Why Going Digital with Your W-9 Signature Matters

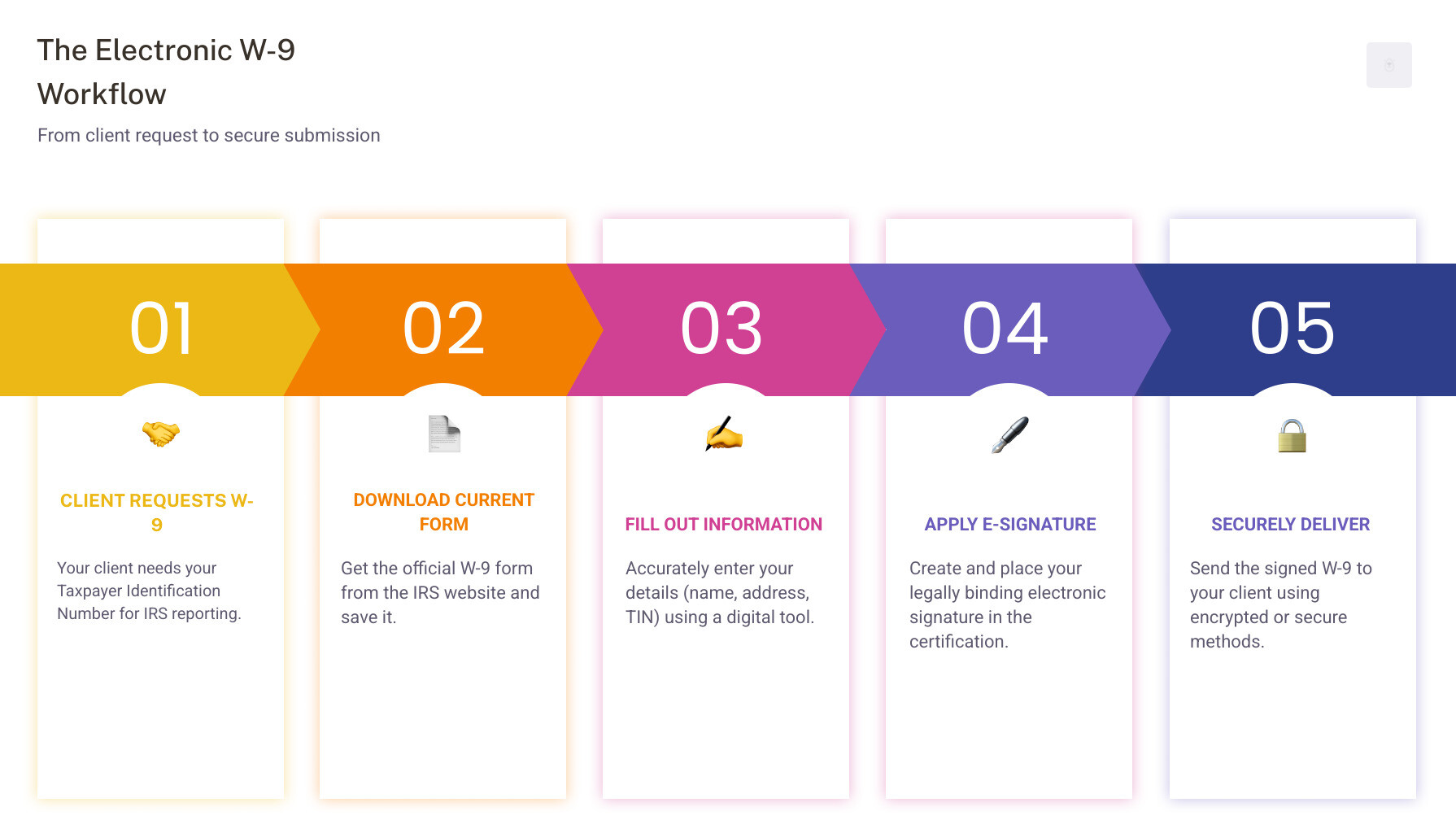

How to sign a w9 electronically is simpler than most freelancers and contractors think. Here’s the quick answer:

Learning how to sign a w9 electronically can streamline your tax processes.

- Download the current W-9 form from the IRS website

- Fill out your information accurately using a PDF editor or online tool

- Create your electronic signature (type, draw, or upload)

- Apply your signature to the certification section

- Save and send securely to your client

The days of printing, signing, scanning, and mailing W-9 forms are over. As one freelancer put it: “Every US contractor is familiar with W-9s. They don’t take long to fill out, but the logistics of getting them signed and delivered can be a hassle.”

Understanding how to sign a w9 electronically is crucial for modern freelancers.

Electronic W-9 signatures are completely legal. The IRS has allowed electronic submission of W-9 forms since 1998 through Announcement 98-27. Your digital signature carries the same legal weight as a wet signature – it identifies you as the signer and authenticates your submission under penalties of perjury.

Going paperless saves time, reduces errors, and protects your sensitive tax information. You can sign from anywhere using your computer or mobile device, making the process faster for both you and your clients.

I’m Haiko de Poel, and I’ve helped hundreds of freelancers and small business owners streamline their tax processes, including mastering how to sign a w9 electronically. My experience in digital change has shown me that the right tools can eliminate the paperwork headaches that slow down independent contractors.

What is a W-9 Form and Who Needs to Fill One Out?

Let’s start with the basics before we jump into how to sign a w9 electronically. If you’re a freelancer or contractor, you’ve probably encountered this form before, but understanding exactly what it is can help you handle it more confidently.

The W-9 form is officially called the Request for Taxpayer Identification Number and Certification form. Think of it as your client’s way of saying, “Hey, I need your tax information so I can report the money I’m paying you to the IRS.”

The form’s main job is collecting your Taxpayer Identification Number (TIN). For most freelancers, that’s your Social Security Number (SSN). If you have a business entity like an LLC or corporation, you’ll use your Employer Identification Number (EIN) instead.

Every freelancer should be informed about how to sign a w9 electronically.

Why does your client need this information? Because when they pay you $600 or more during the year, they’re required to report those payments to the IRS using various Form 1099 documents. Your W-9 gives them the accurate information they need to file those reports correctly.

Who typically fills out W-9 forms? If you’re a freelancer, independent contractor, consultant, or any kind of self-employed professional, you’ll be filling out plenty of these. But it’s not just about your regular contract work. You might also need to complete a W-9 for real estate transactions, mortgage interest payments, stock sales, or even contributions to retirement accounts.

Here’s something important to understand: the W-9 is completely different from the W-4 you might know from traditional employment. The W-4 form, or Employee’s Withholding Certificate is what employees use to tell their employer how much tax to withhold from their paychecks. The W-9, on the other hand, is for independent contractors who are responsible for handling their own taxes.

When you sign a W-9, you’re making a serious commitment. You’re certifying under penalties of perjury that your TIN is correct and that you’re not subject to backup withholding. Backup withholding is what happens when the IRS requires your client to withhold a percentage of your payment due to TIN issues or tax compliance problems.

Make sure to know how to sign a w9 electronically and comply with IRS regulations.

The good news is that most clients only need you to submit a W-9 once, unless your information changes. If you move, change your business structure, or get a new TIN, you’ll need to provide an updated form.

Understanding what you’re signing makes the electronic process much smoother. When you know why each section matters, you can fill out your digital W-9 with confidence and avoid the common mistakes that can delay your payments or cause tax headaches down the road.

The Benefits and Legality of Electronically Signing a W-9

Here’s something that might surprise you: electronic W-9 signatures have been completely legal since 1998. That’s right – while many freelancers and contractors are still printing, signing, and scanning forms, the IRS has been welcoming digital signatures for over two decades through IRS Announcement 98-27.

Your electronic signature on a W-9 carries exactly the same legal weight as putting pen to paper. When you sign a W-9 electronically, you’re still making that crucial certification under penalties of perjury – the digital format doesn’t change the seriousness or validity of your commitment.

The IRS does have specific requirements to ensure your electronic signature is legitimate and binding. The system you use must authenticate your identity, making it reasonably certain that you’re actually the person filling out the form. Data integrity is equally important – what your client receives must be exactly what you submitted, with no alterations along the way.

The perjury statement that appears on paper W-9s must also be present in the electronic version, and your digital signature must acknowledge this serious legal commitment. Finally, your client needs to be able to provide a hard copy to the IRS if requested, which means the electronic record must be robust and printable.

Modern e-signature platforms like those we use at Fillable W9 are specifically designed to meet all these IRS requirements, ensuring your electronic signature is completely compliant and legally bulletproof.

So why make the switch from paper? The benefits are genuinely game-changing for independent contractors:

- Speed: Wet signature is slow (print, sign, scan or mail). Electronic signature is fast (complete digitally in minutes).

- Accessibility: Wet signature often requires a printer or in-person signing. Electronic signature works anywhere on any device.

- Error reduction: Paper forms risk illegible handwriting and missed fields. Digital tools guide entries and validate fields.

- Security: Paper can be lost or mishandled. Reputable e-sign platforms use encryption and audit trails.

- Legality: Wet signatures are traditionally recognized. Electronic signatures are legally binding under IRS and e-signature laws.

- Environmental impact: Paper creates waste. Digital is paperless and more sustainable.

The shift to electronic W-9s isn’t just about keeping up with technology – it’s about making your freelance or contracting business run more smoothly. When you can respond to client requests immediately and securely, you look more professional and get paid faster. Don’t waste time with paper forms — complete your secure W9 online at https://fillablew9.com/apply.

How to Sign a W-9 Electronically: A Step-by-Step Guide

Mastering how to sign a w9 electronically is essential in today’s digital age.

Now that we understand the “why,” let’s get to the “how.” Learning how to sign a w9 electronically is a straightforward process once you have the right tools and know the steps. I’ll walk you through everything you need to know to get your W-9 signed and submitted quickly and securely.

Having the right tools will help in knowing how to sign a w9 electronically with ease.

Choosing the Right Tool for Your W-9 Digital Signature

Before you can sign a W-9 electronically, you need to pick the right platform. You have a few options, but the best choice will be secure, easy to use, and compliant with IRS rules.

PDF editors are a common starting point. The “Fill & Sign” feature in many PDF programs lets you type your information directly into the form and create a digital signature. If you go this route, make sure you download the form from the IRS first, as you cannot save your information on their website.

General eSignature platforms offer more advanced features, but they aren’t always custom for tax forms. They provide legally binding signatures but may require you to upload and prepare the W-9 form yourself.

Specialized W-9 tools like FillableW9 are my personal favorite because they are built specifically for this purpose. Our platform understands the unique requirements of the W-9 form and guides you through the process with helpful features like validation checks and secure submission options. This eliminates guesswork and helps prevent common errors.

When choosing your tool, focus on security features first – you want encryption, SSL connections, and full compliance with e-signature laws. Ease of use comes second because the last thing you need is a complicated platform when you’re trying to get a W-9 out quickly. For more details about how we simplify this entire process, check out more info about our features.

Step-by-Step: How to sign a W-9 electronically

Once you’ve chosen your platform, the actual process to sign a W-9 electronically follows a predictable pattern. Here’s exactly what you need to do:

Follow these guidelines on how to sign a w9 electronically to avoid mistakes.

Step 1: Get the current W-9 form. Always start fresh with the most recent version. Download the W-9 form from the IRS website and save it to your computer. Here’s something important that trips up a lot of people: do not fill out the form on the IRS site as it will not save your information. Download it first, then work with the saved copy.

Step 2: Fill in your information accurately. Open your downloaded PDF with your chosen tool and carefully enter all the required details. You’ll need your name as shown on your income tax return on Line 1, your business name (if different) on Line 2, and your federal tax classification on Line 3. Don’t forget your full mailing address and most importantly, your Taxpayer Identification Number (either your SSN or EIN) in Part I.

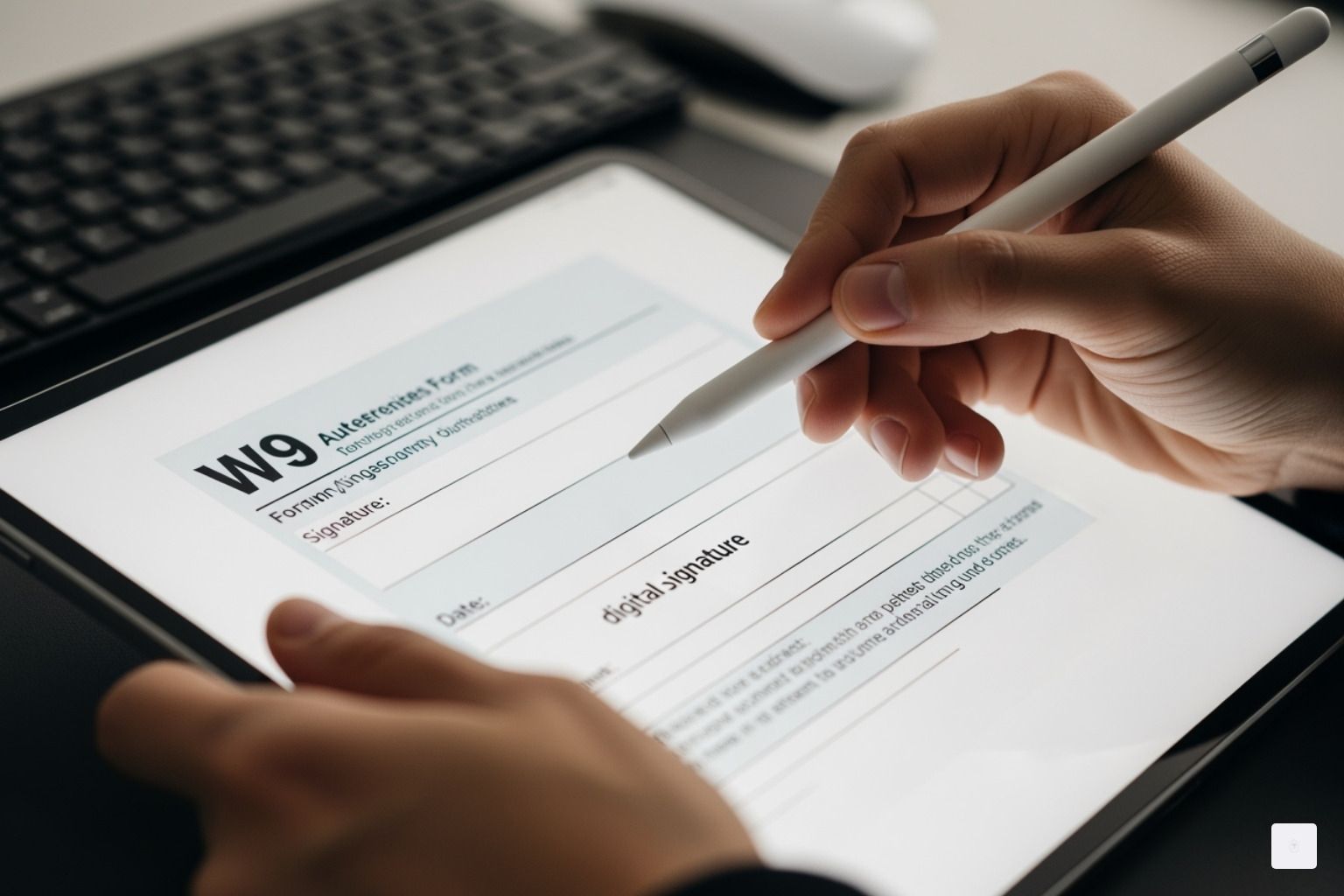

Step 3: Create and apply your electronic signature. This is where the magic happens. Most platforms give you three options: type your name and let the software convert it to a signature font, draw your signature using your mouse or touchscreen, or upload an image of your handwritten signature. Once you’ve created it, simply drag and drop or click to place both your signature and the current date in Part II.

Step 4: Certify under penalties of perjury. When you apply your electronic signature, you’re making the same legal certification as you would with a pen and paper. You’re confirming that your TIN is correct, you’re a U.S. person, and you’re not subject to backup withholding. This isn’t just a formality – it’s a legal declaration with real consequences.

It’s important to understand how to sign a w9 electronically to certify your information.

Step 5: Save and send securely. After signing, save the completed form with a clear filename like “W9YourNameDate.pdf” and send it to the requester using a secure method. Don’t waste time with paper forms — complete your secure W9 online at https://fillablew9.com/apply.

How to sign a W-9 electronically and ensure it’s secure

Security should be your top priority when dealing with sensitive information like your TIN. While electronic signatures are completely legal, how you transmit your signed W-9 makes all the difference.

Email carries significant risks when it comes to sensitive documents. Standard email isn’t encrypted, which means your personal information could potentially be intercepted during transmission. Sending an unencrypted W-9 via regular email is like mailing a postcard with your Social Security number written on it.

Secure portals and dedicated platforms are your best bet for safe transmission. The gold standard is using a secure portal provided by your client or an e-signature platform designed specifically for document exchange. These platforms use advanced encryption techniques like 256-bit SSL connections and RSA 2048 encryption to protect your data both while it’s traveling and when it’s stored.

End-to-end encryption ensures that only you and the intended recipient can read your document. Look for services that specifically mention this feature, as it provides an extra layer of protection for your sensitive tax information.

If you absolutely must email your W-9, password protection is essential. Most PDF editors allow you to password-protect your document before sending. Send the password through a separate communication channel – like a text message or different email – to maintain security.

At FillableW9, we understand that your personal information deserves the highest level of protection. Our platform employs end-to-end encryption, secure cloud storage, and advanced access control to ensure your W-9 is handled with the utmost care and maintains full regulatory compliance.

Common Mistakes When Signing a W-9 (And How to Avoid Them)

Even with the convenience of learning how to sign a w9 electronically, mistakes still happen. Unfortunately, when it comes to tax forms like the W-9, those small errors can snowball into bigger problems that nobody wants to deal with.

The ripple effects of a botched W-9 can be frustrating for everyone involved. Payment delays are probably the most immediate concern – your client might hold your check until they get a properly completed form. Nobody wants to explain to their landlord why rent is late because of a paperwork mistake.

More seriously, incorrect information can trigger backup withholding, where the IRS requires your client to withhold 24% of your payments and send that money directly to the government. That’s a significant chunk of your income tied up until you sort things out with the IRS.

Your clients aren’t immune either. The IRS can slap them with information return penalties of $50 for each incorrectly furnished W-9. While that’s their problem technically, it can strain your professional relationship when they’re paying penalties because of your form.

At the extreme end, deliberately providing false information – like a fake TIN – can lead to perjury charges with serious fines and even jail time. The IRS doesn’t mess around with intentional tax fraud.

Using an outdated form is surprisingly common and completely avoidable. The IRS updates their forms periodically, and while the current W-9 has been stable since October 2018, using an old version from years past might be missing crucial fields or certifications. Always grab the latest version directly from the IRS website before you start. Don’t rely on that PDF you saved to your desktop two years ago.

Incorrect Taxpayer Identification Numbers are the kiss of death for W-9s. Your SSN or EIN is the most critical piece of information on the entire form. Double-check it against your Social Security card or official IRS correspondence. For LLC owners, make sure you’re using the right TIN based on how your business is taxed – it’s not always as straightforward as you’d think.

Wrong tax classification trips up a lot of business owners, especially those with LLCs. If you check “Individual/Sole Proprietor” when you’re actually taxed as an S-Corp, or vice versa, you’re setting yourself up for classification headaches down the road. When in doubt, consult your accountant or the person who set up your business structure.

The missing signature or date mistake might seem obvious, but it happens more often than you’d expect, especially when people rush through electronic forms. Your signature certifies everything under penalties of perjury – it’s not just a formality. Most electronic tools will prompt you for both, but always double-check before hitting submit.

Double-checking your details is crucial when learning how to sign a w9 electronically.

Even with digital forms, incomplete information can still slip through if you’re using a tool that doesn’t guide you properly or if you’re rushing through the process. Take your time and review every field like an IRS agent would – everything should be crystal clear and completely filled out.

The best advice I can give? Treat your W-9 like the important legal document it is. Take a few extra minutes to review everything before you sign. A little attention to detail upfront can save you weeks of headaches and delayed payments later.

Frequently Asked Questions about Electronic W-9s

Clarifying how to sign a w9 electronically can help avoid common pitfalls.

Let me address some of the most common questions I hear from freelancers and contractors about how to sign a W-9 electronically. These answers will help you steer the digital W-9 process with confidence. For even more detailed guidance, you can explore our comprehensive FAQ section at More info about W-9s.

What’s the difference between a W-9 and a 1099?

I get this question all the time, and it’s totally understandable why people get confused! Think of the W-9 and 1099 as partners in a tax reporting dance, each playing a specific role.

The W-9 is your part of the process. As the freelancer or contractor, you fill out this form to give your client your tax information – your name, address, and Taxpayer Identification Number (TIN). You’re essentially saying, “Here’s who I am and how to report payments to me.” The W-9 stays with your client; it never goes to the IRS directly.

The 1099 is your client’s responsibility. Using the information you provided on your W-9, your client creates and files various 1099 forms (like 1099-NEC for contractor payments) with the IRS. They also send you a copy for your tax records. This form reports exactly how much they paid you during the year.

So in simple terms: you complete the W-9 so your client can properly complete the 1099. It’s a two-step process where your W-9 enables accurate tax reporting on both ends.

How often do I need to submit a W-9?

Here’s some good news – you typically don’t need to submit a new W-9 to the same client every year. Once you’ve provided a completed W-9, most clients will keep it on file for future use.

However, life happens, and sometimes you do need to submit an updated form. You’ll need to provide a fresh W-9 whenever something important changes – like your legal name, business name, mailing address, or Taxpayer Identification Number. If you started as a sole proprietor and later formed an LLC, or if your LLC changes its tax classification, that’s definitely time for a new W-9.

Your client might also request an updated W-9 occasionally, even if nothing has changed on your end. They might be updating their records or their accounting system requires fresh forms. It’s always best to cooperate with these requests promptly to avoid any payment delays.

The key is keeping your information current. If anything significant changes in your business or personal tax situation, take a few minutes to submit an updated W-9. It’s much easier than dealing with payment complications later.

Is it safe to send my signed W-9 via email?

Securely transmitting your completed W-9 is vital when you know how to sign a w9 electronically.

This is such an important question, and I’m glad you’re thinking about security! Sending your signed W-9 through regular email is generally not the safest approach. Your W-9 contains your Taxpayer Identification Number – either your Social Security Number or Employer Identification Number – which is incredibly sensitive information.

Standard email isn’t encrypted, which means your personal data could potentially be intercepted while traveling through the internet. That’s a risk I wouldn’t want you to take, especially when better options exist.

The safer alternatives are worth the extra effort. Many companies provide secure client portals specifically designed for submitting tax documents. These portals use advanced encryption to protect your information. Dedicated e-signature platforms like ours at Fillable W9 are built with robust security measures that far exceed basic email protection.

If you absolutely must use email, at minimum password-protect your PDF W-9 before attaching it. Then send the password through a completely separate method – like a text message or phone call to your client. It’s an extra step, but it adds a crucial layer of protection.

Being aware of security measures is key when figuring out how to sign a w9 electronically.

When you sign a W-9 electronically through a reputable platform, you’re leveraging security technology that’s specifically designed to protect sensitive tax information. Your peace of mind is worth choosing the secure route, and your clients will appreciate your professionalism in handling their compliance requirements safely.

Get Your W-9 Done in Minutes

Completing your W-9 quickly is easier when you understand how to sign a w9 electronically.

We’ve taken quite a journey together today, and I hope you’re feeling more confident about the whole W-9 process. From understanding exactly what a W-9 is and who needs to fill one out, to finding the legal benefits and security of electronic signatures, we’ve covered everything you need to know about how to sign a W-9 electronically.

With the right knowledge, learning how to sign a w9 electronically becomes a simple task.

The change from paper to digital isn’t just about keeping up with technology—it’s about reclaiming your time and peace of mind. Think about it: no more frantically searching for a printer when a client needs your W-9 ASAP. No more worrying about whether your handwriting is legible enough for the IRS. No more trips to the post office or concerns about documents getting lost in the mail.

Speed is probably the most obvious benefit. What used to take hours (finding the form, printing, filling out by hand, scanning, emailing) now takes just minutes. Security comes in a close second—reputable electronic platforms use bank-level encryption to protect your sensitive tax information, often making digital submission safer than traditional mail.

Competence in how to sign a w9 electronically will save you time and effort.

For freelancers, contractors, and small businesses across the country, this shift means less paperwork frustration and more time to focus on what actually grows your business. Instead of getting bogged down in administrative tasks, you can spend that energy on your clients, your craft, or even just enjoying a well-deserved break.

IRS compliance is built right into the process when you use the right tools. Electronic W-9 signatures have been legally recognized since 1998, so you’re not taking any risks—you’re simply choosing the more efficient path.

At Fillable W9, we’ve built our entire platform around making this process as smooth and secure as possible. We understand that behind every W-9 request is a real person trying to run their business, pay their bills, and maybe even have a little time left over for the things they love. That’s why we’ve designed our solution to be intuitive, compliant, and lightning-fast.

We’re committed to teaching you how to sign a w9 electronically in the simplest way.

The modern way to handle your tax obligations doesn’t have to be complicated or intimidating. With the right approach and tools, you can complete your W-9 accurately and securely, knowing you’ve checked all the boxes for IRS compliance while protecting your personal information.

Getting familiar with how to sign a w9 electronically will enhance your efficiency.

✅ Ready to complete your W9 in minutes? Apply here now.

Don’t hesitate to learn how to sign a w9 electronically today!