Why Understanding When Do 1099 Come Out Matters for Your Tax Compliance

When do 1099 come out is one of the most common questions freelancers, contractors, and small businesses ask as tax season approaches. The answer directly affects whether you can file on time and avoid penalties, and it connects closely to how and when you complete your W9 form.

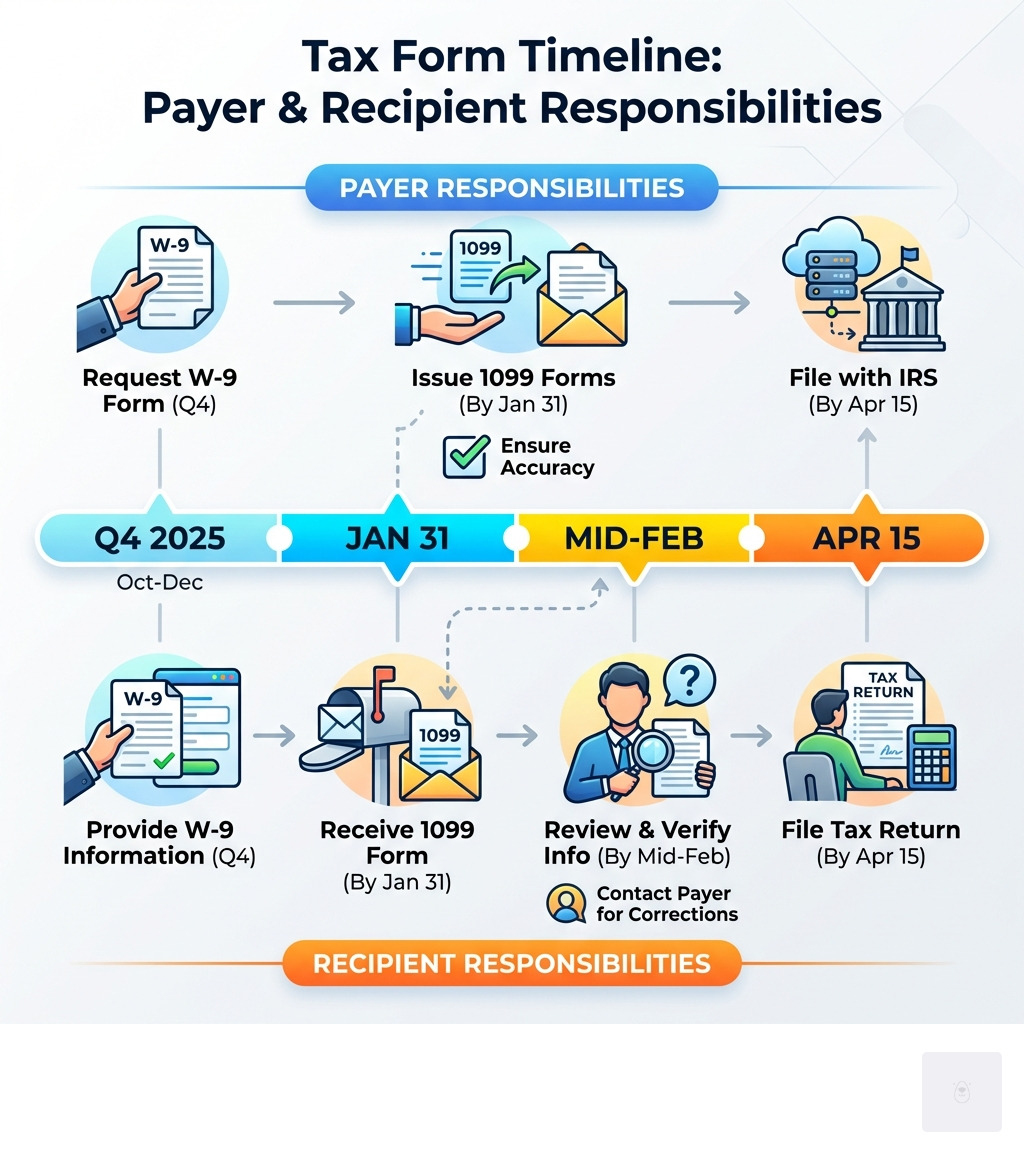

Here are the key dates you need to know:

- January 31 – Most 1099 forms (1099-NEC, 1099-MISC, 1099-INT, 1099-DIV) must be sent to recipients by this date.

- February 17 – Forms 1099-B, 1099-S, and certain 1099-MISC reporting are due to recipients.

- March 2 – Paper filing deadline for payers to submit forms to the IRS.

- March 31 – Electronic filing deadline for payers to submit forms to the IRS.

Every year, millions of independent contractors and businesses scramble to understand tax form deadlines. The confusion starts when a client requests a W9 or fillable W9 form, continues through waiting for 1099s to arrive, and ends with the stress of filing taxes correctly.

This guide breaks down exactly when you should expect to receive your 1099 forms, what to do if they don’t arrive, and how the W9 you filled out earlier connects to the entire process. We will cover the different types of 1099 forms, their specific deadlines, and the important differences between when payers must send forms versus when they must file with the IRS.

I’m Haiko de Poel, and through my work with financial technology platforms and small businesses, I’ve helped hundreds of companies steer the complexities of W9 and 1099 deadlines and establish compliant tax reporting processes. Understanding these deadlines is essential for both payers issuing forms and recipients who need them to file accurate tax returns.

✅ Ready to ensure you never miss a W9 deadline? Complete your secure W9 form online in minutes at https://fillablew9.com/apply and avoid payment delays from clients.

The Foundation: W-9 Form Deadlines and Best Practices

Before we dive into when do 1099 come out, it’s crucial to understand the role of the W9 form. The IRS Form W-9, or Request for Taxpayer Identification Number and Certification, is a vital document in the ecosystem of non-employee compensation. It is how businesses (payers) collect the necessary information from individuals or entities (recipients) to accurately prepare and issue 1099 forms.

As a recipient, you’ll typically be asked to complete a W9 when you start working with a new client or business as an independent contractor, freelancer, or vendor. This form provides your name, address, and most importantly, your Taxpayer Identification Number (TIN) – which can be your Social Security Number (SSN), Employer Identification Number (EIN), or Individual Taxpayer Identification Number (ITIN). This information is essential for the payer to report your income to the IRS.

For payers, the best practice is to request a completed W9 form from every independent contractor or vendor before making any payments. Having an accurate W9 on file ensures that you have all the correct information to issue the proper 1099 form by its deadline. Without a W9, you might be required to withhold taxes from payments (known as backup withholding) or face penalties for incorrect information reporting.

Submitting an accurate W9 promptly as a recipient helps you avoid payment delays and ensures your income is reported correctly. For both parties, maintaining accurate address information is key, as this is where your 1099 forms will be sent. We offer a secure and efficient way to how to fill out a W-9 online, ensuring your information is correct and ready for your clients. Using a fillable W9 online also helps you keep your records organized for future 1099 reporting.

The Foundation: W-9 Form Deadlines and Best Practices

Before we dive into when do 1099 come out, it’s crucial to understand the role of the W9 form. The IRS Form W-9, or Request for Taxpayer Identification Number and Certification, is a vital document in the ecosystem of non-employee compensation. It is how businesses (payers) collect the necessary information from individuals or entities (recipients) to accurately prepare and issue 1099 forms.

As a recipient, you’ll typically be asked to complete a W9 when you start working with a new client or business as an independent contractor, freelancer, or vendor. This form provides your name, address, and most importantly, your Taxpayer Identification Number (TIN) – which can be your Social Security Number (SSN), Employer Identification Number (EIN), or Individual Taxpayer Identification Number (ITIN). This information is essential for the payer to report your income to the IRS.

For payers, the best practice is to request a completed W9 form from every independent contractor or vendor before making any payments. Having an accurate W9 on file ensures that you have all the correct information to issue the proper 1099 form by its deadline. Without a W9, you might be required to withhold taxes from payments (known as backup withholding) or face penalties for incorrect information reporting.

Submitting an accurate W9 promptly as a recipient helps you avoid payment delays and ensures your income is reported correctly. For both parties, maintaining accurate address information is key, as this is where your 1099 forms will be sent. We offer a secure and efficient way to fill out a W-9 online, ensuring your information is correct and ready for your clients. Using a fillable W9 online also helps you keep your records organized for future 1099 reporting.

Common Scenarios and What to Do

Even with clear deadlines, tax season can introduce complications. You might wonder what happens if you do not receive your 1099, or what to do if the information is wrong. The steps below will help you handle these situations confidently.

What Should I Do If I Don’t Receive My 1099?

It is a common concern: the calendar flips to February, and you’re still waiting for a crucial 1099. Here is what you should do:

- Contact the Payer Directly: Your first step should always be to reach out to the person or business that was supposed to issue the 1099. Politely inquire about the status of your form. They might have sent it to an old address, or perhaps it was delayed in the mail. Verify your mailing address with them.

- Check Your E-delivery Consent: If you have opted for electronic delivery, check your online portal for that specific business or financial institution. Also, check your email’s spam or junk folder, as sometimes these notifications can get filtered.

- Report Income Regardless: Even if you do not receive a 1099 form, you are still legally obligated to report all your taxable income to the IRS. The IRS has a matching program that cross-references income reported by payers with income reported by recipients. If you fail to report income, you could face penalties and interest. Use your own records (invoices, bank statements, payment confirmations) to accurately calculate and report your earnings.

- Consider an Extension: If you’ve contacted the payer and still haven’t received your form, and you’re nearing the tax deadline, consider filing for an extension. This gives you more time to gather all your documents without rushing or filing an incomplete return.

Why Didn’t I Get a 1099? Understanding Reporting Thresholds

Sometimes, you might not receive a 1099 simply because the payment did not meet the IRS reporting threshold.

- The $600 Threshold: For most types of income reported on a 1099-NEC (nonemployee compensation) or 1099-MISC (rents, other income), the payer is only required to issue a form if they paid you $600 or more in a calendar year. If you earned $599.99 from a client, they are not obligated to send you a 1099, but you still need to report that income.

- The $10 Threshold: For interest income (1099-INT) and dividends (1099-DIV), the threshold is lower, at $10. If you earned less than $10, you likely will not receive a form.

- 1099-K Threshold Changes: The 1099-K, which reports payment card and third-party network transactions (such as payments received through online payment platforms for goods and services), is only issued once the platform crosses the applicable filing thresholds. These thresholds can change when the IRS updates its guidance, so it is important to verify the current rules each year on the official IRS website.

- No Reportable Activity: For certain accounts, like retirement accounts, you might not receive a tax form if there was no reportable activity (for example, no distributions or contributions) during the year. Similarly, taxable accounts with minimal income or distributions (such as less than $10) might not generate a form.

Regardless of whether you receive a 1099, you must still report all taxable income.

How does e-delivery affect when do 1099 come out?

Electronic delivery has changed how many recipients get their tax forms, including 1099s.

- Instant Availability: If you have agreed to e-delivery, your 1099 form is often available online by January 31st. This means you do not have to wait for postal delivery.

- No Postal Delays: The frustration of a lost or delayed paper form is reduced. Your form is accessible through a secure online portal provided by the payer.

- Consent is Key: You must provide affirmative consent to receive your tax forms electronically. If you have not, the payer is still obligated to mail you a paper copy.

- Checking Online Portals: Many platforms provide early access or notification for tax information verification between October and December, with the actual 1099 form available by January 31st if you’ve opted for e-delivery. Remember to log into these portals to confirm your tax information (name, address, SSN/EIN/ITIN) before the payer’s cutoff date for updates.

- Spam Folders: Always check your email’s spam or junk folder for notifications that your electronic tax document is ready. It is an easy place for important emails to hide.

Using a fillable W9 and keeping your details current with clients and platforms helps ensure your 1099s are issued correctly and on time.

Frequently Asked Questions about 1099 and W-9 Deadlines

This section answers common questions about W9 and 1099 deadlines so you can stay organized and compliant.

What is the absolute latest I should receive my 1099-NEC?

The absolute latest you should receive your 1099-NEC form is January 31st of the year following the tax year. This deadline applies whether the form is delivered by mail or electronically. For example, for income earned in 2025, you should receive your 1099-NEC by January 31, 2026. If this date falls on a weekend or holiday, the deadline shifts to the next business day. If you have not received it by then, it is time to contact the payer.

Is it okay to file my taxes before all my 1099s arrive?

Generally, filing your taxes before all your 1099s arrive is not recommended. While you are responsible for reporting all your income regardless of whether you receive a form, waiting for the official documents ensures you have complete and accurate information. Filing without them could lead to errors, requiring you to file an amended return later.

However, if you have followed up on a missing 1099 (contacted the payer multiple times, checked online portals) and the tax deadline is close, you should calculate your income using your own records (bank statements, invoices) and report it. The IRS matches the 1099s they receive from payers against your tax return, so it is vital that the income you report is as accurate as possible.

What’s the difference between a 1099 mailing date and its online availability date?

The difference lies in the method of delivery and access. The mailing date is when a paper copy of your 1099 form is physically placed into the postal system. This means you must account for postal delivery times, which can vary. The online availability date, on the other hand, is when your electronic 1099 form becomes accessible through a secure online portal or via an email notification.

If you’ve consented to e-delivery, your form is often available online at the same time or very close to when paper forms are mailed. This means online forms are frequently accessible sooner than their paper counterparts arrive in your mailbox.

Using a fillable W9 and keeping your information up to date helps payers issue both paper and electronic 1099s accurately and on schedule.

Conclusion: Stay Compliant with Timely Tax Form Management

Navigating W9s and 1099s does not have to be a headache. By understanding when do 1099 come out and the crucial role of the W9 form, you can stay ahead of tax season and ensure compliance.

Remember these key takeaways:

- W9s are the foundation: Always provide an accurate W9 when requested, and as a payer, always request one before making payments to independent contractors. This ensures correct information for 1099 reporting.

- January 31st is paramount: This is the primary deadline for recipients to receive most 1099 forms, including 1099-NEC, 1099-MISC, 1099-INT, and 1099-DIV.

- Different forms, different deadlines: Be aware that forms like 1099-B, 1099-S, and Form 5498 have later recipient deadlines.

- Payer deadlines vary: Payers have until January 31st to file 1099-NEC with the IRS, but until February 28th (paper) or March 31st (electronic) for many other 1099s.

- Do not wait, communicate: If you do not receive a 1099 by the expected date, proactively contact the payer.

- Report all income: Even if you do not receive a 1099, you are still responsible for reporting all your taxable income.

At Fillable W9, we understand that managing tax forms can be complex. That is why we are dedicated to simplifying the process. Our platform helps you securely and efficiently complete your fillable W9 online, setting you up for a smoother tax season when those 1099s arrive.

✅ Ready to complete your W9 in minutes? Complete your W-9 securely and efficiently now!