Understanding Your Tax Forms: W-9 vs 1099 Employee Status

W9 vs 1099 employee isn’t quite the right comparison—but if you’re searching for this, you’re probably trying to figure out your worker status and which tax forms you need. Here’s the quick answer:

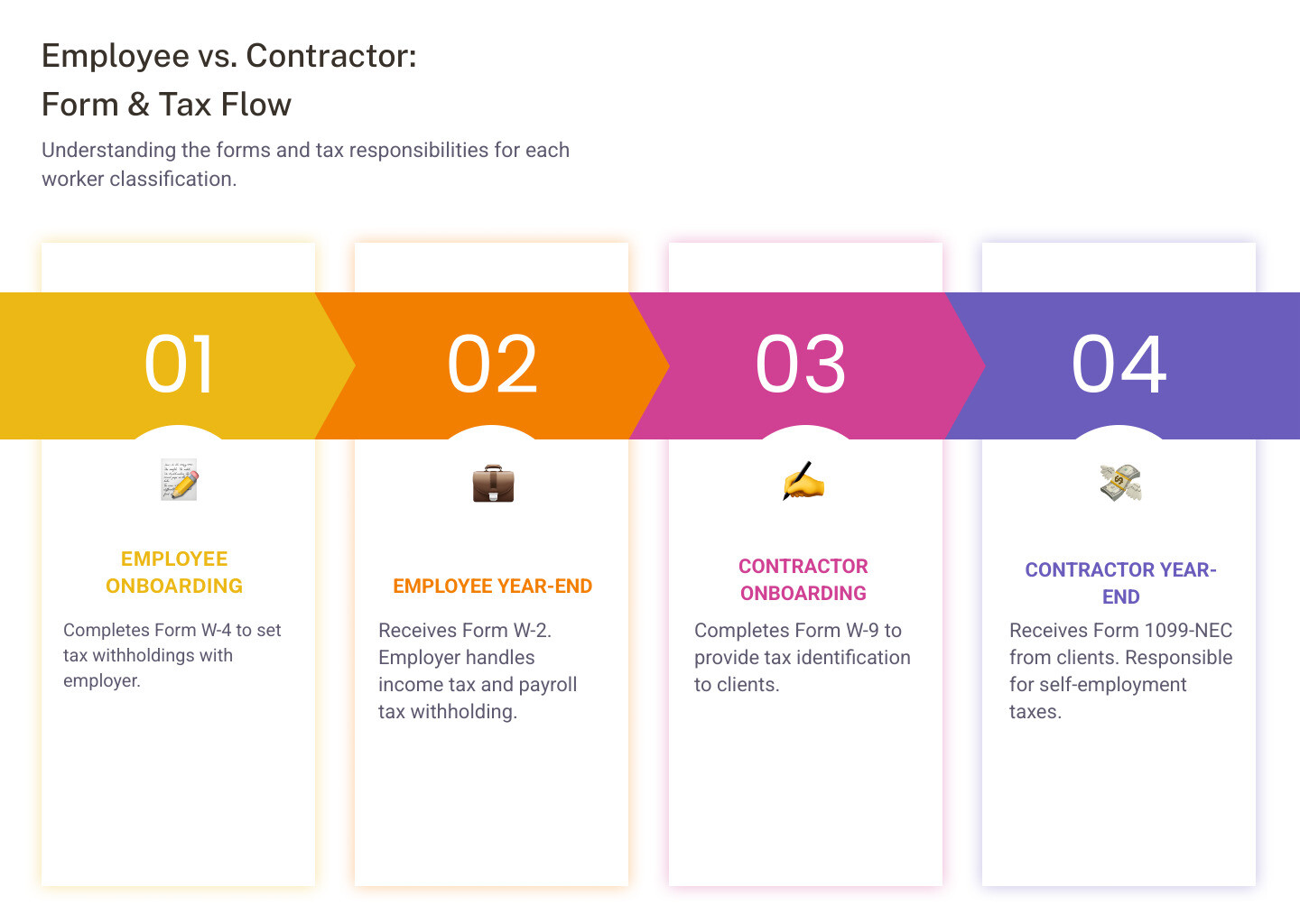

| Worker Type | Forms You Use | Who Controls Taxes |

|---|---|---|

| Employee | W-4 (when hired), W-2 (year-end) | Employer withholds taxes |

| Independent Contractor | W-9 (when hired), 1099-NEC (year-end) | You pay your own taxes |

The key difference: W-9 and 1099 forms go together for contractors, while W-4 and W-2 forms pair up for employees. The W-9 is what you fill out to give your tax info to a client. The 1099 is what they send you (and the IRS) to report what they paid you.

A job isn’t just a job when it comes to taxes. According to IRS data, 92% of people filing tax returns report their income based on a W-2 issued by their employer. The remaining workers—freelancers, consultants, gig workers, and independent contractors—receive 1099 forms instead. Getting this classification wrong can lead to unexpected tax bills, penalties, or even legal trouble.

The stakes are high because your worker status determines everything: how much you pay in taxes, who withholds those taxes, whether you get benefits, and which forms you need to file. Businesses must withhold income taxes, Social Security, and Medicare taxes from employee wages—but for independent contractors, those responsibilities fall entirely on you.

I’m Haiko de Poel, and through my work as a fractional CMO helping companies with rebranding and digital change, I’ve guided countless businesses and contractors through proper w9 vs 1099 employee classification to ensure tax compliance. Understanding these distinctions has been crucial in my consulting work with startups and established companies alike.

This guide will walk you through exactly which forms you need, when to use them, and how to avoid costly mistakes. Whether you’re just starting out as a freelancer, hiring your first contractor, or simply want to understand your tax obligations better, we’ll break down the W-9, 1099, W-2, and W-4 forms in plain English.

Start filling your W9 now at https://fillablew9.com/apply

Simple guide to w9 vs 1099 employee terms:

Employee vs. Independent Contractor: The Core Distinction

One of the most crucial distinctions in the tax world is whether you (or your workers) are classified as an employee or an independent contractor. This isn’t just a semantic difference; it dictates a cascade of tax obligations, benefits, and legal protections. The IRS is very clear that correctly determining worker status is critical for business owners.

The IRS uses a set of “common law rules” to determine worker classification, looking at the entire relationship between the worker and the business. These rules focus on three main categories:

- Behavioral Control: Does the company have the right to direct or control what the worker does and how the worker does their job? This includes instructions, training, and evaluation methods. If the business controls the “how” and “what” of the work, it leans towards an employee relationship.

- Financial Control: Does the business control the business aspects of the worker’s job? This includes how the worker is paid, whether expenses are reimbursed, who provides tools and supplies, and whether the worker can seek other business opportunities. If the worker has a significant investment in their own business or can realize a profit or loss, it points to an independent contractor.

- Type of Relationship: How do the parties perceive their relationship? This includes written contracts, whether benefits (like health insurance or retirement plans) are provided, the permanency of the relationship, and whether the services performed are a key aspect of the business. A long-term, exclusive relationship with benefits suggests an employee.

For employees, businesses generally must withhold income taxes, Social Security taxes, and Medicare taxes from their wages. They also pay the employer’s portion of these taxes and unemployment tax. On the flip side, businesses generally do not have to withhold or pay these taxes on payments made to independent contractors.

This is where the concept of Self-Employment Tax comes into play. Independent contractors are responsible for paying their own state and federal income taxes, as well as self-employment taxes, which cover Social Security and Medicare. The self-employment tax rate is 15.3% (12.4% for Social Security up to a certain income limit, and 2.9% for Medicare on all net earnings).

Misclassifying an employee as an independent contractor, or vice versa, can lead to significant headaches for both parties. For businesses, misclassification can result in back taxes, penalties, and interest. For workers, it can mean an unexpected tax bill at the end of the year if they haven’t been making estimated tax payments. Understanding these distinctions is the first step to navigating tax forms correctly.

The Role of Each Form: W-9, 1099, W-2, and W-4

These forms are the backbone of tax reporting for both employees and independent contractors. Each serves a distinct purpose, but they are all interconnected in ensuring the IRS knows who earned what and who paid whom.

Form W-9: The Information Collector

The W-9 tax form, officially titled “Request for Taxpayer Identification Number and Certification,” is a single-page document that acts as an information collector. Its primary purpose is for a business (the payer) to request the correct name and Taxpayer Identification Number (TIN) from a U.S. person (the payee) who is not an employee.

As a contractor, freelancer, or sole proprietor, you’re responsible for filling out the W-9. This form asks for your legal name, business name (if applicable), address, and your TIN. Your TIN can be your Social Security Number (SSN) if you’re an individual or sole proprietor, or an Employer Identification Number (EIN) if you operate as a business entity like an LLC or corporation.

Businesses should request a W-9 from any non-employee individual or entity they expect to pay $600 or more during the tax year. It’s best practice to collect this form before you make the first payment, or at least before year-end, to ensure you have the necessary information for year-end reporting.

One critical aspect related to the W-9 is backup withholding. If a payee fails to provide their correct TIN on a W-9, or if the IRS notifies the payer that the TIN is incorrect, the payer may be required to withhold 24% of future payments and remit it to the IRS. This is why collecting accurate W-9s upfront is so important for businesses.

When submitting your W-9, always prioritize security. Send it as an encrypted file attachment or mail a hard copy. Never email an unencrypted W-9, as it contains sensitive personal information.

Form 1099-NEC & 1099-MISC: The Income Reporters

While the W-9 collects information, the 1099 forms report income. These are critical for businesses that pay independent contractors and other non-employees. Businesses are responsible for issuing these forms to report payments made to individuals or unincorporated entities.

The most common 1099 forms for contractors are:

- Form 1099-NEC (Nonemployee Compensation): This form is used to report payments of $600 or more made to non-employees for services performed in the course of your trade or business. This is the form your clients will send you if you’re a freelancer, consultant, or independent contractor. The IRS brought back the 1099-NEC starting with the 2020 tax year to specifically track nonemployee compensation, separating it from other miscellaneous income.

- Form 1099-MISC (Miscellaneous Information): This form is used to report other types of miscellaneous income totaling $600 or more. This can include rents, royalties, prizes and awards, medical and healthcare payments, and payments to attorneys. The Form 1099-MISC is still widely used, but for services, the 1099-NEC is now the go-to.

Businesses must prepare a 1099 form for every contractor who has earned more than $600 from them in a single tax year. The deadline for providing these forms to your contractors (payees) is typically January 31st. For the IRS, the filing deadline for 1099-NEC is also January 31st. For 1099-MISC, it’s February 28th for paper filers and March 31st for electronic filers. We must meet these deadlines to avoid penalties.

Starting January 1, 2024, the IRS has changed the threshold requiring electronic filing of information returns like 1099 forms to 10 or more forms, down from 250. This means more businesses will need to e-file.

How W-9 and 1099 Forms Work Together

The W-9 and 1099 forms are two sides of the same coin, working in tandem to ensure proper tax reporting. Think of it as a cycle:

- Information Collection: When a business engages an independent contractor, they request a W-9 form from the contractor. This form provides the business with the contractor’s accurate legal name, address, and TIN (SSN or EIN).

- Payment and Record Keeping: Throughout the year, the business makes payments to the contractor, keeping detailed records.

- Year-End Reporting: At the end of the tax year, if the total payments to the contractor reach $600 or more, the business uses the information from the collected W-9 to accurately prepare a 1099-NEC (for services) or 1099-MISC (for other income).

- Distribution and Filing: The business then sends a copy of the 1099 to the contractor by January 31st and files another copy with the IRS by the relevant deadline.

The W-9 is a prerequisite for the 1099. Without a correctly filled-out W-9, a business can’t accurately complete the 1099, potentially leading to backup withholding or penalties. For the contractor, the 1099 serves as documentation of their income, which they will use when filing their own tax return.

How W-2 and W-4 Differ for Employees

Now, let’s briefly look at the forms designed for traditional employees, which operate quite differently from the W-9 and 1099 pair.

- Form W-4 (Employee’s Withholding Certificate): This form is filled out by an employee when they start a new job. It tells their employer how much federal income tax to withhold from their paychecks based on their marital status, dependents, and any other adjustments. The W-4 helps ensure the correct amount of tax is withheld throughout the year.

- Form W-2 (Wage and Tax Statement): This is the year-end report for employees. According to the IRS, employers must file a Form W-2 for any employee to whom they paid $600 or more for the year. The W-2 shows an employee’s total wages, tips, and other compensation, along with the amounts withheld for federal, state, and local income taxes, Social Security, and Medicare.

The key difference here is who handles the tax withholding. For W-2 employees, the employer is responsible for withholding and remitting taxes. For independent contractors, there is typically no withholding, and the contractor handles their own tax obligations.

W9 vs 1099 Employee: A Guide to Compliance and Penalties

Navigating w9 vs 1099 employee classifications and their associated forms can feel like walking through a minefield. For businesses, ensuring compliance is not just good practice; it’s a legal necessity with significant consequences for missteps. For independent contractors, understanding your obligations is key to avoiding an unwelcome surprise from the IRS.

Don’t waste time with paper forms — complete your secure W9 online at https://fillablew9.com/apply

Understanding the Tax Impact of the W9 vs 1099 Employee Classification

The fundamental difference in worker classification translates directly into distinct tax obligations. As an independent contractor, you are essentially running your own business. This means you are responsible for:

- Self-Employment Tax: You pay both the employer and employee portions of Social Security and Medicare taxes. This totals 15.3% of your net earnings (12.4% for Social Security up to an annual limit, and 2.9% for Medicare on all net earnings). This is a significant difference from employees, whose employers pay half of these taxes.

- Estimated Taxes: Since no employer is withholding taxes from your payments, you are generally required to pay estimated taxes quarterly throughout the year. Failing to do so can result in penalties.

- Deductible Business Expenses: On the bright side, as a self-employed individual, you can deduct legitimate business expenses (like home office costs, supplies, or professional development) on Schedule C to reduce your taxable income.

This is why how to know if you’re an employee or a contractor – and why it matters is such a crucial question. Millions of workers are surprised each year when they receive a 1099-NEC and realize they owe a large tax bill because they haven’t been setting aside money for taxes. Even if you make less than $400, you still need to report your business income on Schedule C, though you won’t owe self-employment tax.

Correcting Misclassification in a W9 vs 1099 Employee Scenario

What happens if there’s a disagreement about worker classification? The IRS takes misclassification very seriously. If a business misclassifies an employee as an independent contractor without a reasonable basis, it could be liable for employment taxes for that worker.

The IRS uses its “common law rules” (behavioral, financial, and type of relationship factors) to determine worker status. If you, as a worker, believe you’ve been misclassified, or if a business is unsure about a worker’s status, there are pathways to seek clarification:

- Form SS-8 (Determination of Worker Status for Purposes of Federal Employment Taxes and Income Tax Withholding): Either the business or the worker can file this form with the IRS to request an official determination of worker status. Be prepared, though—the process can take at least six months. The SS-8 Instructions provide detailed guidance.

- Form 8919 (Uncollected Social Security and Medicare Tax on Wages): If you are a worker who believes you were improperly classified as an independent contractor, you can use Form 8919 to figure and report your share of uncollected Social Security and Medicare taxes. You’d typically file this with your federal income tax return.

- Voluntary Classification Settlement Program (VCSP): For eligible businesses, the IRS offers the VCSP. This program allows taxpayers to reclassify their workers as employees for future tax periods, offering partial relief from federal employment taxes if they agree to prospectively reclassify their workers and enter into a closing agreement with the IRS.

Correct classification is vital for both compliance and fairness.

Penalties for Non-Compliance

The IRS imposes significant penalties for non-compliance with W-9 and 1099 filing requirements. These penalties vary based on the severity and timeliness of the failure.

For businesses failing to file or furnish 1099s:

- Failure to file a correct 1099 on time: For 2024, penalties range from $60 to $330 per form, depending on how late the filing is.

- Failure to furnish a correct 1099 to the payee: Similar penalties apply, ranging from $60 to $330 per form for 2024.

- Intentional disregard of filing requirements: This is serious and can result in a penalty of $660 per form for 2024, with no maximum penalty cap.

For W-9 related issues:

- Failure to furnish a TIN on a W-9: If a contractor fails to provide their TIN (or provides an incorrect one) to a business, a penalty of $50 per occurrence may apply, unless it’s due to reasonable cause and not willful neglect.

- Backup Withholding: As mentioned, if a payee fails to provide a correct TIN, the business is required to withhold 24% of payments as backup withholding.

- False information on a W-9: Providing false information that results in no backup withholding can lead to a civil penalty of $500. Criminal penalties, including fines and prison terms, can apply for willfully falsifying certifications or affirmations.

These penalties underscore the importance of meticulous record-keeping and timely, accurate filing.

Frequently Asked Questions about W-9 and 1099 Forms

We understand that these forms can be confusing, so let’s tackle some common questions.

What is the minimum payment that requires a Form 1099?

A business is generally required to issue a Form 1099 (either 1099-NEC or 1099-MISC) if they pay a non-employee $600 or more for services or other specific types of income in a calendar year. For example, if you pay a freelance graphic designer $750 for a project, you’ll need to issue them a 1099-NEC. There are some exceptions, such as payments to corporations, but the $600 threshold is the general rule for most independent contractors.

Who fills out the W-9 and who fills out the 1099?

- Form W-9: The payee (the independent contractor, freelancer, or vendor) fills out the W-9 and provides it to the payer (the business or client).

- Form 1099-NEC or 1099-MISC: The payer (the business or client) fills out the 1099 using the information from the W-9, and then sends it to the payee and the IRS.

Think of it this way: you give your client your W-9, and your client gives you (and the IRS) a 1099.

What happens if I don’t receive a 1099 for work over $600?

Even if you don’t receive a 1099 form for work where you earned $600 or more, you are still legally obligated to report all of your income to the IRS. The IRS matches the 1099 forms they receive from businesses against the income you report on your tax return. If there’s a discrepancy, it could trigger an audit or penalties.

As an independent contractor, you should always keep meticulous records of all your income, regardless of whether you receive a 1099. You’ll report this income, along with your business expenses, on Schedule C (Profit or Loss From Business) when you file your Form 1040. If a client fails to send you a 1099, you should first contact them to request it. If they still don’t provide it, report your income accurately anyway, and keep documentation of your efforts to obtain the form.

Step-by-Step Guide: How to Fill Out a W9 Form Securely Online

Filling out a W-9 doesn’t have to be daunting. With Fillable W9, we make it easy and secure. Here’s a quick guide:

Checklist for Filling Out Your W-9:

- Download the latest fillable W9 form: Always use the most current version from the IRS website or a trusted platform like Fillable W9.

- Enter your name and business name (if applicable):

- Line 1: Enter your legal name as it appears on your federal income tax return.

- Line 2: If you have a business name, trade name, DBA (doing business as) name, or if you’re a disregarded entity (like a single-member LLC that’s taxed as a sole proprietorship), enter that here.

- Select your federal tax classification: Check the appropriate box that describes your tax entity type.

- If you’re an individual, sole proprietor, or single-member LLC (taxed as a sole proprietor), check “Individual/Sole proprietor/Single-member LLC.”

- For LLCs, you’ll check the “Limited liability company” box and then specify how it’s taxed (C=C corporation, S=S corporation, or P=Partnership).

- Other options include C Corporation, S Corporation, Partnership, Trust/Estate.

- Provide your SSN or EIN:

- If you’re an individual or sole proprietor, use your Social Security Number (SSN).

- If you have an Employer Identification Number (EIN) for your business, use that.

- Sign and date the form: Certify that the information is correct and that you are not subject to backup withholding.

- Submit securely (never email unencrypted forms): Once completed, send the form back to the requester. Use secure methods like an encrypted file attachment, a secure online portal (like Fillable W9 offers), or mail a hard copy.

- Store a copy for your records: Always keep a copy of every W-9 you fill out for your own files.

Tip: Use Fillable W9 to complete your secure W9 online in minutes. We simplify the process, ensuring accuracy and providing a secure way to send your completed form to clients.

Conclusion: Simplify Your Tax Compliance

Understanding the distinctions between an employee and an independent contractor, and the forms that accompany each (w9 vs 1099 employee for contractors, W-2/W-4 for employees), is fundamental to successful tax compliance. It impacts everything from who withholds taxes to what penalties you might face.

For businesses, correctly classifying workers and diligently collecting W-9s to issue accurate 1099s is crucial to avoid significant IRS penalties. For independent contractors, proactively managing your W-9s, tracking your income, and understanding your self-employment tax obligations means you’ll avoid unwelcome tax surprises.

Compliance doesn’t have to be complicated. With the right tools and information, you can steer these requirements with confidence.

✅ Ready to complete your W9 in minutes? Apply here now