Why Understanding W-2 Deadlines is Critical for Employees and Employers

When do employers have to send out W-2s is one of the most common tax questions every January. Here’s the quick answer you need:

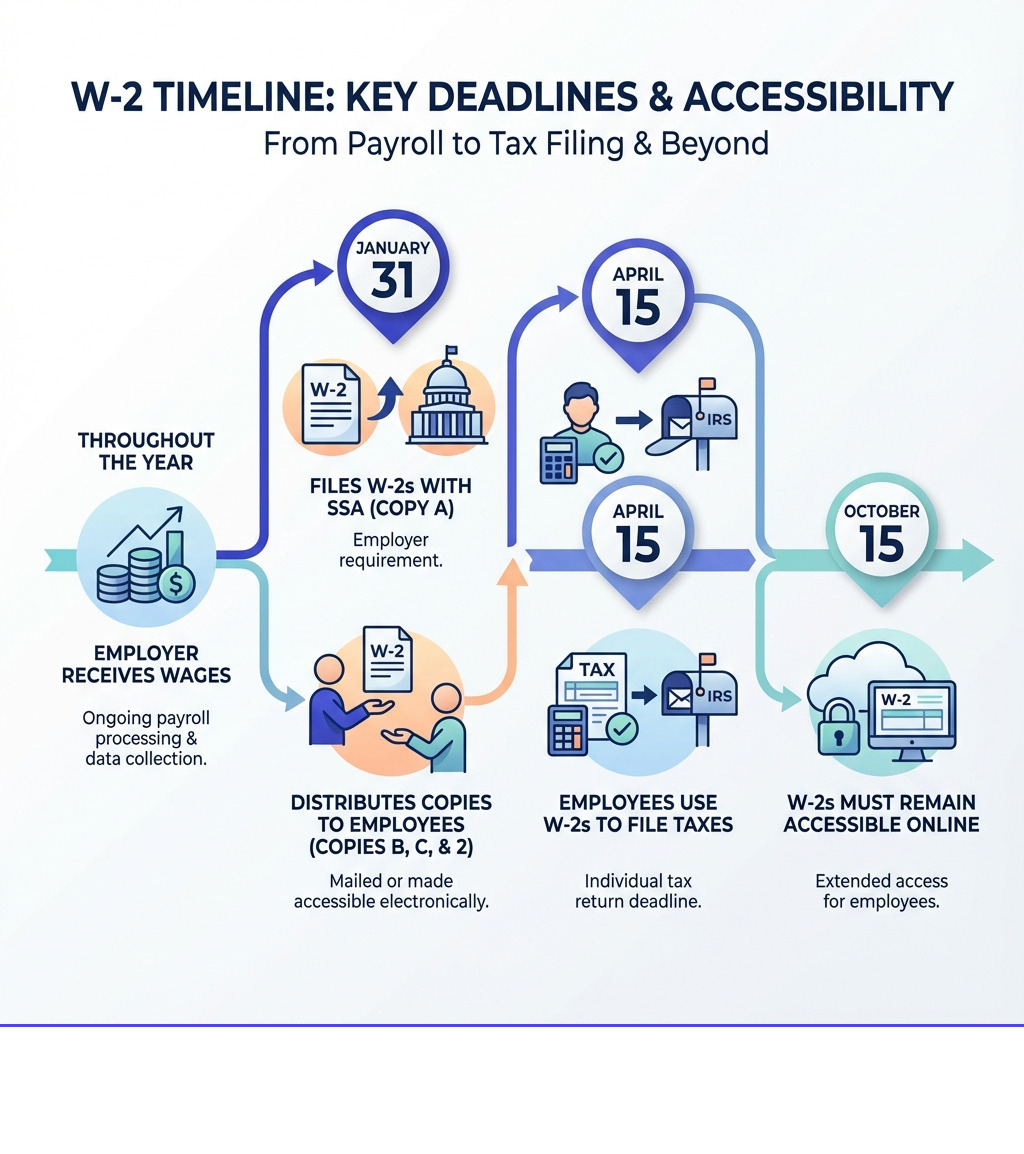

Key W-2 Deadlines:

- January 31 – Employers must send W-2s to employees (Copies B, C, and 2)

- January 31 – Employers must file Copy A with the Social Security Administration (SSA)

- If January 31 falls on a weekend or holiday – The deadline moves to the next business day

- For terminated employees – W-2s can be sent anytime after employment ends, but no later than January 31

- If an employee requests their W-2 – Employers have 30 days from the request or final wage payment (whichever is later) to provide it

Every year, millions of workers wait anxiously for their W-2 forms to arrive so they can file their taxes. Whether you’re a freelancer juggling multiple clients, a small business owner managing payroll, or an employee simply trying to meet the April 15 tax deadline, understanding when do employers have to send out W-2s helps you plan ahead and avoid last-minute stress.

The W-2 form—officially called the Wage and Tax Statement—reports your annual wages and the taxes withheld from your paychecks. Without it, you can’t accurately file your federal tax return. For employers, missing the deadline can trigger penalties ranging from $60 to $660 per form, depending on how late the filing is and whether the error was intentional.

The IRS and Social Security Administration take these deadlines seriously. Late or incorrect W-2 filings can result in significant fines, and in extreme cases, even criminal charges. That’s why both employees and employers need to know the rules.

I’m Haiko de Poel, and through my work with payroll systems and tax compliance for growing businesses, I’ve seen how confusion about when do employers have to send out W-2s can disrupt both personal finances and business operations. Understanding these deadlines is the first step to a smooth tax season.

The Big Question: What is the Deadline for Employers to Send W-2s?

The tax season often feels like a race against the clock, and the starting gun for employees is the arrival of their W-2 forms. For employers, this means a crucial deadline: January 31st. This isn’t just a suggestion; it’s a firm requirement from the IRS and the Social Security Administration (SSA). This date applies to both sending the forms to employees and filing them with the government. If January 31st happens to fall on a weekend or a legal holiday, don’t panic! The deadline graciously shifts to the next business day, giving everyone a little extra breathing room.

To ensure compliance and avoid unnecessary stress, we strongly recommend that employers familiarize themselves with the detailed guidelines provided by the SSA. You can find comprehensive information, including helpful resources for W-2 filing, on the Employer W-2 Filing Instructions & Information page.

When do employers have to send out W-2s to employees?

Employers are legally obligated to furnish Copies B, C, and 2 of Form W-2 to their employees by January 31st of the year following the tax year. For example, for wages earned in 2025, employees should receive their W-2s by January 31, 2026. This deadline ensures that employees have ample time to prepare and file their income tax returns before the April 15th deadline.

If we mail the W-2 forms, the IRS considers us compliant as long as they are postmarked on or before January 31st, provided the employee’s mailing address is accurate and the forms are delivered within two weeks of that date. For those embracing the digital age, electronic W-2s must be made accessible to employees online by January 31st.

What happens if an employee leaves your company mid-year? We can provide their W-2 any time after their employment ends, but no later than the January 31st deadline of the following year. If a former employee specifically asks for their W-2, we must provide them with Copies B, C, and 2 within 30 days of their request or within 30 days of their final wage payment, whichever comes later.

What is the deadline for filing with the government?

Just as important as sending W-2s to employees is filing Copy A of the form with the federal government. Employers must submit Copy A of Form W-2, along with a summary form called Form W-3, to the Social Security Administration (SSA) by January 31 of the year following the tax year. This means for 2025 wages, the deadline to file with the SSA is January 31, 2026. This unified deadline for both employee distribution and government filing was implemented to help the IRS detect refund fraud more effectively by giving them the data earlier. More information can be found on IRS Topic No. 752, Filing Forms W-2 and W-3.

Whether we choose to file by mail or electronically, the January 31st deadline remains consistent. However, the IRS strongly encourages electronic filing, especially for businesses of a certain size. If you are an employer filing 10 or more information returns (including W-2s), you are generally required to file electronically unless the IRS grants a waiver. For smaller businesses with fewer than 10 employees, both electronic and paper filing options are available. Electronic filing often leads to faster processing, fewer errors, and a more secure transmission of sensitive data.

Understanding Your W-2: What’s Inside and Why It Matters

The W-2, or Wage and Tax Statement, is more than just a piece of paper; it’s a comprehensive summary of an employee’s annual earnings and the taxes withheld throughout the year. It’s the cornerstone document for filing personal income tax returns, providing the IRS and state tax authorities with crucial information about an individual’s taxable income. For us, as employers, it’s our official report to the government and our employees about their compensation and tax contributions. This form details everything from federal and state income tax withheld to contributions for Social Security and Medicare.

What is a W-2 Form and What Information is on It?

A W-2 form reports an employee’s total wages, tips, and other compensation, along with the federal, state, and local taxes withheld from their paychecks. It’s a critical document for both employees and the government. Each W-2 form contains several boxes, each designated for specific information:

- Box a: Employee’s Social Security Number (SSN): This unique nine-digit number identifies the employee. Accuracy here is paramount.

- Box b: Employer Identification Number (EIN): This is our unique nine-digit federal tax ID number, identifying our business to the IRS.

- Boxes e & f: Employee’s Name and Address: These fields display the employee’s full legal name and current mailing address.

- Box 1: Wages, Tips, Other Compensation: This is the total taxable income, including wages, bonuses, and certain taxable fringe benefits. It’s the amount generally used to calculate federal income tax.

- Box 2: Federal Income Tax Withheld: The total amount of federal income tax withheld from the employee’s paychecks throughout the year.

- Box 3: Social Security Wages: The portion of wages subject to Social Security tax. This amount is capped annually.

- Box 4: Social Security Tax Withheld: The total amount of Social Security tax withheld.

- Box 5: Medicare Wages and Tips: The total wages subject to Medicare tax. Unlike Social Security wages, there is no annual cap on Medicare wages.

- Box 6: Medicare Tax Withheld: The total amount of Medicare tax withheld.

- Box 12: Codes: This box uses specific codes to report various types of compensation, benefits, or deductions that are not included in Box 1 wages. Some common codes include:

- Code D: Elective deferrals to a 401(k) cash or deferred arrangement.

- Code DD: The cost of employer-sponsored health coverage (for informational purposes only, not taxable).

- Code W: Employer contributions to an employee’s Health Savings Account (HSA).

- Code P: Excludable moving expense reimbursements paid directly to a member of the U.S. Armed Forces.

For a complete list and detailed explanations of all boxes and codes, we encourage you to consult the official IRS General Instructions for Forms W-2 and W-3.

W-2 vs. W-4 vs. 1099: What’s the Difference?

Understanding the different tax forms is key to navigating payroll and tax compliance. While they all deal with income and taxes, their purposes, who fills them out, and when they are used vary significantly. Let’s break down the distinctions:

| Feature | W-2 Form (Wage and Tax Statement) | W-4 Form (Employee’s Withholding Certificate) | 1099 Form (Various, e.g., 1099-NEC for Nonemployee Compensation) |

|---|---|---|---|

| Purpose | Reports employee’s annual wages and taxes withheld. | Tells employer how much federal income tax to withhold from paychecks. | Reports income paid to independent contractors or other non-employees. |

| Who Fills It Out | Employer | Employee | Payer (e.g., business hiring a contractor) |

| Who Receives It | Employee, SSA, IRS, state/local tax departments | Employer | Recipient (e.g., contractor), IRS, state tax departments |

| When It’s Used | Annually, by January 31st for previous year’s earnings | When starting a new job, or when personal/financial situation changes | Annually, by January 31st for previous year’s payments (1099-NEC) |

| Tax Status | For employees (W-2 employees are on payroll) | For employees (determines withholding) | For independent contractors, freelancers, self-employed individuals |

| Tax Withholding | Taxes (federal, state, FICA) are automatically withheld by employer | Employee designates withholding amount | No taxes are typically withheld by the payer; recipient pays self-employment taxes |

The W-4 form is an employee’s responsibility. It’s the document they complete when starting a new job to inform us, their employer, how much federal income tax to withhold from their pay. This form dictates the amount we send to the IRS on their behalf throughout the year.

In contrast, the W-2 form is our responsibility as the employer. It serves as the official record of the actual wages paid and taxes withheld for that employee over the entire tax year.

The Form 1099 series, particularly Form 1099-NEC (Nonemployee Compensation), is for payments made to independent contractors or freelancers. The key difference here is the relationship: a W-2 employee is on our payroll, while a 1099 contractor is self-employed. When we pay a contractor, we generally don’t withhold taxes from their payments. Instead, we report the total amount paid on a 1099 form, and the contractor is responsible for paying their own self-employment taxes. This distinction is crucial for both tax compliance and defining the nature of the work relationship.

When do employers have to send out w2s: A Guide to Compliance and Penalties

Navigating W-2s can sometimes feel like walking a tightrope. The IRS and SSA are very clear about their expectations for employers: timely and accurate filing. As employers, we have a significant responsibility to ensure that our employees receive their W-2s on time and that the information reported to the government is correct. Failing to meet these requirements can lead to a range of penalties, from monetary fines to more severe consequences. This is why understanding when do employers have to send out W-2s correctly is not just good practice, but a legal necessity.

What are the penalties for filing W-2s late or incorrectly?

The IRS takes a dim view of late or incorrect W-2 filings, and the penalties can add up quickly. These fines are designed to encourage timely and accurate compliance, and they vary depending on how late the forms are filed and the size of our business.

According to the official IRS instructions, for filings due after December 31, 2025 (i.e., for the 2025 tax year), the penalties for failure to file correct information returns by the due date are:

- $60 per Form W-2 if filed within 30 days after the due date (with a maximum penalty of $683,000 per year, or $239,000 for small businesses).

- $130 per Form W-2 if filed more than 30 days after the due date but by August 1 (with a maximum penalty of $2,049,000 per year, or $683,000 for small businesses).

- $340 per Form W-2 if filed after August 1, or if the form is never filed or corrected (with a maximum penalty of $4,098,500 per year, or $1,366,000 for small businesses).

These penalties apply not only to filing with the SSA but also to furnishing correct payee statements (i.e., sending the W-2s to our employees) by the deadline. The penalties are the same for both.

What if the error is due to intentional disregard? If we intentionally disregard the requirement to file or furnish correct W-2s, the penalty is significantly higher: at least $680 per Form W-2, with no maximum limit. The Department of Justice actively enforces employment tax compliance, and intentional disregard can lead to more severe consequences, including restitution and even criminal convictions.

For more detailed information on penalties and how to avoid them, you can refer to the IRS’s page on penalties for filing late.

How Can an Employer Correct a W-2?

Mistakes happen, even to the most diligent employers. If we find an error on an employee’s Form W-2 after we’ve already sent it to the SSA, it’s crucial to correct it promptly. We can do this by submitting a Form W-2c, Corrected Wage and Tax Statement.

When filing a Form W-2c by mail, we must also include a Form W-3c, Transmittal of Corrected Wage and Tax Statements. This acts as a summary for all the W-2c forms we’re submitting. If we originally filed the W-2s electronically through the SSA’s Business Services Online (BSO) platform, we can also make the W-2c corrections electronically using the same system, which is often faster and more efficient.

After submitting the corrected forms to the SSA, we also need to provide the corrected W-2c to the affected employee. This ensures they have the accurate information needed to file or amend their tax return. Prompt correction is key to mitigating potential penalties and ensuring our employees’ tax records are accurate.

Special Circumstances and Modern Solutions for W-2s

The landscape of W-2 distribution has evolved significantly, with electronic options becoming increasingly prevalent. These modern solutions offer convenience and efficiency for both employers and employees. However, they come with their own set of rules and requirements, especially regarding employee consent and data security. Additionally, certain circumstances, like changes in employment or natural disasters, can affect the standard W-2 timeline, requiring us to be aware of special provisions and extension possibilities.

Can W-2s Be Sent Electronically?

Absolutely! Electronic W-2s have become a popular and efficient way to distribute wage statements. They offer numerous benefits, such as reduced printing and mailing costs, faster delivery to employees, and improved record-keeping. However, there are strict IRS requirements we must follow to ensure compliance:

- Employee Consent: We must obtain affirmative consent from each employee before providing their W-2 electronically. This consent must be given in a way that reasonably demonstrates the employee can access the W-2 in the electronic format it will be provided. Employees also have the right to withdraw their consent at any time and request a paper copy.

- Required Notifications: We must provide employees with clear, conspicuous disclosures regarding the electronic W-2. This includes informing them about any hardware or software requirements, how long the W-2 will be available, how to withdraw consent, and how to request a paper copy.

- Secure Portal: Due to the sensitive nature of the information on a W-2 (Social Security numbers, wages, etc.), we cannot simply send it as an email attachment. We must use a secure online portal or encrypted system that protects the employee’s personal data. An email can be used to send a link to this secure portal, but the form itself should not be attached.

- Accessibility Period: If we post W-2s on a website portal, we must ensure they are accessible to employees online by January 31st and remain available through October 15th of that same year. This gives employees ample time to access their forms, even if they need them for later purposes like loan applications.

The benefits of electronic W-2s for us include reduced administrative burden and cost, while employees enjoy instant access to their forms from anywhere. It’s a win-win when handled correctly.

Don’t waste time with paper forms — complete your secure W9 online at https://fillablew9.com/apply/.

What About Terminated Employees or Filing Extensions?

Life happens, and sometimes employees leave before the end of the year. When this occurs, our responsibility to provide a W-2 remains. If an employee’s employment ends before December 31st of the tax year, we may furnish their W-2 any time after their employment ends, but no later than the standard January 31st deadline of the following year. If they specifically request it, we must provide it within 30 days of their request or their final wage payment, whichever is later.

What if we face extraordinary circumstances, like a natural disaster or a fire that destroys our records, making it impossible to meet the January 31st deadline? In such limited cases, we can request an extension of time to file Forms W-2 with the SSA. This is done by submitting a complete application on Form 8809, Application for Extension of Time To File Information Returns. If granted, this typically provides an additional 30 days to file. However, it’s crucial to remember that an extension to file with the SSA does not automatically extend the deadline to furnish the W-2s to our employees. For an extension to furnish W-2s to employees, we would need to fax Form 15397, Application for Extension of Time to Furnish Recipient Statements, and approval is not automatic, usually granting no more than 15-30 days.

Frequently Asked Questions about W-2s

We know that W-2s can sometimes raise a lot of questions. Here, we’ll address some of the most common concerns that employers and employees have about these essential tax documents.

What happens if an employer does not file a W-2 at all?

Failure to file a W-2 form for an employee is a serious offense that can lead to significant repercussions. The IRS and SSA rely on these forms to match income reported by employees with what employers report. If we, as employers, fail to file a W-2 for an employee who meets the reporting requirements (e.g., $600 or more in wages, or any amount of income, Social Security, or Medicare tax withheld), we face substantial penalties.

As mentioned earlier, these penalties can range from $60 to $340 per form, depending on the timeliness of filing, with higher penalties for intentional disregard (at least $680 per form with no maximum). Beyond monetary fines, consistent or intentional failure to file can result in more severe actions, including restitution orders and even criminal convictions, particularly if it’s deemed an attempt to evade taxes. The Department of Justice actively pursues cases of employment tax enforcement. It’s simply not worth the risk; compliance is always the best policy.

Are employers required to notify employees about the Earned Income Tax Credit (EITC)?

Yes, absolutely! We are required to notify employees about their potential eligibility for the Earned Income Tax Credit (EITC), especially those who had no income tax withheld. The EITC is a refundable tax credit for low-to-moderate-income working individuals and families, and many eligible employees might not even be aware they qualify.

The notice about the EITC typically appears on the back of Copy B of the W-2 form. However, if an employee’s W-2 does not include this notice, or if we are not issuing a W-2 to an employee who may still be eligible, we must provide a substitute statement. This ensures that all eligible employees are aware of this valuable credit, which can significantly boost their tax refund. Providing this notification is part of our responsibility to help our employees steer their tax obligations and benefits. More details can be found on the Earned Income Tax Credit (EITC) page.

How long must an employer keep W-2 records?

Maintaining accurate records is a fundamental aspect of tax compliance for any business. For W-2 forms and related employment tax documents, the IRS generally requires us to keep records for at least four years after the date the tax becomes due or is paid, whichever is later. This applies to copies of Forms W-2, Forms W-3, and any supporting documentation, such as payroll records, time sheets, and employee applications.

This four-year retention period is crucial because these records may be needed for future audits by the IRS or SSA. They serve as proof of wages paid, taxes withheld, and our compliance with federal tax laws.

What about undeliverable W-2s? If we attempt to furnish a W-2 to an employee but it comes back as undeliverable, we must retain that undelivered copy for four years. However, if the undelivered Form W-2 can be produced electronically through April 15th of the fourth year after the year at issue, we do not need to keep the physical undeliverable employee copies. It’s important never to send undeliverable employee copies of Forms W-2 to the Social Security Administration.

Conclusion: Your Next Steps for a Smooth Tax Season

Understanding when do employers have to send out W-2s is vital for a smooth tax season for everyone involved. For us, as employers, it’s about meeting our legal obligations, avoiding penalties, and ensuring our employees have the necessary documents to file their taxes accurately and on time. For our employees, it means knowing when to expect their wage statements so they can plan their tax filing process without unnecessary delays.

Here are our key takeaways:

- January 31st is the Golden Rule: This is the firm deadline for both furnishing W-2s to employees and filing them with the Social Security Administration. Mark your calendars!

- Accuracy is Paramount: Double-check all information on W-2s before distribution and filing. Errors can lead to corrections (Form W-2c) and potential penalties.

- Accept Electronic Solutions: Electronic W-2s offer efficiency and convenience, but always ensure you have employee consent and are using secure, compliant methods.

- Know the Exceptions: Be aware of rules for terminated employees, extensions in extraordinary circumstances, and specific notifications like the EITC.

- Record Keeping is Key: Retain all W-2 related documents for at least four years for audit purposes.

By staying informed and proactive, we can ensure that tax season is as seamless as possible for our business and our valued team members. If you’re a business owner looking to streamline your tax compliance for independent contractors, a proper W9 form is just as crucial as the W-2 for employees.

✅ Ready to complete your W9 in minutes? Apply here now at https://fillablew9.com/apply/.