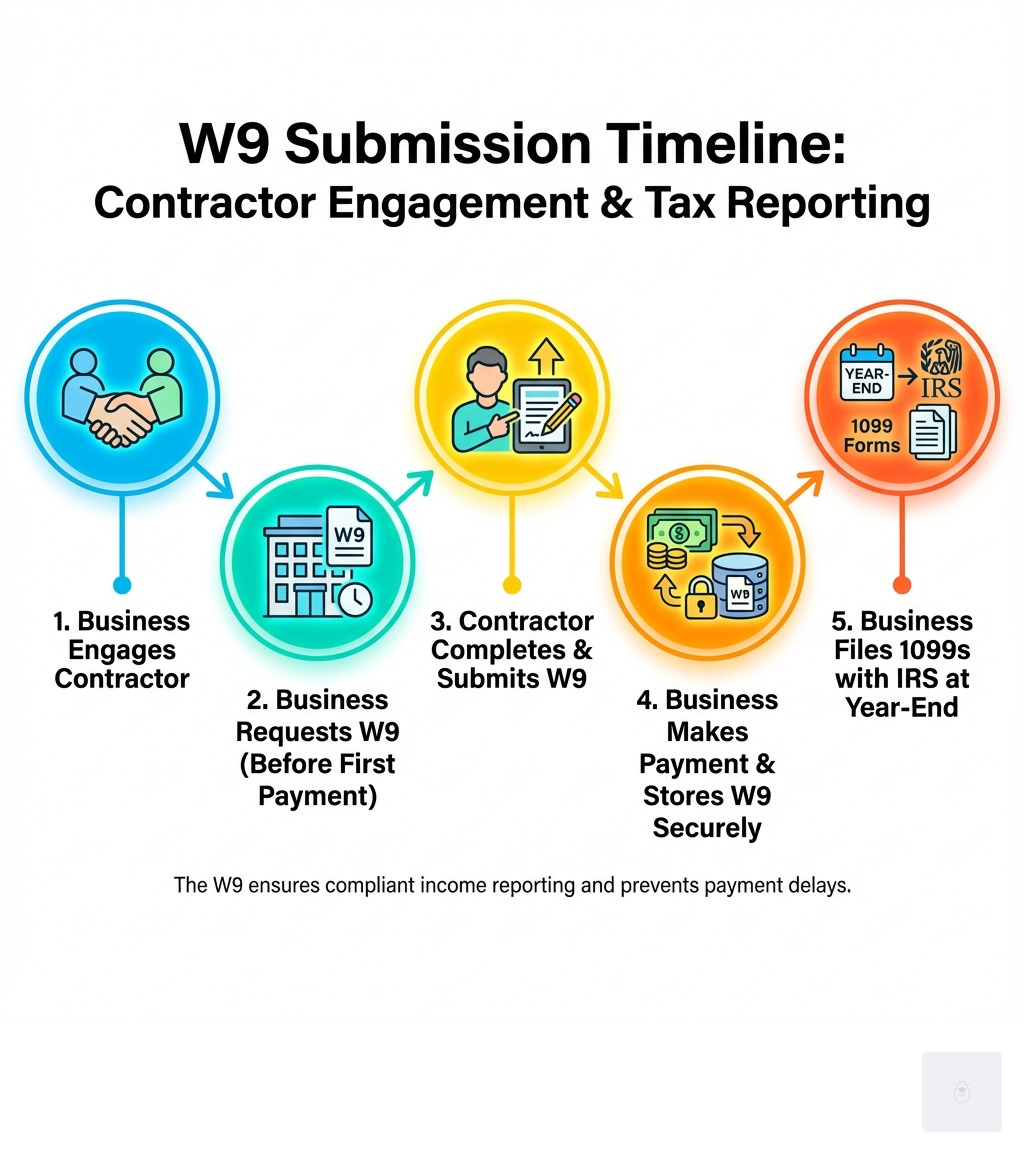

When to send W9 forms depends on your role: businesses should request W9s from vendors and contractors before making the first payment, while freelancers and independent contractors should submit W9s immediately upon client request or proactively when starting a new engagement. Here’s the quick breakdown:

For Businesses (Requesters):

- Before first payment to a new vendor or contractor

- When onboarding new suppliers or service providers

- Annually or whenever vendor information changes

- Even if payments may be under $600 (best practice)

For Contractors/Freelancers (Payees):

- Immediately when a client requests one

- Proactively when starting work with a new client

- Whenever your business name, address, or TIN changes

- Before submitting your first invoice

If you’ve ever been confused about whether a W9 is for residence verification, employment status, or tax purposes, you’re not alone. The W9 is actually a simple IRS form used to collect your Taxpayer Identification Number (TIN) so businesses can report payments to you on forms like the 1099-NEC. It’s not about where you live or proving you’re an employee—it’s about helping the business that pays you stay compliant with IRS reporting requirements.

The form itself requests basic information: your name, business name (if applicable), tax classification, address, and your Social Security Number or Employer Identification Number. Businesses use this information to prepare information returns at year-end, particularly when they’ve paid you $600 or more during the tax year. Understanding when to send W9 forms prevents delays in payments, avoids mandatory backup withholding, and keeps both parties compliant with federal tax law.

I’m Haiko de Poel, and through my work with startups and growing businesses at Mass Impact, I’ve helped countless freelancers and small business owners steer the complexities of when to send W9 forms and establish compliant contractor relationships. My experience rebranding and launching fast-growing companies has shown me that proper documentation timing—especially for tax forms—is critical to smooth business operations.

Who Needs to Fill Out a W9 and Who Requests It?

The W9 form plays a crucial role in the American tax system, acting as a bridge between those who pay for services and those who provide them. It’s all about ensuring that income is properly reported to the IRS. So, let’s clarify who’s on each side of this essential tax document.

Payees: The People and Entities Who Complete the W9

A payee is the individual or entity receiving payment, and if you’re a “U.S. person” for tax purposes and getting paid for services, you’re likely the one filling out a W9. But what exactly constitutes a U.S. person in this context? The IRS has a clear definition, and it’s broader than you might think.

A U.S. person required to complete a W9 includes:

- U.S. citizens or resident aliens: This covers individuals who live and work in the United States, as well as U.S. citizens living abroad.

- Partnerships: Any partnership formed or organized in the United States.

- Corporations: This includes both C corporations and S corporations established in the U.S.

- Companies or associations created or organized in the United States.

- Estates: Any estate, other than a foreign estate.

- Trusts: Any trust, other than a foreign trust.

- Sole proprietors: If you’re a sole proprietor or a single-member LLC treated as a disregarded entity, you’ll complete the W9 as an individual.

Essentially, if you’re an independent contractor, freelancer, gig worker, or a vendor providing services or goods to a business, and you fall into one of these U.S. person categories, you’ll be asked to provide a W9. This form doesn’t get sent to the IRS by you; instead, it’s kept on file by the business that pays you.

Foreign individuals or entities generally do not fill out a W9. Instead, they typically use a Form W-8BEN (Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting) or other appropriate W-8 series forms to certify their foreign status and claim any applicable tax treaty benefits. You can find more details on these distinctions in the IRS instructions for W9 requesters.

Requesters: The Businesses That Ask for the W9

On the other side of the transaction are the requesters—the businesses or individuals who are paying you for goods or services. These entities need your W9 primarily because the IRS requires them to report certain payments they make to non-employees. This reporting helps the IRS track income and ensure everyone pays their fair share of taxes.

A business will typically request a W9 from you if they expect to pay you $600 or more in a calendar year. This threshold applies to various types of payments that need to be reported on forms like the 1099-NEC (for nonemployee compensation) or 1099-MISC (for rents, royalties, and other income). Without your W9, the business won’t have the necessary Taxpayer Identification Number (TIN) to complete these crucial year-end tax forms.

This is why we often see businesses asking for a W9 as part of their onboarding process for new vendors or independent contractors. It’s not just good practice; it’s a critical step in their compliance with IRS regulations. If they don’t collect this information, they could face penalties or even be required to withhold a portion of your payments, which nobody wants!

The Critical Timing: When to Send W9 Forms

Understanding when to send W9 forms is paramount for both businesses and contractors. Timing is everything in tax compliance, and getting this right can save a lot of headaches (and potential penalties) down the line. Let’s break down the optimal moments for requesting and submitting this essential document.

When to Send a W9 if You’re a Business

For businesses, being proactive about W9 collection is a golden rule. Our goal is to ensure we have all the necessary information well before tax season rolls around.

Here are the key instances when to send W9 requests:

- New Vendor Onboarding: This is the most crucial time. As soon as you decide to engage a new independent contractor, freelancer, or vendor, you should request a completed W9. Ideally, this happens before they even start work. Why? Because you need their Taxpayer Identification Number (TIN) to properly report any payments.

- Before the First Payment: This goes hand-in-hand with onboarding. You should aim to have a signed W9 on file before you issue that very first payment. This eliminates scrambling later and ensures you’re ready for year-end reporting.

- Annually or When Information Changes: While not strictly required annually if the information hasn’t changed, it’s a best practice to periodically confirm the W9 information. More importantly, if a vendor’s business name, address, or tax classification changes, they should submit an updated W9 immediately. We should also request a new W9 if we receive an IRS notice indicating an incorrect TIN.

- The $600 Threshold: The IRS generally requires you to file a Form 1099-NEC or 1099-MISC if you pay an unincorporated vendor $600 or more in a calendar year. However, we strongly recommend requesting a W9 from all vendors, even if you anticipate paying them less than $600. It’s hard to predict exact payment totals, and having the W9 on file prevents issues if payments unexpectedly exceed the threshold. Plus, a W9 is not required when payments are not associated with conducting a trade or business, but for most payments made by a business, it’s safer to request one.

The IRS provides extensive guidance on reporting payments to independent contractors, underscoring the importance of this process. Proactively collecting W9s simplifies your year-end tax reporting and helps you avoid potential penalties.

Don’t waste time with paper forms — complete your secure W9 online at https://fillablew9.com/apply/

When to Send a W9 if You’re a Contractor or Freelancer

If you’re an independent contractor or freelancer, you’re the payee, and the responsibility to provide your W9 falls to you. Being prepared and prompt with your W9 submission reflects professionalism and ensures you get paid without delays.

Here’s when to send W9 forms from your perspective:

- Upon Client Request: The most common scenario. When a new client asks for your W9, provide it promptly. This is a standard part of their vendor setup process.

- With Your First Invoice: Many savvy freelancers include their completed W9 along with their first invoice to a new client. This proactive step demonstrates preparedness and ensures the client has everything they need for payment processing and tax reporting.

- When Personal or Business Details Change: If your legal name, business name, address, or Taxpayer Identification Number (TIN) changes, you must provide an updated W9 to all clients who have your previous information on file. This ensures their records are accurate for future tax reporting.

- Proactive Submission: While not always necessary, some freelancers choose to have a ready-to-go W9 that they can easily send to prospective clients as part of their onboarding packet. This can streamline the process and make a good impression.

Your W9 contains sensitive information (like your Social Security Number or EIN), so always ensure you’re sending it through a secure method. We’ll cover best practices for secure W9 management later in this article.

The W9 and Its Connection to Other Tax Forms

The W9 form isn’t just a standalone document; it’s a foundational piece of the tax reporting puzzle. Its primary purpose is to collect the necessary data—specifically, your Taxpayer Identification Number (TIN) and correct name—that businesses need to fulfill their IRS reporting obligations. Think of it as the precursor to other crucial tax forms, primarily the 1099 series.

How W9 Information is Used for Form 1099-NEC and 1099-MISC

The information you provide on your W9 form is directly used by the payer to generate various 1099 forms at the end of the year. These forms report different types of income you’ve received to both you and the IRS. The most common ones for independent contractors and freelancers are:

- Form 1099-NEC (Nonemployee Compensation): This form is used to report payments of $600 or more made to non-employees for services performed in the course of the payer’s trade or business. If you’re a freelancer, consultant, or independent contractor, this is the form you’ll most likely receive. The W9 provides the payer with your name and TIN, which are essential for completing the 1099-NEC accurately.

- Form 1099-MISC (Miscellaneous Information): While 1099-NEC now handles nonemployee compensation, 1099-MISC is still used for reporting other types of payments of $600 or more, such as:

- Rents (e.g., if you rent property to a business)

- Royalties (e.g., from intellectual property)

- Prizes and awards

- Other income payments

The W9 ensures that the payer has your correct legal name and TIN, preventing discrepancies that could trigger IRS notices or penalties. It’s the critical first step in accurately reporting income to the IRS. For a deeper dive into how these forms interact, you can check out resources like this article explaining how W9 and 1099 forms work together.

Understanding Backup Withholding and Form 945

Now, what happens if a business doesn’t get a valid W9 from a payee, or if the information provided is incorrect? That’s where “backup withholding” comes into play – and it’s something both parties want to avoid!

Backup withholding is essentially a mechanism the IRS uses to ensure that income taxes are collected when a payee hasn’t provided the necessary information. If you, as a payee, fail to furnish your Taxpayer Identification Number (TIN) in the required manner, provide an incorrect TIN, or if the IRS notifies the payer that your TIN is incorrect, the payer may be required to withhold a portion of your payments.

The current backup withholding rate is 24%. This means that instead of receiving your full payment, the payer would send 24% directly to the IRS. This continues until you provide the correct TIN to the payer. While this might sound like a hassle, it’s the IRS’s way of saying, “We need that information!” You can learn more about this on the IRS Tax Topics page for backup withholding.

For businesses, if they are required to withhold federal income tax (including backup withholding) from nonpayroll payments, they must file Form 945, Annual Return of Withheld Federal Income Tax. This form reports all federal income tax withheld from nonpayroll payments throughout the year. You can find the official Form 945 instructions on the IRS website.

Here’s a quick comparison to help distinguish the W9 from another common tax form, the W4:

| Feature | Form W-9 (Request for Taxpayer Identification Number and Certification) | Form W-4 (Employee’s Withholding Certificate) |

|---|---|---|

| Purpose | To provide your TIN to a payer for income reporting (1099 forms). | To tell an employer how much federal tax to withhold from your paycheck. |

| Who Fills It Out | Independent contractors, freelancers, vendors, individuals receiving interest/dividends (non-employees). | Employees. |

| Who Requests It | Businesses paying non-employees. | Employers. |

| Key Information | Name, business name, tax classification, address, TIN, certifications. | Name, address, SSN, marital status, allowances/adjustments. |

| IRS Filing | Not filed with the IRS by the payee; kept by the payer. | Filed with the employer; employer sends info to IRS. |

Best Practices for Managing W9 Forms Securely

Given that the W9 form contains highly sensitive personal identifiable information (PII) like Social Security Numbers (SSNs) or Employer Identification Numbers (EINs), managing these forms securely is not just a best practice—it’s a critical necessity. Data breaches can lead to identity theft and significant legal repercussions. We take security seriously, and we know you do too!

For Businesses Requesting W9s

If you’re a business collecting W9s, you become the custodian of sensitive data. Here’s how to handle this responsibility with care:

- Secure Collection Process: Avoid requesting W9s via unsecured email attachments. Instead, use secure online portals or dedicated secure file transfer services. At Fillable W9, we offer a secure, encrypted platform designed specifically for this purpose, ensuring that information is protected from the moment it’s submitted.

- Digital Storage: Once collected, store W9s digitally in encrypted, password-protected systems, ideally with access controls limited to authorized personnel. Physical copies, if any, should be kept in locked cabinets.

- Four-Year Retention Rule: The IRS generally requires you to keep W9 forms on file for at least four years after the tax year in which the payment was made. This allows for potential audits or inquiries.

- Verifying Information (TIN Matching): To prevent errors and avoid backup withholding, consider using the IRS’s Taxpayer Identification Number (TIN) Matching service. This free e-service allows payers to verify name and TIN combinations against IRS records before filing information returns. This helps reduce notices for incorrect TINs and potential penalties.

For Freelancers Submitting W9s

As a freelancer or contractor, you’re entrusting your personal information to a client. It’s smart to be cautious and proactive about how you submit your W9:

- Verify Requester Legitimacy: Before sending your W9, ensure the request is legitimate. Double-check the client’s identity and the context of the request. If anything feels “off,” don’t hesitate to ask for clarification.

- Avoid Unsecured Email Attachments: Just like businesses should avoid requesting them this way, you should avoid sending W9s as attachments to regular, unencrypted emails. This is a common vector for data theft.

- Use Secure Portals: Whenever possible, use secure online platforms provided by your client or a trusted third-party service like Fillable W9. These platforms encrypt your data during transmission and storage, significantly reducing the risk of unauthorized access.

- Proactive Submission: Having your W9 ready to go through a secure channel can speed up your onboarding with new clients and ensure timely payments.

Start your secure W9 online now at https://fillablew9.com/apply/

Frequently Asked Questions about the W9 Form

We understand that tax forms can sometimes feel like navigating a maze. Here are some of the most common questions we hear about W9 forms, along with clear answers to guide you.

What are the penalties for providing an incorrect TIN?

Providing an incorrect Taxpayer Identification Number (TIN) on a W9 form can lead to tax complications and potential penalties for both the payee and the payer.

For the payee (you), the most immediate consequence is often backup withholding. The IRS requires the payer to withhold 24% of your income if your TIN is incorrect or not provided. This money is sent directly to the IRS. You can stop this once you provide the correct TIN to the requestor.

For the payer (the business), the IRS may impose a penalty of $50 per incorrect TIN for each failure, up to an annual cap. These penalties can be significant for businesses dealing with many contractors. However, penalties may be waived if the payer can show reasonable efforts were made to provide the correct TIN, often through a process like TIN matching. This highlights why accurate W9 collection is so important for businesses. You can find more details about backup withholding and its implications on the IRS website.

Are there exceptions to when a W9 is required?

Yes, there are situations where a W9 form is not strictly required, though it’s often still a good idea to have one on file.

- Payments Under $600: Generally, if a business expects to pay a non-employee less than $600 in a calendar year, they are not required to issue a 1099 form, and therefore, a W9 is not strictly necessary for reporting purposes. However, as we mentioned, it’s still a best practice for businesses to request a W9 from all vendors, as payment totals can be unpredictable.

- Payments to Corporations: Payments made to C corporations and S corporations are generally exempt from 1099-NEC reporting (with some exceptions, such as payments to attorneys or for medical/health care services). Therefore, a W9 might not be required for these entities, but many businesses still request one to confirm their corporate status.

- Payments to Foreign Persons: If the payee is a foreign individual or entity, they should not provide a W9. Instead, they would typically furnish a Form W-8BEN or another appropriate W-8 series form to certify their foreign status and claim any applicable treaty benefits.

- Payments Not in the Course of Trade or Business: If a payment is not made in the course of the payer’s trade or business (e.g., a personal payment from one individual to another for a small service), a W9 and subsequent 1099 reporting are not typically required.

What happens if a contractor refuses to provide a W9?

This can be a tricky situation for businesses, but the IRS has clear guidelines. If an independent contractor or vendor refuses to provide a W9, the business is legally obligated to take specific steps to comply with tax regulations and avoid penalties.

First, the IRS rules state that you must request a W-9 form in writing from the vendor a minimum of three times. Documenting these requests is crucial.

If, after these multiple requests, the contractor still refuses to provide a W9 or an accurate Taxpayer Identification Number (TIN), the business is then required to initiate backup withholding at the current rate of 24% on all future payments to that contractor. This means 24% of their payment will be sent directly to the IRS. As a business, you would report this withheld amount on Form 945, Annual Return of Withheld Federal Income Tax. You can read more about this on the IRS page regarding backup withholding.

Furthermore, if a business cannot obtain a W9, it may be unable to deduct the payments made to that contractor as a business expense, potentially leading to a higher tax liability for the business. This is why it’s so important for businesses to emphasize the necessity of the W9 upfront and for contractors to understand the consequences of not providing it.

Conclusion: Simplify Your W9 Process Today

Understanding when to send W9 forms is a cornerstone of compliant financial operations for both businesses and independent contractors. We’ve explored that the W9 is not about your residence or employment status, but rather a vital tool for accurate income reporting to the IRS, preventing headaches like backup withholding and ensuring smooth business deductions.

For businesses, the takeaway is clear: always request a W9 from your U.S. person vendors and contractors, ideally before the first payment and whenever their information changes. This proactive approach saves you time, stress, and potential penalties during tax season. For freelancers and contractors, providing your W9 promptly and securely demonstrates professionalism and ensures you receive your full payments without interruption.

At Fillable W9, we understand that tax forms can be daunting. That’s why we’ve streamlined the process, making it easy, secure, and efficient to complete and manage your W9 forms online. Our platform protects your sensitive information and ensures you meet your tax obligations with confidence.

Accuracy is key, and secure processing is paramount. Let us help you steer the complexities of W9s so you can focus on what you do best.

✅ Ready to complete your W9 in minutes? Apply here now