Why Getting Your Form 1040 Mailing Address Right Matters

Knowing where to send Form 1040 is crucial for timely tax processing and avoiding costly delays. Sending your return to the wrong IRS processing center can add weeks to your processing time, which is especially critical as the April filing deadline approaches.

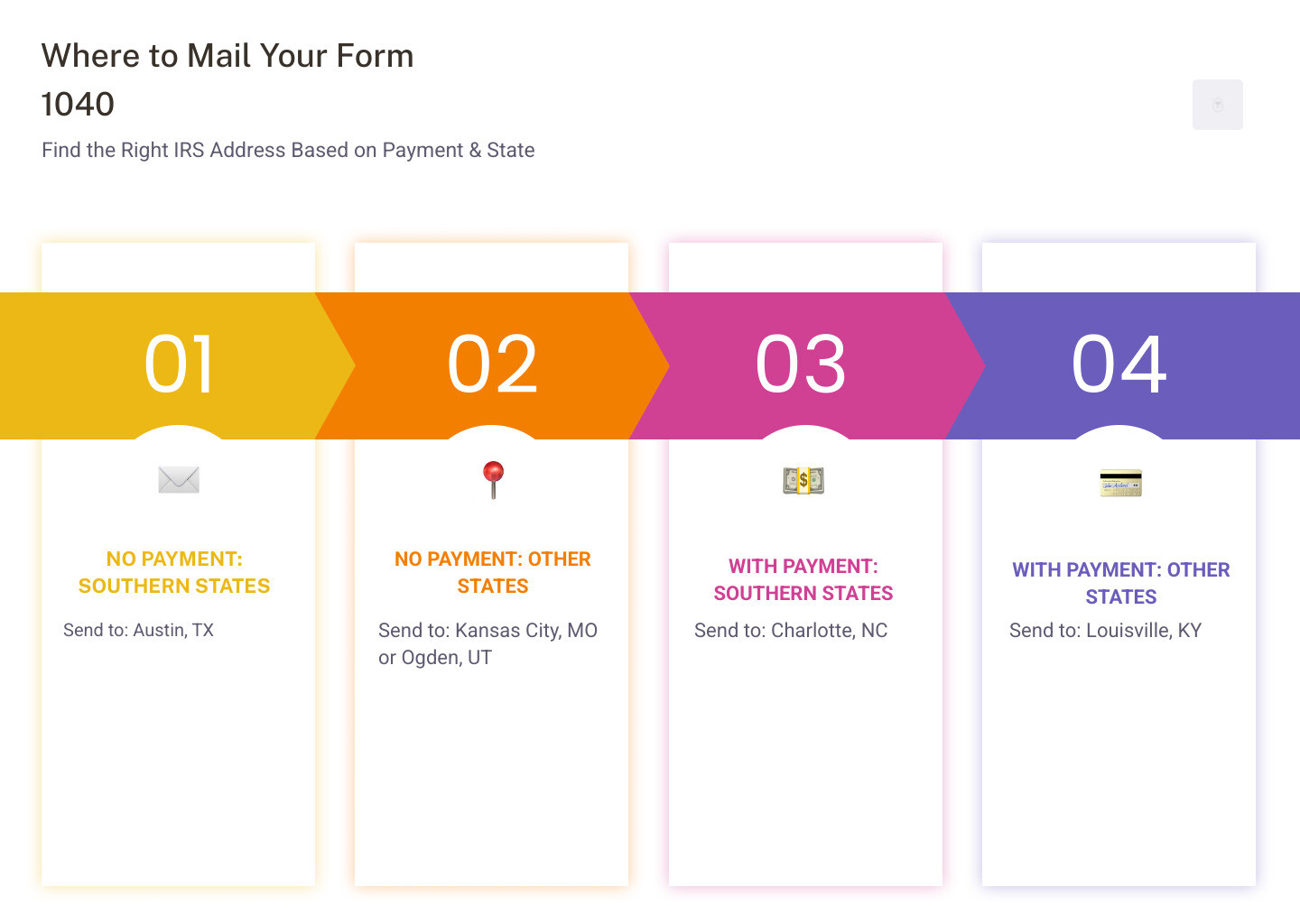

Quick Answer – Where to Send Form 1040:

- Without Payment: Austin, TX (Southern states), Kansas City, MO (Eastern/Central states), or Ogden, UT (Western states)

- With Payment: Charlotte, NC (Southern states) or Louisville, KY (all other states)

- International/APO/FPO: Austin, TX (without payment) or Charlotte, NC (with payment)

The correct address depends on your state of residence and whether you’re including a payment. While e-filing is faster, millions of taxpayers still mail paper returns. Staying on top of tax compliance, from filing your 1040 correctly to managing other documents like the W9 form, is key for a stress-free financial year.

This guide will ensure your Form 1040 gets to the right place. For other essential tax forms, you can start filling your W9 now at https://fillablew9.com/apply.

The Correct IRS Mailing Address for Form 1040 & 1040-SR

Getting your tax return to the right place is simple once you understand the IRS’s system. The agency routes Form 1040 and 1040-SR to different processing centers based on your location and whether you are enclosing a payment. This separation is designed for efficiency.

Returns with payments go to specialized “lockbox” facilities where banks can quickly process your check. Returns without payments (or those due a refund) go to other centers optimized for faster data processing. This ensures everyone’s return is handled as quickly as possible.

Where to send Form 1040 if you are NOT enclosing a payment?

If you expect a refund or owe no additional tax, your return goes to one of three centers based on your state.

- Austin, TX 73301-0002: For filers in Alabama, Arkansas, Arizona, Florida, Georgia, Louisiana, Mississippi, New Mexico, North Carolina, Oklahoma, South Carolina, Tennessee, and Texas.

- Kansas City, MO 64999-0002: For filers in Connecticut, Delaware, District of Columbia, Illinois, Indiana, Iowa, Kentucky, Maine, Maryland, Massachusetts, Minnesota, Missouri, New Hampshire, New Jersey, New York, Pennsylvania, Rhode Island, Vermont, Virginia, West Virginia, and Wisconsin.

- Ogden, UT 84201-0002: For filers in Alaska, California, Colorado, Hawaii, Idaho, Kansas, Michigan, Montana, Nebraska, Nevada, North Dakota, Ohio, Oregon, South Dakota, Utah, Washington, and Wyoming.

Always verify these on the official IRS “Where to File” page, as addresses can occasionally change.

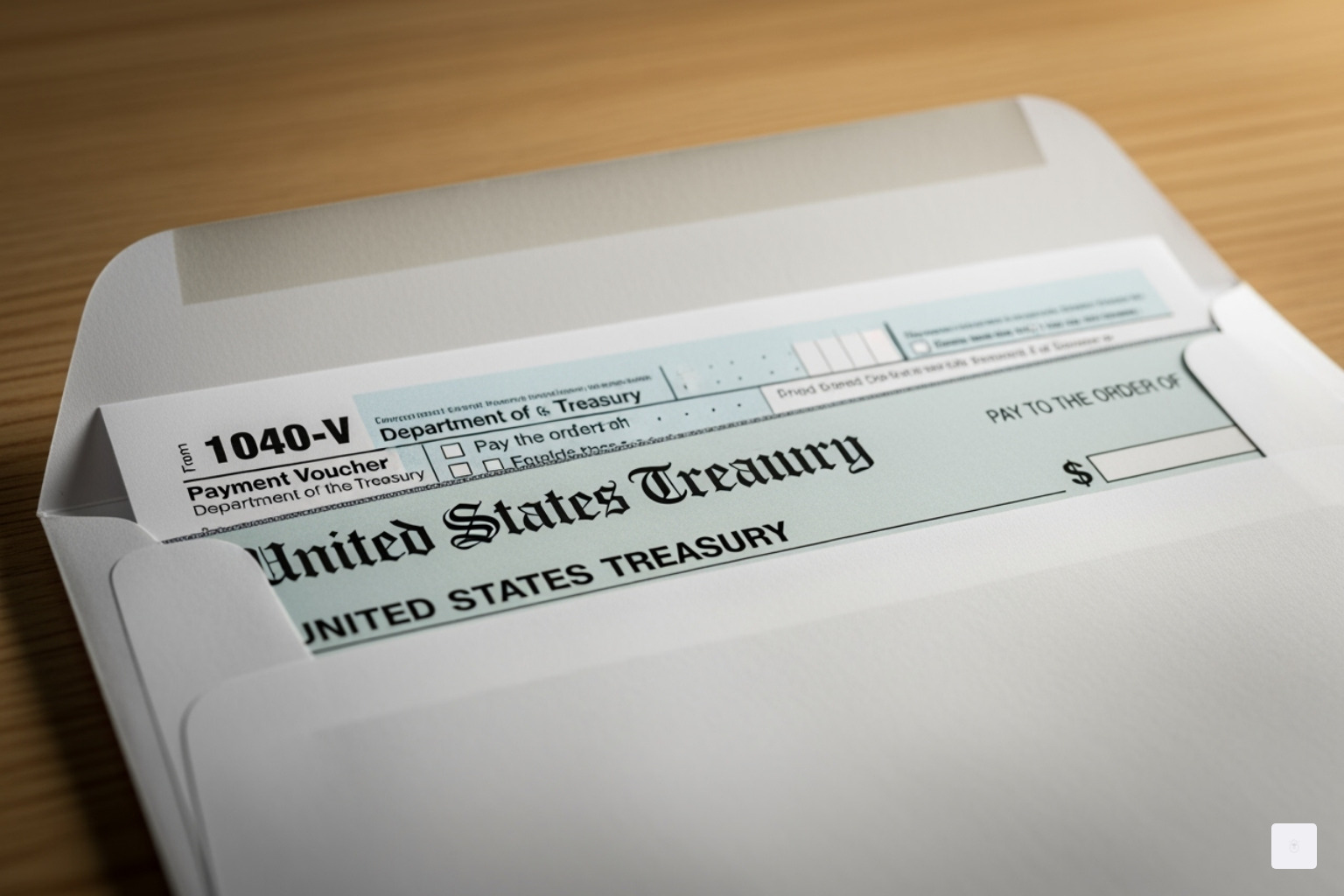

Where to send Form 1040 if you are enclosing a payment?

If you owe taxes and are sending a check or money order, your return goes to a different address. Remember to include Form 1040-V (Payment Voucher) with your payment to ensure it’s correctly matched to your return.

- Charlotte, NC 28201-1214: For filers in Alabama, Florida, Georgia, Louisiana, Mississippi, North Carolina, South Carolina, Tennessee, and Texas. The full address is Internal Revenue Service, P.O. Box 1214, Charlotte, NC 28201-1214.

- Louisville, KY 40293-1000: For filers in all other states. The full address is Internal Revenue Service, P.O. Box 931000, Louisville, KY 40293-1000.

Use the complete reference table below to find the exact address for your state.

| State | Address without Payment | Address with Payment |

|---|---|---|

| Alabama | Department of the Treasury Internal Revenue Service Austin, TX 73301-0002 | Internal Revenue Service P.O. Box 1214 Charlotte, NC 28201-1214 |

| Alaska | Department of Treasury Internal Revenue Service Ogden, UT 84201-0002 | Internal Revenue Service P.O. Box 931000 Louisville, KY 40293-1000 |

| Arizona | Department of the Treasury Internal Revenue Service Austin, TX 73301-0002 | Internal Revenue Service P.O. Box 931000 Louisville, KY 40293-1000 |

| Arkansas | Department of the Treasury Internal Revenue Service Austin, TX 73301-0002 | Internal Revenue Service P.O. Box 931000 Louisville, KY 40293-1000 |

| California | Department of Treasury Internal Revenue Service Ogden, UT 84201-0002 | Internal Revenue Service P.O. Box 931000 Louisville, KY 40293-1000 |

| Colorado | Department of Treasury Internal Revenue Service Ogden, UT 84201-0002 | Internal Revenue Service P.O. Box 931000 Louisville, KY 40293-1000 |

| Connecticut | Department of the Treasury Internal Revenue Service Kansas City, MO 64999-0002 | Internal Revenue Service P.O. Box 931000 Louisville, KY 40293-1000 |

| Delaware | Department of the Treasury Internal Revenue Service Kansas City, MO 64999-0002 | Internal Revenue Service P.O. Box 931000 Louisville, KY 40293-1000 |

| District of Columbia | Department of the Treasury Internal Revenue Service Kansas City, MO 64999-0002 | Internal Revenue Service P.O. Box 931000 Louisville, KY 40293-1000 |

| Florida | Department of the Treasury Internal Revenue Service Austin, TX 73301-0002 | Internal Revenue Service P.O. Box 1214 Charlotte, NC 28201-1214 |

| Georgia | Department of the Treasury Internal Revenue Service Austin, TX 73301-0002 | Internal Revenue Service P.O. Box 1214 Charlotte, NC 28201-1214 |

| Hawaii | Department of Treasury Internal Revenue Service Ogden, UT 84201-0002 | Internal Revenue Service P.O. Box 931000 Louisville, KY 40293-1000 |

| Idaho | Department of Treasury Internal Revenue Service Ogden, UT 84201-0002 | Internal Revenue Service P.O. Box 931000 Louisville, KY 40293-1000 |

| Illinois | Department of the Treasury Internal Revenue Service Kansas City, MO 64999-0002 | Internal Revenue Service P.O. Box 931000 Louisville, KY 40293-1000 |

| Indiana | Department of the Treasury Internal Revenue Service Kansas City, MO 64999-0002 | Internal Revenue Service P.O. Box 931000 Louisville, KY 40293-1000 |

| Iowa | Department of the Treasury Internal Revenue Service Kansas City, MO 64999-0002 | Internal Revenue Service P.O. Box 931000 Louisville, KY 40293-1000 |

| Kansas | Department of Treasury Internal Revenue Service Ogden, UT 84201-0002 | Internal Revenue Service P.O. Box 931000 Louisville, KY 40293-1000 |

| Kentucky | Department of the Treasury Internal Revenue Service Kansas City, MO 64999-0002 | Internal Revenue Service P.O. Box 931000 Louisville, KY 40293-1000 |

| Louisiana | Department of the Treasury Internal Revenue Service Austin, TX 73301-0002 | Internal Revenue Service P.O. Box 1214 Charlotte, NC 28201-1214 |

| Maine | Department of the Treasury Internal Revenue Service Kansas City, MO 64999-0002 | Internal Revenue Service P.O. Box 931000 Louisville, KY 40293-1000 |

| Maryland | Department of the Treasury Internal Revenue Service Kansas City, MO 64999-0002 | Internal Revenue Service P.O. Box 931000 Louisville, KY 40293-1000 |

| Massachusetts | Department of the Treasury Internal Revenue Service Kansas City, MO 64999-0002 | Internal Revenue Service P.O. Box 931000 Louisville, KY 40293-1000 |

| Michigan | Department of Treasury Internal Revenue Service Ogden, UT 84201-0002 | Internal Revenue Service P.O. Box 931000 Louisville, KY 40293-1000 |

| Minnesota | Department of the Treasury Internal Revenue Service Kansas City, MO 64999-0002 | Internal Revenue Service P.O. Box 931000 Louisville, KY 40293-1000 |

| Mississippi | Department of the Treasury Internal Revenue Service Austin, TX 73301-0002 | Internal Revenue Service P.O. Box 1214 Charlotte, NC 28201-1214 |

| Missouri | Department of the Treasury Internal Revenue Service Kansas City, MO 64999-0002 | Internal Revenue Service P.O. Box 931000 Louisville, KY 40293-1000 |

| Montana | Department of Treasury Internal Revenue Service Ogden, UT 84201-0002 | Internal Revenue Service P.O. Box 931000 Louisville, KY 40293-1000 |

| Nebraska | Department of Treasury Internal Revenue Service Ogden, UT 84201-0002 | Internal Revenue Service P.O. Box 931000 Louisville, KY 40293-1000 |

| Nevada | Department of Treasury Internal Revenue Service Ogden, UT 84201-0002 | Internal Revenue Service P.O. Box 931000 Louisville, KY 40293-1000 |

| New Hampshire | Department of the Treasury Internal Revenue Service Kansas City, MO 64999-0002 | Internal Revenue Service P.O. Box 931000 Louisville, KY 40293-1000 |

| New Jersey | Department of the Treasury Internal Revenue Service Kansas City, MO 64999-0002 | Internal Revenue Service P.O. Box 931000 Louisville, KY 40293-1000 |

| New Mexico | Department of the Treasury Internal Revenue Service Austin, TX 73301-0002 | Internal Revenue Service P.O. Box 931000 Louisville, KY 40293-1000 |

| New York | Department of the Treasury Internal Revenue Service Kansas City, MO 64999-0002 | Internal Revenue Service P.O. Box 931000 Louisville, KY 40293-1000 |

| North Carolina | Department of the Treasury Internal Revenue Service Austin, TX 73301-0002 | Internal Revenue Service P.O. Box 1214 Charlotte, NC 28201-1214 |

| North Dakota | Department of Treasury Internal Revenue Service Ogden, UT 84201-0002 | Internal Revenue Service P.O. Box 931000 Louisville, KY 40293-1000 |

| Ohio | Department of Treasury Internal Revenue Service Ogden, UT 84201-0002 | Internal Revenue Service P.O. Box 931000 Louisville, KY 40293-1000 |

| Oklahoma | Department of the Treasury Internal Revenue Service Austin, TX 73301-0002 | Internal Revenue Service P.O. Box 931000 Louisville, KY 40293-1000 |

| Oregon | Department of Treasury Internal Revenue Service Ogden, UT 84201-0002 | Internal Revenue Service P.O. Box 931000 Louisville, KY 40293-1000 |

| Pennsylvania | Department of the Treasury Internal Revenue Service Kansas City, MO 64999-0002 | Internal Revenue Service P.O. Box 931000 Louisville, KY 40293-1000 |

| Rhode Island | Department of the Treasury Internal Revenue Service Kansas City, MO 64999-0002 | Internal Revenue Service P.O. Box 931000 Louisville, KY 40293-1000 |

| South Carolina | Department of the Treasury Internal Revenue Service Austin, TX 73301-0002 | Internal Revenue Service P.O. Box 1214 Charlotte, NC 28201-1214 |

| South Dakota | Department of Treasury Internal Revenue Service Ogden, UT 84201-0002 | Internal Revenue Service P.O. Box 931000 Louisville, KY 40293-1000 |

| Tennessee | Department of the Treasury Internal Revenue Service Austin, TX 73301-0002 | Internal Revenue Service P.O. Box 1214 Charlotte, NC 28201-1214 |

| Texas | Department of the Treasury Internal Revenue Service Austin, TX 73301-0002 | Internal Revenue Service P.O. Box 1214 Charlotte, NC 28201-1214 |

| Utah | Department of Treasury Internal Revenue Service Ogden, UT 84201-0002 | Internal Revenue Service P.O. Box 931000 Louisville, KY 40293-1000 |

| Vermont | Department of the Treasury Internal Revenue Service Kansas City, MO 64999-0002 | Internal Revenue Service P.O. Box 931000 Louisville, KY 40293-1000 |

| Virginia | Department of the Treasury Internal Revenue Service Kansas City, MO 64999-0002 | Internal Revenue Service P.O. Box 931000 Louisville, KY 40293-1000 |

| Washington | Department of Treasury Internal Revenue Service Ogden, UT 84201-0002 | Internal Revenue Service P.O. Box 931000 Louisville, KY 40293-1000 |

| West Virginia | Department of the Treasury Internal Revenue Service Kansas City, MO 64999-0002 | Internal Revenue Service P.O. Box 931000 Louisville, KY 40293-1000 |

| Wisconsin | Department of the Treasury Internal Revenue Service Kansas City, MO 64999-0002 | Internal Revenue Service P.O. Box 931000 Louisville, KY 40293-1000 |

| Wyoming | Department of Treasury Internal Revenue Service Ogden, UT 84201-0002 | Internal Revenue Service P.O. Box 931000 Louisville, KY 40293-1000 |

Mailing Addresses for Special Cases and Other Forms

Not everyone files from a standard U.S. address. The IRS has specific mailing instructions for international filers, those needing to amend a return, or those filing for an extension. Getting where to send Form 1040 right in these cases is just as important.

International, APO/FPO, and U.S. Territory Filers

If you live abroad, in a U.S. territory, or have an APO/FPO address, the IRS has dedicated facilities for you. This applies to those filing Form 1040-NR (nonresident aliens), Form 1040-PR (Puerto Rico residents), or Form 1040-SS (for other U.S. territory residents).

- Without a payment: Send your return to: Department of the Treasury, Internal Revenue Service, Austin, TX 73301-0215 USA.

- With a payment: Mail your return and payment to: Internal Revenue Service, P.O. Box 1303, Charlotte, NC 28201-1303 USA.

The system is simple: one address for refunds/no tax due, and another for payments. For the latest information, always check the IRS resource for International filers.

Amended Returns (Form 1040-X) and Extensions (Form 4868)

Mistakes happen, and sometimes you just need more time. Form 1040-X is used to amend a previously filed return to correct income, deductions, or filing status. Form 4868 grants an automatic six-month extension to file your return.

Crucially, an extension to file is not an extension to pay. You must still estimate and pay any taxes owed by the original deadline to avoid penalties.

The mailing addresses for these forms generally follow the same state-based rules as Form 1040, but exceptions can exist. The safest approach is to check the official instructions for the specific form you are filing. You can find this on the main IRS “Where to File” page.

Don’t waste time with confusing paper forms for your other tax needs. You can complete your secure W9 online at https://fillablew9.com/apply.

Best Practices for Mailing Your Tax Return

Knowing where to send Form 1040 is the first step. Following best practices for mailing ensures your return arrives safely and on time. Proper preparation can prevent stressful last-minute issues.

USPS Mailing Tips and Proof of Mailing

The IRS considers your return filed on time if it is properly addressed, has sufficient postage, and is postmarked by the deadline. Here are key tips for using the U.S. Postal Service (USPS):

- Use Correct Postage: Tax returns often weigh more than one ounce and require extra postage. Weigh your envelope or have it weighed at the post office to avoid it being returned.

- Get a Postmark: If mailing near the deadline, take your return to a post office counter and ask for it to be hand-postmarked. This serves as proof of your mailing date.

- Get Proof of Mailing: For peace of mind, use a service that provides proof of mailing and delivery. Certified Mail offers a tracking number and delivery confirmation. Certificate of Mailing is a cheaper option that provides official proof of the mailing date without tracking.

- Choose the Right Service: While First-Class Mail is standard, Priority Mail or Priority Mail Express offer faster delivery with tracking included.

For current rates and options, visit the USPS website’s tax mailing guide at Mail Your Tax Return with USPS.

Using a Private Delivery Service (PDS)

The IRS also approves certain private delivery services (PDS) like FedEx, UPS, and DHL Express. Under the “timely mailing as timely filing” rule, your return is considered on time if sent by the deadline using an approved service.

Important: You cannot use a PDS to mail returns to an IRS P.O. Box address. These services require a physical street address. The IRS provides a specific list of street addresses for use with PDS.

Before mailing, you must check the official list at IRS.gov/PDSstreetAddresses to find the correct physical address for the processing center. Using the wrong address will cause delays, even with premium shipping.

Frequently Asked Questions about Where to Send Form 1040

Even with a guide, specific questions can arise. Here are clear answers to the most common questions about where to send Form 1040.

Where can I find the most up-to-date IRS mailing addresses?

The only reliable source is the official IRS website. Addresses can change, so relying on old instructions or third-party sites is risky. Always verify the address before you mail.

Your go-to resource is the IRS “Where to File” page. Bookmark this page and check it every tax season for the correct and current mailing addresses.

Are the mailing addresses for Form 1040-SR different from Form 1040?

No. Form 1040-SR, the U.S. Tax Return for Seniors, uses the exact same mailing addresses as the standard Form 1040.

Although Form 1040-SR features larger print to be more accessible, it is functionally identical to Form 1040. You should follow the same state-by-state and payment-based guidelines provided in this article.

Why are there different addresses for returns with and without payments?

This system is designed for efficiency. The different addresses route returns to specialized facilities to speed up processing for everyone.

- Returns with a payment go to a “lockbox” facility, often managed by a bank. These centers are equipped to process and deposit your payment quickly and securely.

- Returns without a payment go to different IRS processing centers that focus solely on data entry and verification, allowing them to process refunds and zero-balance returns faster.

By separating the workload, the IRS can handle both types of returns more efficiently.

Conclusion: Mail with Confidence

You now have the information needed to mail your tax return with confidence. Understanding where to send Form 1040 is straightforward when you follow a few key steps.

The most important takeaway is to double-check the mailing address based on your state and whether you are including a payment. This simple action can save you from weeks of processing delays. Also, remember to use sufficient postage and get proof of mailing for your records.

While this guide covers Form 1040, tax compliance is a year-round responsibility. For freelancers and businesses, managing other documents like the fillable W9 is just as crucial as filing your annual return. Using reliable tools for all your tax form needs ensures you remain compliant and prepared.

✅ Ready to complete your W9 in minutes? Apply here now